THINGS CAN’T BE TOO BAD IF DAD MAKES ‘SUNDAY TEE TIME’

Today, we check in on the economy with one of our favorite gauges…

Regular DailyWealth readers know we like to follow certain sectors for insight into the strength of the economy.

Tracking recreational spending can tell us if consumer confidence is high – like when luxury sport companies are raking in profits…

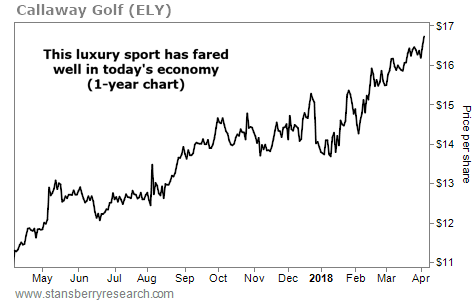

For example, look at Callaway Golf (ELY).

The $1.6 billion company is the largest manufacturer of golf clubs in the world…

And it’s the No. 1 club brand in the U.S.

Following the 2008 recession, participation in the golf industry dropped off.

But things have turned around in today’s bull market. Callaway’s net sales increased 20% in 2017. And its outlook for this year is positive as the industry continues to strengthen.

As you can see, shares of ELY have risen nearly 50% over the past year. They recently hit a new multiyear high. The company’s climb is a reassuring sign for the economy. After all, if dad has the cash for golf clubs and green fees, things can’t be all that bad today…

I recently visited Mar-a-Lago... And now I'm prepared to put my reputation on the line. Since 1998, my proprietary system would've returned 13,126% in backtests. (That's 13X the S&P and 106X the average investor, according to JP Morgan.) However, one investment I just uncovered could be my biggest winner of all... It involves President Trump, Elon Musk, trillions of dollars, China... And a MAJOR upgrade to the artificial intelligence revolution. See for yourself!

Source: Daily Wealth Market Notes