The 10-Year Treasury yield is holding at 2.85%, but another run to 3% is coming soon.

Let’s use this breather to sell our weakest dividends and replace them with stocks that should actually head higher as rates rise.

You know the playbook by now.

When the 10-Year yield rallies, it crushes stocks with pathetic yields or meager dividend growth.

These “bond proxies” get dumped for the real thing as first-level investors scamper to the 3% yields on “safe” US government debt.

If your portfolio relies on laggards like these—I’m talking about penny-a-year hikers like AT&T (T) and Walmart (WMT), or stocks that haven’t hiked their payouts in years, like Wynn Resorts (WYNN)—I have two words for you:

Sell now!

Your 3-Word Action Plan: “Outrun Interest Rates”

Instead of buying pretenders like these and practicing “buy-and-hope” investing, we’re going to scientifically book profits, no matter what interest rates do.

How?

By snapping up stocks with big dividend hikes ahead. As I’ve written before, a surging payout has two knock-on effects that balloon your nest egg over the long haul:

- Your income stream surges. A stock I told you about recently, Royal Caribbean Cruises (RCL), is a great example: thanks to its massive 500% dividend hike in the last 6 years, folks who bought in 2012 are yielding a monstrous 10.2% now—even though RCL’s current yield is 2.1%!

- Higher dividends = higher share prices: As the stock’s dividend payout races higher, the first-level crowd piles in, driving share prices up right alongside them. (This, by the way, is why many stout dividend growers go undetected by the masses, because their current yield stays pretty much the same.)

And I don’t know about you, but I don’t want to wait around a full year for my next payout hike; I want to buy dividends that will move higher now, so I can start raking in a bigger dividend stream and outsized gains right away.

Here are 3 stocks to put on your list—each one is poised to deliver a serious dividend hike between now and June.

AAPL: A Dividend Star Hiding in Plain Sight

Apple (AAPL): Don’t let the 1.5% current yield fool you. Apple has boosted its payout 44% in the last five years, and there are many more hikes—and corresponding share-price gains—to come.

Say all you want about iPhone sales, but Apple’s real future rests with its 1.3-billion-strong collection of installed devices, which is driving skyrocketing sales of movies, music and ebooks. In its fiscal 2018 first quarter, Apple’s services division (including content) raked in $8.7 billion in revenue, up 18% from a year ago and nearly double what it delivered in the first quarter of 2014.

Throw in the company’s $285.1-billion cash hoard—up $16.2 billion in just one quarter—and Apple investors are looking at a dividend hike that should top last year’s 11% boost when the company announces its next payout in May.

The topper? Share buybacks, which cut the number of shares outstanding, boost earnings per share and help throw a floor under the share price.

Apple’s Share-Price “On” Switch

And Apple’s bargain valuation (just 12.3 times forward earnings) means management is guaranteed to keep bargain hunting its stock. Let’s follow their lead.

GWW’s “Inevitable” Payout Hike

W.W. Grainger (GWW): The funny thing about rising interest rates is that most folks ignore the best thing about them: they signal a growing economy.

And diversified industrial stocks like Grainger are poised to cash in: GWW peddles ladders, gloves, janitorial supplies and inventory management services to 3.2 million businesses around the world.

It’s a “boring” business that’s the polar opposite of Apple!

But its latest results are anything but: sales surged 7% in Q4, and adjusted earnings per share (EPS) jumped 20%. Management also goosed full-year EPS guidance to between $12.95 and $14.15, a big leap from the previous $10.60 to $11.80.

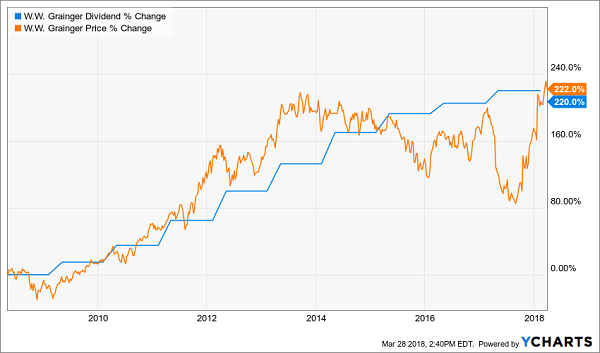

And don’t let Grainger’s Apple-sized 1.8% current yield fool you. Management has boosted the payout 220% in the last decade, and where the dividend goes, the share price follows almost exactly:

220% Dividend Raise Drives a 221% Price Gain

Best of all, a hefty payout hike looks inevitable in April: Grainger paid just 37% of free cash flow (FCF) as dividends in the last 12 months, so it could double the payout and still have plenty of FCF left over. Grab this one now, before its next dividend increase pushes it out of reach.

LSI: A Dividend “Hat Trick”

Self-storage operator Life Storage (LSI), a stock I’ve written about before, ticks all three of our boxes:

- A high current yield: Buy now and you’ll kick-start a 4.8% income stream, way higher than the S&P 500 average and the yield on the 10-Year Treasury.

- Fast dividend growth: the dividend has more than doubled, to $1.00 a share, in the past 5 years, and…

- An imminent hike: Last year, the real estate investment trust (REIT) announced a payout boost on April 7, so you can expect another raise either late this week or early next.

And that boost could be significant: in addition to LSI’s history of fast dividend growth, it posted record 91.6% occupancy in Q4, driving a 5% rise in funds from operations (FFO; the REIT equivalent of EPS).

It also paid out $4 in dividends in the last 12 months, or 74% of the midpoint of this year’s FFO guidance ($5.38 per share). That’s easily manageable in the REIT world, where ratios around the 85% mark are common.

The kicker? You can grab this growing 4.8% dividend for just 15.6 times forecast FFO—a bargain!

— Brett Owens

7 Urgent Buys to Double Your Income and Triple Your Nest Egg [sponsor]

When you buy the 7 “set-it-and-forget it” dividend growers I’m pounding the table on now, you get something truly special:

- Immediate dividend payouts you can rely on,

- Growing retirement income, and

- Solid capital gains year in and year out.

What does that mean in dollars and cents?

I’m talking about payout growth that will DOUBLE your nest egg every 6 years while TRIPLING your retirement income!

You simply can’t get growth and income like that from the misers of the S&P 500 (whose pathetic 1.9% average payout is quickly devoured by inflation) or so-called “safe” Treasuries, CDs and the like.

These 7 off-the-radar buys are cheap now, but that will change in short order as more investors catch on to the life-changing profits on offer here.

Don’t miss your chance to tap these rock-solid dividend growers at a bargain! Click here to get the names, ticker symbols, buy-under prices and my complete research on these 7 off-the-radar cash machines now.

Source: Contrarian Outlook