Mention cloud computing and investors typically think about Amazon.com Inc. (NasdaqGS:AMZN), Apple Inc. (NasdaqGS:AAPL), and Alphabet Inc. (NasdaqGS:GOOGL).

Very few think about Microsoft Corp. (NasdaqGS:MSFT) – but, they should.

Redmond-based Microsoft could not only be a $1 trillion company, but it could hit that mark sooner than any of the competitors I’ve just mentioned and, in the process, win the race to become the world’s first trillion-dollar business.

It’s a point I spoke about on Fox Business Network [earlier this week] with Neil Cavuto, when I made the point that the broader tech-led rollover that started almost concurrently with my appearance would treat tech stocks based on personal trust differently than those based on corporate data, security, and operations.

The former – led by Facebook Inc. (NasdaqGS:FB) and Twitter Inc. (NYSE:TWTR), for example – are going to get clobbered, while the broader pullback will give savvy investors in the latter a massive and potentially very profitable opportunity.

I’m not alone in my thinking, either.

Morgan Stanley (NYSE:MS) analysts just released a new price target of $130 a share within a year – or roughly 38.78% higher than where the stock is trading, as I write – which is a nudge higher than my own target of $125 a share within two years.

Microsoft has a few things going for it that stand out, and I’m thrilled to see Morgan Stanley take a slightly more aggressive view:

- CEO Satya Nadella’s emphasis on cloud computing matches markets perfectly at a time when, according to Morgan Stanley, “public cloud adoption is expected to grow from 21% of workloads today to 44% in the next three years” – a figure I think is 10% too low, incidentally. Former CEO Steve Ballmer’s view didn’t… so he missed damn near every major development in the cloud computing space, overpaid for acquisitions that didn’t make sense, and completely dismissed groundbreaking products – chief among them was the “smartphone.”

- Microsoft has several cloud units, including everything serving up the Office 365 product line and Azure hosting. The company’s also got the popular Xbox hardware and software, as well as LinkedIn.

- The company has a massive user base, legacy contracts, and improving margins, all of which mean better operating income and earnings ahead over time.

Bear in mind, these are all things focused on the public cloud market which will more than double to $250 billion over the same Morgan Stanley price target time frame. The private cloud market is estimated to grow at a CAGR of 31.61% over the next nine years, reaching $237 billion by 2026, according to research from Statistica.

Gartner, a leading consultancy and technology research firm, suggests that the “cloud shift” we’re talking about could impact more than $1 trillion in IT spending within the next two years – a staggering impact if I’ve ever seen one.

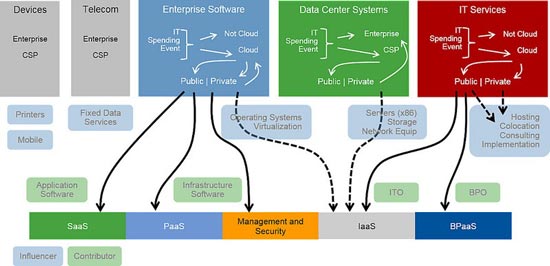

Importantly, the spending will be across virtually the entire spectrum which you can clearly see in this chart, courtesy of Gartner:

Source: Gartner

Source: Gartner

Most investors will, of course, miss the massive, game-changing nature of what we’re discussing… just as they’ll fail to grasp what I’m going to say next.

I believe every single one of the numbers I’ve just mentioned may be 2x to 3X too low.

For one thing, nobody knows how much additional money Microsoft can bring to the bottom line because of the President’s tax cuts. And, for another, there is no way of knowing how Microsoft’s stock buyback programs will develop which, in turn, means there could be additional and very aggressive support for its stock lurking unseen to current investors.

My guess is that the company will accelerate both of these things – tax savings and buybacks – as a means of dramatically enhancing results from the company’s cloud-based businesses.

It’s not a stretch… revenues for Office 365 could jump from $10.7 billion in 2017, to more than $25.6 billion by 2020, but I think $27 billion is more likely. Similarly, Morgan Stanley sees Azure’s top line increasing from $3.9 billion last year, to $21.6 billion over the same time frame – but I suspect $23 billion, perhaps even $24 billion, is more like it.

Morgan Stanley analysts haven’t made a mistake, though.

The markets have.

As usual when this is the case, you’ve got a great opportunity at hand.

Professional traders, you see, often game short-term support and resistance levels to grab more immediate profits at the expense of less-well capitalized players who are incapable of seeing the longer-term moves being set up.

Knowing this tactic gives you an edge that can dramatically improve your risk to reward ratio and result in bigger profits.

For example, I observed this same sort of analytical pattern with Raytheon Co. (NYSE:RTN) and recommended it to readers in our sister publication, the Money Map Report. Everyone who followed along as directed had the chance to see peak returns of 463.74%. The same is true of Harris Corp. (NYSE:HRS) and Becton, Dickinson and Co. (NYSE:BDX), which have turned in peak gains of 109.56% and 224.66%, respectively.

Three Ways to Position Yourself for Profits

The easiest way to play along is to simply buy Microsoft stock.

Right now, that’s trading at $92.61, which means you’ll spend $9,261.00 for every 100 shares, not including commissions and fees that vary by broker. A projected 45% run in less than 12 months is nothing to shake a stick at. Buying on dips is a great way to build your position quickly, as long as the business case I’ve outlined remains intact.

Option savvy investors looking for a little more “juice” could purchase Microsoft LEAPS (Long Term Equity Anticipation Security).

The advantage with a LEAP is that you can control the same amount of stock at a dramatically lower cost. Many investors use them as a risk reduction tool for this reason.

My favorite choice in this department is the Microsoft January 17, 2020 $95 Call (MSFT200117C00095000), which is trading at roughly $12.80 per contract as I type. The breakeven is $108.38 per share, which strikes me as “about right,” given the expectations I’ve just laid out and the time frame.

And, finally, if you fancy something a little more unorthodox?

I recommend a neutral-to-bullish trade in two stages.

Step 1 is that you sell-to-open a Microsoft January 17, 2020 $90 Put (MSFT200117P00092000) option. As of press time, that contract is roughly $10.27, which means you’ll receive a healthy credit of $1,027 in your account for every option “sold.” Conventional thinking is that you don’t want an option like this one to finish out of the money but, in my case, that’s exactly what I want because I like “getting paid” to go shopping.

Step 2 is a little more nuanced. Assuming the option in Step 1 is exercised, I recommend immediately using the initial $1,027 credit to offset the price of buying a bullish call spread with a minimum return of around 200%, based on a spread price of $0.25 and a maximum profit of around $0.75.

Unfortunately, I am unable to recommend specific strikes for Step 2 at the moment because I have no idea where prices will be when it’s time to make your move. The trade could grind forward at a snail’s pace or pop quickly, depending on market conditions.

Admittedly, this sounds a lot more complicated than it really is – but don’t let that put you off. What I am describing is no different than one of boxing legend Muhammad Ali’s famous “one-two” punch combinations. Most online options platform scan for trades like this, using parameters you type in, so it’s just a matter having the discipline to “tune in” whenever there’s a big price day working in your favor.

Until next time,

Keith Fitz-Gerald

Chief Investment Strategist

Source: Total Wealth Research