The S&P 500 has already increased in value by over $1 trillion in 2018—and January isn’t even over yet!

What’s behind this incredible bull market isn’t euphoria or hysteria—it’s actually sound investing principles. As I wrote in a January 18 article, the bull market is being driven by the best possible trend: higher earnings and sales for America’s best companies, which is itself the result of improving economic conditions for everyday Americans.

Parties ultimately end, of course.

And this one is no different—the bull market is being driven by a solid and reasonable belief that American companies will go up in value.

But eventually that sound line of thinking will turn into a euphoria that creates a bubble—then a crash.

Fortunately, we aren’t there yet, and we probably won’t be for a couple years or so.

Unfortunately, though, we are seeing some foolish investing decisions being made as a result of naive first-level thinking.

Today I’m going to show you 2 common mistakes—and 2 investments—that have captured the herd’s attention for all the wrong reasons. Read on to learn more about them, and how you can steer clear.

Mistake #1: Buying on Dividend Yield Alone

The Eagle Point Credit Company (ECC) pays an outsized 13% dividend yield as I write this and makes a simple claim: that its financial professionals know how to make money from obscure and complicated investments.

But that’s not the whole story.

It’s true that ECC is one of the biggest investors in collateralized loan obligations (CLOs), and it’s true that CLOs are very complicated. You can think of CLOs as derivatives that are a lot like the mortgage-backed securities that were at the heart of the financial crisis; ECC claims to understand these assets and can make a profit accordingly.

The real problem, though, is ECC’s sky-high fees.

Last quarter, ECC reported a 10.7% expense ratio. In other words, for every $1.00 in assets the company has, it takes out 10.7 cents per year in fees. ECC needs to make a 10.7% profit on its investments just to pay its managers—before shareholders get a penny!

Of course, before many folks even get to the fees, they see the juicy dividend yield I mentioned earlier, which has ranged to nearly 15% so far this year, and hit the buy button.

Juicy Income—At First Glance

Trouble is, that sky-high yield is because the stock’s price keeps falling.

Trouble is, that sky-high yield is because the stock’s price keeps falling.

ECC Not a Grower

Notice the huge drop in price over the last week? That’s because ECC issued new shares, diluting current investors’ ownership. Why would ECC do such a thing? They may want to release more shares to make more aggressive bets in the CLO market. It’s also true that more shares translates into more assets to manage, generating more fees for ECC.

Notice the huge drop in price over the last week? That’s because ECC issued new shares, diluting current investors’ ownership. Why would ECC do such a thing? They may want to release more shares to make more aggressive bets in the CLO market. It’s also true that more shares translates into more assets to manage, generating more fees for ECC.

This is definitely an investment to avoid.

Mistake #2: Ignoring History

It’s true that history doesn’t repeat itself, but it does rhyme, and in financial markets, rhymes on historical events are sometimes all the signal you need to stay away.

This is the case with Prospect Capital Corporation (PSEC).

I haven’t talked about this stock in over a year, because it was pretty clear that Prospect’s past mistakes were recurring, and that meant we would see the same chain of events as in yesteryear.

And that’s what 2017 delivered.

Let’s back up. PSEC is a business development company (BDC) that’s structured to give most of its income to shareholders. That’s why PSEC yields over 10% right now.

There are just a couple problems.

For one, the BDC world is getting extremely crowded. BDCs are a good idea—they pool together a lot of money from investors and then lend that money out to small and medium-sized businesses that can’t get loans easily from banks.

But BDCs are such a good idea that a lot of new ones have opened up in the last few years. It’s an easy way to make money if you have connections and access to capital, so the barrier to entry is low. That crowdedness has also resulted in profit margins shrinking for BDCs, in turn lowering the income most BDC shareholders have access to.

Meantime, the extremely illiquid portfolios that BDCs hold are nearly impossible to sell in a market panic, which further boosts their risk.

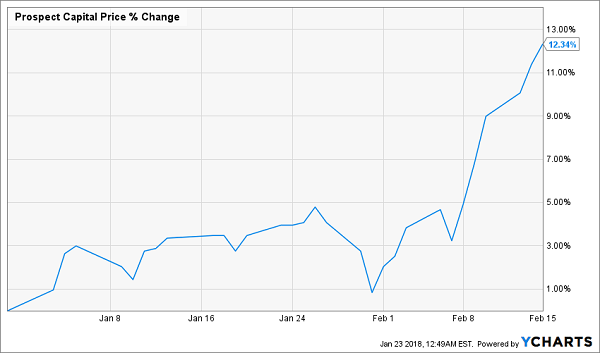

Those two reasons alone are good motivation to stay away. But many investors ignored them in the first couple months of 2017, which is why PSEC did this:

A Crowded Trade

If you were playing PSEC for the short term, this was great. Most PSEC holders aren’t, though—they buy for that 10%+ dividend and hold forever. Which is why PSEC shareholders aren’t happy now, as you can see from this chart:

If you were playing PSEC for the short term, this was great. Most PSEC holders aren’t, though—they buy for that 10%+ dividend and hold forever. Which is why PSEC shareholders aren’t happy now, as you can see from this chart:

A Steep Drop

Not only has PSEC’s price crashed since its big early 2017 run-up, but its dividend has been slashed by 28%, as well. Note that the majority of the price crash happened before the dividend cut. The market isn’t clairvoyant—but a lot of investors who looked closely at PSEC saw that its dividend coverage ratio had fallen below 100%, and it could no longer afford to pay its high payout to shareholders.

Not only has PSEC’s price crashed since its big early 2017 run-up, but its dividend has been slashed by 28%, as well. Note that the majority of the price crash happened before the dividend cut. The market isn’t clairvoyant—but a lot of investors who looked closely at PSEC saw that its dividend coverage ratio had fallen below 100%, and it could no longer afford to pay its high payout to shareholders.

This wasn’t a shock; Prospect had the same problem in 2015. And it will have this problem again and again and again … causing the stock to keep crashing and the income stream to keep shrinking.

2 Takeaways to Protect and Grow Your Nest Egg

What can we learn from these 2 examples?

First, be suspicious of high dividends. While 7% or 8% yields can be sustainable in many cases, it’s very rare (but not impossible, as I’ll show you in a moment) for a 10% yield to be sustainable. The higher the yield, the more need for a careful analysis of how sustainable that dividend really is.

Second, we need to pay attention to history. Investors who took the time to look just a couple years back into Prospect Capital’s past knew to stay away.

The third, and perhaps most important, lesson relates to complexity. Some financial advisors urge clients to avoid investing in anything they don’t understand. This is silly. None of us really understand what goes into our iPhones, but that hasn’t stopped Apple (AAPL) from soaring.

Companies that produce financial products are no different. They provide a value and a service, and investors can profit from them even if they don’t understand the technicalities.

However, we must be able to identify and quantify the value a company provides, and how that value is changing. The real problem with ECC isn’t that its business is too complicated—it’s that ECC’s management earns too much money by charging shareholders for their services.

The bottom line? Find companies and funds that have management teams whose interests align with yours, a history of making the right decisions and a structure that rewards shareholders more than managers. When you do, you’ll find that massive profits come your way.

— Michael Foster

One Click for the 14 Best Funds of 2018 [sponsor]

Or better yet, let me do the research for you!

Because right now, my team and I are pounding the table on no less than 14 funds throwing off some of the highest, and SAFEST, yields on the market (including one “unicorn” that pays a steady 9.2% payout!).

Oh, and these 14 cash machines are primed for double-digit GAINS in 2018, too! You can get the names of all 14 when you take a no-risk 60-day trial to my CEF Insider service today.

Simply CLICK HERE to start your trial now. When you do, you’ll get instant access to the names, tickers and all of my research on each of the 14 funds in the service’s portfolio.

These 14 bargain funds all trade at absurd discounts to net asset value (NAV, or what their underlying assets are worth) that are slowly narrowing. That puts a relentless lift under their share prices and sets us up for market-crushing gains in 2018!

But the best part—by far—is the dividends.

Right now, the portfolio boasts an average yield of 7.4%. But remember, that’s just the average! Cherry-pick my 3 highest-yielding funds, and you’ll be pocketing life-changing payouts like 9.2%, 8.6% and 8.2%!

I hope you’ll take this no-risk opportunity to join the small group of investors across the country who are pocketing regular monthly dividend checks from these 14 terrific funds.

And to sweeten the pot further, I’ll also GIVE you my latest Special Report FREE!

This exclusive guide reveals the names, tickers, buy-under prices and more on my 4 favorite CEFs for 2018. Grab these 4 cash machines now and you’ll trigger an 8.1% income stream and position yourself for 20%+ upside by the time 2019 dawns!

Source: Contrarian Outlook