Individual investors were “all in.” It felt like the top.

The problem was that it wasn’t the top.

It was early 1998. Investors were betting on a continued uptrend – they had gone “all in” on stocks, based on one measure.

If you’d sold then simply because investors were “all in,” you would have been kicking yourself later.

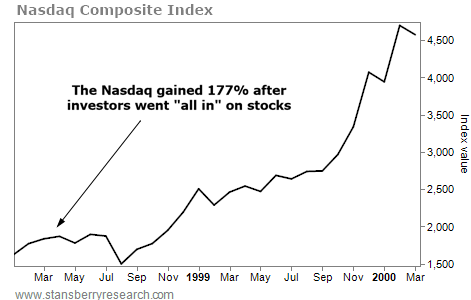

That’s because the market didn’t peak until two years later – in early 2000.

Said another way, if you’d gotten out when investors first went “all in,” you would have missed out on two years’ worth of upside.

Today, we’re seeing the same scenario. Investors are “all in” on stocks, just like they were in 1998. And just like that time, selling early could be a huge mistake.

Let me explain…

I always want to know what individual investors are doing with their money.

It tells us when investments are hated or loved… And how to act as contrarians.

Still, the timing around sentiment indicators can be tricky. That’s the case with today’s “all in” measure for stocks.

The American Association of Individual Investors (AAII) has been tracking investor portfolios for decades. One of its surveys covers the cash, stock, and bond allocations of individual investors.

According to the latest survey, individual investors’ cash positions are at the lowest level we’ve seen in nearly two decades. Investors hold just 13% of their portfolios in cash right now.

Again, cash positions haven’t been that low since the dot-com boom. But it doesn’t mean stocks are peaking today. Here’s how things went last time…

In January 1989, individual investors held 36% of their portfolios in cash. Stocks boomed over the next several years. And by March 1998, investors held only 11% of their portfolios in cash.

The dot-com boom was in full swing. And investors had gone “all in.”

Sounds scary, right? Well, it wasn’t.

From March 1998 to March 2000, the tech-heavy Nasdaq Composite Index gained 177%…

Getting out just as investors were piling in would have been a terrible mistake.

Today, we’re in a similar position. Mom-and-pop investors’ cash allocations are at 13%, according to AAII.

That tells us that sentiment is getting more positive. Investors are more excited to own stocks. But it doesn’t mean a crash is imminent.

When cash positions hit similar lows in early 1998, the Nasdaq nearly tripled in less than two years.

Now, I’m not saying that stocks are certain to double or triple from here. But we have no reason to expect this is the top just because individuals have moved into the stock market, either.

History says the opposite is true… We could still have years of upside ahead of us – along with some of the biggest gains of this bull market.

Good investing,

Brett Eversole

The legendary stockpicker who built one of Wall Street's most popular buying indicators just announced the #1 stock to buy for 2026. His last recommendations shot up 100% and 160%. Now for a limited time, he's sharing this new recommendation live on-camera, completely free of charge. It's not NVDA, AMZN, TSLA, or any stock you'd likely recognize. Click here for the name and ticker.

Source: Daily Wealth