It’s hip to be square, or at least invested in Square Inc (NYSE:SQ), but it does come with its share of risk. Our advice for SQ stock traders looking to cash in on the volatile bullish trend is to use a fully hedged and flexible collar strategy to your advantage. Let me explain.

SQ Stock: You Should Buy Square Inc TodaySince I last wrote about Square two months ago, the company has quickly gone from finding decent investor favor on Wall Street as an upstart mobile banker to becoming a bonafide trader’s stock.

During this period, SQ stock raced higher by nearly 70%, only to collapse 27% in less than two weeks and in the process take back more than 60% of the prior gains.

Behind the personality change and maybe schizophrenic behavior is Square’s early adoption of the cryptocurrency craze.

The company announced in November it was implementing a pilot program where select users of its Square Cash app could buy and sell bitcoin.

Coupled with media-savvy CEO Jack Dorsey promoting the potential of cryptocurrency transactions, a decent growth narrative for SQ stock has become a highly volatile affair, as bulls and bears take turns jockeying shares around based on optimistic prognostications and dire warnings that nobody really has a firm handle on in one trader’s humble opinion.

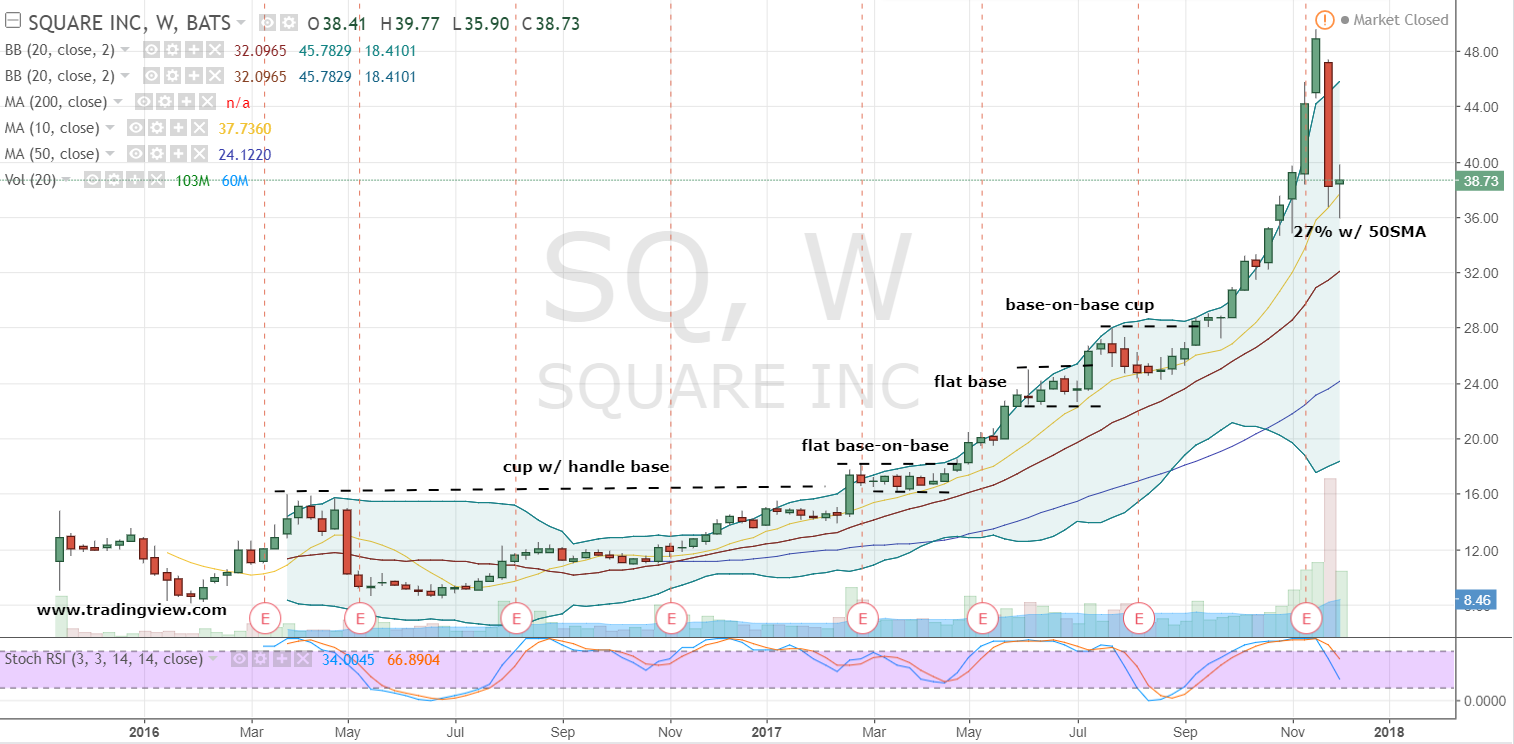

SQ Stock Weekly Chart

As the weekly chart of SQ stock shows, a change of character has occurred over the last several weeks.

As the weekly chart of SQ stock shows, a change of character has occurred over the last several weeks.

From a technically constructive tale of growth potential as evidenced by multiple tighter base patterns within an uptrend, shares of Square have moved into being a momentum name with its fast rise and even quicker correction.

If you want my two bitcoins on SQ stock, I think shares are offering traders a nice bullish entry point. Bottom line, all stocks correct. And if one believes in the underlying narrative of Square, buying into a healthy 27% correction, a test of the 50-day simple moving average and a weekly reversal candle in-the-making makes enough sense technically speaking.

SQ Stock Collar Strategy

In October I outlined a bullish and fully hedged collar strategy for SQ stock. The strategy worked well on the run higher, albeit offering traders lesser returns than a straight long stock play. But the real payday or benefit would have been the subsequent trend adjustments as Square rallied higher.

Adjusting the collar around SQ stock as it raced up in price would have prevented the trader from experiencing the recent technical fallout while keeping the bulk of the trader’s gains without having to sell during a panic which began out of left field due to a broker downgrade.

I still like the collar for positioning, particularly after the healthy corrective pullback, but we simply don’t know if it will mark “the bottom.”

Reviewing the SQ stock options board and shares at $38.73, the Jan $45 call/$35 put combination is priced for $39.08, or a premium of just 35 cents over outright Square stock.

What does the slight additional cost offer traders?

I’ve been through the math for collars on more than a few occasions and to be quite honest, it’s quite straightforward. More importantly, given what’s been discussed technically, business-wise and the solid past performance of this strategy through bullish and bearish periods; I personally only see upside and not an extra expense with this collar on SQ stock.

— Serge Berger

[ad#IPM-article]

Source: Investor Place