At CEF Insider, we regularly pound the table on top-notch US closed-end funds (CEFs).

And we still see America as our “go to” for huge yields, income and big gains.

But if you take a pass on other parts of the world, you’ll miss a proven way to cut your risk (thanks to the tremendous variety in the global economy) and big upside too.

That’s why we constantly keep our eyes trained on the horizon. And today, one particular place has caught our attention: Asia.

For a long time, Asian stocks were a sucker’s bet, for a couple reasons.

The biggest? Loose accounting made many of them way too dangerous.

And the biggest ones were insanely complicated, making them nearly impossible to value and stunting the flow of profits to shareholders.

Thirdly—and most worryingly—the crash in commodity prices crushed many Asian firms. Look what happened to poor folks holding PetroChina (PTR) over the last decade:

The Oil Crash’s Biggest Victim

But things are changing, and we need to look at Asia differently. In a moment, I’ll give you 3 dead-giveaway signals that now is the time to make your move.

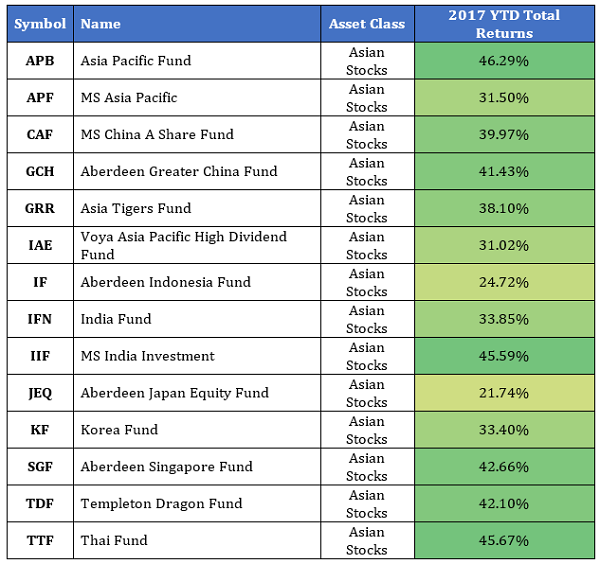

First, let’s look at what our CEF Insider data says about Asia-focused funds in 2017:

The worst fund has so far delivered “only” 21.7% returns (!), while the Asia Pacific Fund (APB), India Fund (IFN) and the Thai Fund (TTF) have clocked in at more than 45%.

The bad news? Insiders have noticed—and they’re getting greedy.

Most recently, England-based City of London Investment Group successfully pressured the Thai Fund to shut down and liquidate. This is sad because TTF has crushed the S&P 500—and its gains have been accelerating in recent years:

Hedgies Crash TTF’s Party

The lesson?

If you want to lock in Asia’s gains, now is the time to buy into other Asian funds before greedy hedge funds lean on them, too.

Here are three other unbeatable reasons to “buy Asian” now.

Buy Signal #1: The Diving Dollar

It’s no secret that the greenback is looking a little pale lately.

It’s fallen against most currencies, and particularly against emerging-market and Asian ones. The US dollar now buys 4.2% fewer Chinese yuan than it did at the start of 2017:

Lower Greenback Gives Us an In

Notice that big dip and swift recovery in the last few weeks? That’s all about uncertainty surrounding how the Chinese yuan is going to be used abroad.

A year ago, the International Monetary Fund said it would use the yuan in its “special drawing rights basket,” a fancy way of saying more companies will be able to buy and sell in yuan. Only recently has the market started pondering what this means for the yuan’s value.

In this moment of uncertainty over the yuan’s future, we’re getting a respite from the dollar’s fall. That translates into a great entry point for us.

Why is a weaker dollar good for Asian companies?

For one, many borrow in dollars and earn money in local currency, so a weaker dollar lightens their debt load. Plus, since they report their results in local currency, a weak greenback pumps up their numbers from a US-dollar perspective.

The upshot? When the dollar is on its back, you need to invest abroad. Now is the time.

Buy Signal No. 2: Auditors Get Tougher—and Corruption Gets the Boot

A crucial development throughout Asia has been a clampdown on corruption and moves to bolster accounting standards.

Stories of dodgy accounting leaving investors holding an empty bag have left Asian companies red faced. Last year, NASDAQ said it would crack down on its Chinese constituents in response. That, plus pressure from international accounting firms caught up in the drama, caused many Chinese companies to change tack.

That’s come in lockstep with anti-corruption efforts in China, Indonesia and Malaysia that have made these countries a bit safer for investors. The crackdown is in early innings, but as these countries’ middle classes gain clout (and complain more loudly), it will speed up.

Buy Signal No. 3: Japan’s QE and Foreign Investment

The least-talked-about development in Asia is happening in Japan.

Japan isn’t a growth economy and (famously) hasn’t been for decades. That’s left Japanese firms with two choices: invest abroad or die.

They’ve chosen option 1, and it’s been great for the mainland. Japanese firms have been pouring into emerging markets like Thailand, Taiwan and even South Korea, which is quickly catching up to Japan. And when South Korea fully catches up, it too will need to invest more heavily in other Asian nations.

In fact, it already has: at the start of 2017, Samsung said it would invest $2.5 billion in its Vietnamese factories. That single investment will boost Vietnam’s GDP per capita by 1.2%, and it’s just the start. In August, Vietnam said it would record $16 billion in foreign investment in 2017, contributing 7.9% growth to the country’s GDP.

In the shade here is Japan’s quantitative easing (or the purchasing of bonds by its central bank), which has left the country awash in cash—and a lot of it has flowed to Southeast Asia. More is coming, yet the gains from all that investment are only now starting to register. You can bet they’ll flow to investors for years to come.

— Michael Foster

Get VIP Access to My 11 Top Funds for Yields Up to 9.5% [sponsor]

My CEF Insider service holds 11 off-the-radar picks I see as the very best fund picks right now—poised for fast double-digit gains and throwing off SAFE yields up to 9.5%.

All you have to do is CLICK HERE to road test CEF Insider and get immediate access to this incredible portfolio with no risk and no obligation whatsoever.

That’s not all.

Your no-risk trial comes with my latest FREE Special Report, which reveals my 4 “Best Buy” CEFs now.

These “unicorns” boast 7.4% CASH payouts, on average! AND I’m expecting strong dividend growth here, too, so you’ll be pocketing 10% or more in short order.

The kicker? Thanks to their ridiculously cheap discounts, they’re also on the launchpad for 20%+ price gains in the next 12 months (or sooner)!

Your Special Report, the entire CEF Insider portfolio and all the other benefits of membership are waiting for you now.

But I must warn you: we can only let 500 people take advantage of this offer to try CEF Insider—and 400 have already snapped up trial memberships. With thousands of investors likely reading this now, I expect those remaining spots to go FAST!

Don’t wait. CLICK HERE to get instant access to the CEF Insider portfolio and the complete service with no risk whatsoever!

Source: Contrarian Outlook