Introduction

When the Dow Jones Industrial Average first hit 20,000 in January of this year it generated quite a buzz within the financial community. Since January the Dow Jones Index has continued to rise and currently is over 22,700.

However, the Dow Jones is not the only market index that is currently sitting at or near all-time highs. The broader S&P 500 index is also at a historic peak.

However, even though the Dow Jones sits at an all-time high, it does not logically follow that all stocks in the Dow Jones are at all-time highs.

Perhaps more importantly, even though the index is at an all-time high, it does not necessarily mean that all the stocks in the Dow Jones are overvalued.

On the other hand, since the index is at an all-time high, it might also logically follow that many (if not all) of the stocks in the Dow Jones are overvalued. As I’ve often pointed out, it is a market of stocks not a stock market.

Consequently, the only way that any of these things can truly be determined is by evaluating each of the individual constituents that make up the 30 Dow Jones Industrial Average. The good news is there are only 30 stocks in the index; therefore, it is not too difficult or overly time-consuming to evaluate each of the constituents independently. But more to the point, I think there is a significant benefit and enlightenment achieved through examining each of the 30 constituents individually.

Then, not only will the veracity of the statement: “it is a market of stocks” be validated, the reality of how different each individual company that makes up the market is also vividly revealed. Therefore, this will be the first of a series of 5 articles where I will examine each of the 30 Dow Jones Industrial constituents individually. Moreover, I will be presenting the 30 stocks 6 at a time, in order of valuation highest to lowest. As a prelude to what will be revealed relative to valuation, I intend to illustrate that approximately half of the Dow Jones constituents are currently reasonably valued.

Portfolio Review: The 6 Most Expensive Stocks in the Dow Jones Industrial Average

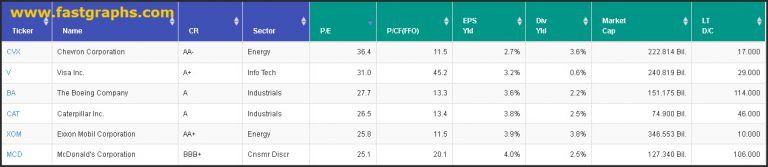

The following portfolio review lists the 6 most expensive stocks in the Dow Jones Industrial Average based on their current blended P/E ratio. However, there are many ways to value a stock in addition to the P/E ratio. Consequently, I suggest the reader also notices the price to cash flow of each of these 6 Dow constituents. For those investors most interested in dividend income, price to cash flow might be more relevant for higher-yielding dividend paying stocks. Furthermore, when ascertaining valuation, other factors such as expected growth need to be considered as well. I will elaborate more fully in the video below.

FAST Graphs Analyze Out Loud Valuation Analysis

This video will present a quick overview of each of these Dow constituents based primarily on price relative to earnings and cash flow. However, for certain constituents I will also evaluate several other metrics. For any reader concerned with the current valuation of the stock market, this video and the subsequent 4 videos that follow in future articles are must watches.

Furthermore, although I will be only providing a cursory, or a pre-more comprehensive due diligence analysis, I believe you will find the video enlightening and hopefully entertaining.

Summary and Conclusions

In part 1 of this 5-part series I covered what I consider the 6 most expensive stocks in the Dow Jones. With my next article (part 2) I will look at the next 6 Dow stocks relative to valuation. I believe you will find that relative valuation of these next 6 Dow stocks is quite similar to these first 6. However, with each respective installment I will be reviewing additional Dow constituents that appeared to be more attractively valued.

As an aside, many of you may have seen or read about Warren Buffett’s recent prediction that the Dow Jones Industrial Average will someday hit $1 million. Personally, I believe that Warren Buffett may in fact be correct. But more importantly, that prediction needs to be put into perspective. His timeframe is 100 years and this would imply that the Dow Jones increases only by 4% a year. Nevertheless, the reason I bring this up is simply to point out that stocks have generally risen over the long run.

Consequently, I believe the Dow Jones will in fact increase in value over time. On the other hand, that does not mean that stocks will go never-endingly up. As history has proven, there will be interruptions along the way. Nevertheless, the most vulnerable stocks will be those that are most overvalued just prior to a correction occurring.

— Chuck Carnevale

[ad#Sure Dividend]

Source: FAST Graphs

Disclosure: Long CVX,V,BA,XOM,MCD at the time of writing.