There’s no polite way to say it: Americans are over a barrel when it comes to retirement.

Two decades of slow-rolling growth and the worst crisis since the Great Depression mean around 40% of today’s workforce has nothing saved for retirement.

Too many people have too little money and too little time. And too many of them don’t even realize it.

There’s no big conspiracy, no giant hose job going on; it’s a tragedy of errors.

People are settling for subpar returns…

…and it’s dooming them to a dismal retirement.

This is a grim picture, sure, but I’m not finished yet.

Let me paint you another. It’ll show you how we got here, and, of course, what you can do about it…

Submitted for Your Approval: This Guy Has No Idea He’s Doomed

Consider a man… a 55-year-old man sitting comfortably at a bar in any one of the dozens of fairly prosperous, anonymous suburbs dotting the Washington, D.C. – New York Corridor.

Our man is sipping a 12-year-old scotch (with a splash of water to bring out the aromas) as he contemplates his life.

It’s on the verge of early evening, and our hero is feeling pretty good about himself.

On the surface, it’s easy to see why…

He has a great job as the regional sales manager of a plumbing products company, and business has been pretty good; people need plumbing through boom and bust.

He makes a little over $100,000 a year, and his wife is a mid-level administrator for the local school board bringing in another $50,000. They have a nice house in a nice neighborhood, the kids are all grown, and the last of the three finally finished college a year ago.

And, to top it all off, our protagonist has just had a meeting with his broker, and he’s feeling pretty good about the prospect of having a retirement that does not entirely suck.

Now, he’s known his broker, Brad, for years. They met in their early twenties, when they both joined a few civic groups in town to meet other up-and-comers and socialize. They share a love of all things football, and they’re not terrible at golf, either.

Our hero has done business with Brad since the day he made his first investment, and they have a really solid business relationship with more than a few hallmarks of a real friendship: There are the golf games, of course, and they talk once every other week or so – a little more often when the market’s volatile.

Our guy is pleased with the relationship, and the results have not been entirely awful, either, as far as he can tell.

Today’s review went pretty well, for instance. Our man has about $200,000 in his retirement plans, and his wife has another $25,000 in her 403(b) annuity.

What’s more, he has another $50,000 and change in what he considers his “trading account.”

He and Brad have attempted some more aggressive strategies to try and grow that account and, while results have been a little spotty the last year or so, he has to admit that the adrenaline rush from trading hot stocks and buying options is a bit of a thrill.

He and Brad have the retirement assets in a classic 60/40 stock/bond mix using mutual funds offered by Brad’s firm.

If the stock/bond allocation earns the historical rate of return – about 8% – and he and the missus put 5% of their income into the plans, then their retirement nest egg would grow over the next decade to about $600,000.

Now, once upon a time, the couple often talked about investing all of his wife’s after-tax salary… but that never actually came to fruition.

You see, when the kids were growing up most of that went to all the extras… like team sports, field trips, band camps, tutoring, vacations, $100 tennis shoes – plus all the other stuff kids need.

Then, of course, it went to all the college expenses. Putting three children through college, even a combination of community college and local state college, is not cheap anymore.

But anyhow, they were finally all done with that, and the kids had a good start of stable careers.

They had hoped that once the kids were done with school, they could use more of her salary for themselves, but you know how it is with kids…

Junior needed a little help with a down payment on a house. Little Jeanie, their first grandchild, needed braces and didn’t want to suffer the indignity of metal braces, so Grandma sprung for the cost of Invisalign braces – not covered by insurance, of course, but soothing to the little one’s self-esteem.

Their youngest girl, their wild child, had finally settled down. She’d graduated with a teaching degree and had an apartment of her own. They were proud of her… but good grief, that car she drove was a death trap, and they just couldn’t let her drive around in it any longer. So they went in with her on some new, safer wheels.

“It seems you’re never done raisin’ kids,” our suburban super-dad thinks to himself as he raises his glass to take the first sip of his elegant, earthy scotch, inhaling all the peaty, smoky goodness therein…

Our man’s thoughts drifted back to his money… and his buddy, Brad the broker.

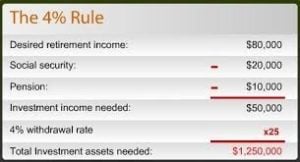

Brad was talking about using the “Rule of Four.” To hear him tell it, it’s a rough estimate of how much of your account value you can withdraw in retirement without using up all your principle. (It’s a little flawed, but it’s close enough; we’ll use it for the purposes of our story here.)

Brad was talking about using the “Rule of Four.” To hear him tell it, it’s a rough estimate of how much of your account value you can withdraw in retirement without using up all your principle. (It’s a little flawed, but it’s close enough; we’ll use it for the purposes of our story here.)

By the “Rule of Four,” Brad was advocating a retirement income of about $7,000 a month. It made good sense to our hero here and sounded pretty comfortable, given that the house will be paid for.

Much of the discussion with Brad today was about what to do with the $50,000 account. Brad wants him to put it into a variable annuity. Our man didn’t understand it very well, but according to his old buddy, he would earn returns similar to a stock and bond mix – but it would never go down, and they would never pay taxes.

That sounded pretty good to him. Of course, he would miss the thrill of making the occasional money-doubling trade, but that’s alright: It would mean another $350 he could safely add to his monthly retirement income.

So… If everything’s so good and the future’s so bright… Why does out hero have doubts creeping in around the edges? The tiniest little knot in his innards that not even 80-proof scotch can subdue?

“Is This Really What I Worked 45 Year For?”

Now, if this were a “Twilight Zone” episode, we’d be right at the point in the story where a six-foot, bunny-suited woman named Ethel would throw herself down on the adjoining bar stool, order a tall gin rickey, no lime, lean back, light an unfiltered Pall Mall (you can still smoke in bars in the Twilight Zone), look our intrepid financial adventurer in the eye and, in a raspy voice, declare…

“You, my friend, are screwed.”

Taking a deep drought of the gin and a healthy draw on her Pall Mall, Ethel would continue, “Your whole plan is based on the idea of getting a 7% or better return on a 60/40 stock-bond mix.

“That’s worked okay in the past, but the past is the past: There is no guarantee that it will work in the future.

“In fact, odds are you won’t even come close, and I’ll show you why in a minute…” Ethel promises.

“Let’s say everything goes according to plan.

“That $7,350 a month Brad told you about sounds great, but consider a few things:

You’ll still have to pay income taxes.

Then there are real estate taxes that will take a bite.

Medicare is a hundred fifty or so, and add a little more than double that for a decent Medicare supplement.

House upkeep, car insurance, life insurance, utility bills, and all the other ongoing expenses of life still have to be paid.

“While that $700,000 number sounds fantastic, the hard truth is that you are looking at golf at the municipal course once in a while – not three rounds a week at the country club,” says Ethel.

Our hero’s jaw drops slightly…

“You might take the grandkids to the local amusement park once in a while, not on a Disney Cruise. You’ll get family vacations at the Jersey shore for a long weekend rather than two weeks in Florida for Christmas with the whole family,

“In short, with that $700,000 nest egg, you’re really looking at a ‘Is this really what I worked 45 years for?’ kind of retirement.

“And that’s provided nothing goes wrong.

“If anyone gets seriously ill, gets Parkinson or Alzheimer’s and requires full-time care, your nest egg is going to disappear quicker than Tiger Woods’ golf swing.”

Our hero’s scotch waters over as he gets clobbered by Ethel’s “Straight Talk Express.”

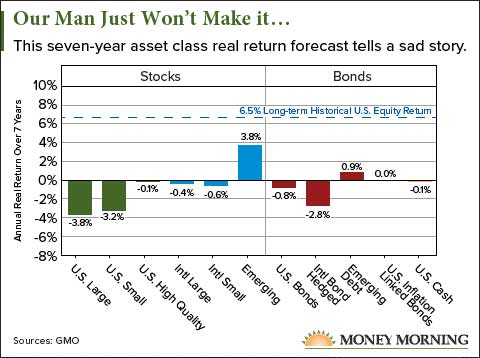

Ethel continues, “Now, let’s talk about those expected returns. The 7% to 8% or higher returns being tossed around are simply not realistic.

“If we look back in time, we see that interest rates have been falling steadily for the last 35 years after peaking near 15% in the 10-year Treasury note.

“They have since dropped by more than 80% to less than 2.5%.

“In fact, the expected return on a long-term bond portfolio is – historically – roughly equivalent to the beginning yield, so the bond component of your 60/40 portfolio can be expected to return about 2% to 3% over the next decade.

“Now let’s look at the stock side of the equation.”

Our protagonist takes a deep breath.

Ethel says, “If you look back at the starting point of those long-term returns, the S&P 500 had a price/earnings ratio of around 10. Today it’s almost 25 – about 60% higher than the historical median ratio of 15.

“It gets worse: If we look at the historical data, the expected return from current levels is a slight negative over the next decade. Given high valuations and low interest rates as a starting point, your long-term expected return on the 60/40 mix is something close to zero.”

Our man looks puzzled. Very puzzled…

“Let me repeat that – you look like you’re having a little trouble absorbing this: Sky-high valuations and rock-bottom interest rates mean your 60/40 approach is dead on arrival. Expected long-term returns: zero, or close to it.

“Oh, yeah: One last thing,” Ethel says as she gulps down the last of the gin and lights another cigarette from the stub of the first.

“Brad is a good guy, but all his training is in the sales process; he’s taught to gather assets for his firm, not to manage money or seek high returns.

“If you buy that fancy annuity, Brad will earn $4,000 or more right off the top. In every investment transaction, there are three participants: the broker, the client…and the broker’s firm.

“Two of the three can emerge a winner. Most of the time it will be the firm and the broker. If it’s not, Brad will either go broke or get fired. Brad is a nice guy, but he has kids and bills of his own and Brad doesn’t want to go broke or get fired.”

And with that, Ethel stubs out the cigarette, gathers her things, adjusts her bunny ears, curtseys, and exits into the fading suburban daylight.

And if we’re real quiet, we’d swear we could hear Rod Serling himself saying, “Consider a man, sobbing at a strip mall bar, face down in a puddle of high-end scotch and lowered expectations.”

We then fade to black as the credits roll…

And we come to the heart of the matter.

Here’s the Simple Truth… and the Bold Solution

Clearly, this is a fictional view of the real issue facing a lot of would-be retirees, but that doesn’t make it untrue.

And the truth is, many investors are facing the same “Twilight Zone”-like conditions as they get closer to retirement. Wall Street’s prepackaged, self-interested mediocrity will not provide the higher returns needed to fund a meaningful and enjoyable retirement.

What’s worse, nobody is talking about the current forecasted return expectations; they’re just blissfully assuming the next decade will look something like all the ones before it.

Considering the starting point, the “where we’re at” of the situation, there is almost no way that’s going to happen.

Instead, everyone from our scotch-drinking, would-be retiree, his wife, and millions of other Americans running headlong into retirement age, have to face a couple of facts.

First, they need to be more selfish.

It’s nice to help the kids along their way in life, but there comes a time when you have to focus on you. You educated them; you got them started. Now you have to concentrate on building your nest egg, because the simple truth is you are running out of time.

Let them buy their own cars, have metal braces and save up for a down payment on a house like you did. It won’t do them any harm. On the other hand, being the Bank of Mom and Dad (BOMAD) may have some minor psychological rewards but is doing major financial harm to your retirement prospects.

Second, and perhaps most important: You have to earn higher returns on your money.

Even the excellent returns over the past 20 years from a 60/40 stock/bond mix are not going to get the job done.

$600,000 or $700,000 isn’t going to be enough, and I suspect only a very small handful of folks will clear even that low threshold of wealth.

You must – repeat: must – get higher returns on your money, and that is not going to happen doing the same things everyone else is doing.

Let’s rewind a minute and consider what happens when our protagonist grapples with these two truths.

Here’s How Our Man Can Pull Off the Retirement He Wants

Starting with the same $275,000 total they have now, adding $18,000 a year (or about half the wife’s take-home pay), and earning an average return of 15% a year brings their age-65 nest egg up to over $1.4 million.

Using the “Rule of Four” and Social Security estimates, we now have a total income of over $100,000.

If we can get up to 20% annually, we have a nice stash of roughly $2.1 million, and their income in retirement will be just about what they make now.

And they’re set…

They can hit the country club a couple times of week, take the family on grand adventures, maybe take that cruise to Alaska they always talked about and enjoy their wonderful retirement.

Now, I can hear the scoffing from here.

“No one can do that! Nobody makes 15 or 20% a year on their money.”

That’s the big lie you hear from Wall Street and mainstream media, but the truth is that lots of people do exactly that or more.

I am not talking about wild-eyed speculation or a “place-your-bets-and-pray” strategy, either.

These folks are what I call careful, aggressive investors. And year-in, year-out, they beat the pants off of the market.

I’m talking about extraordinary returns here. Here’s how it happens…

“Unreasonably Great” Returns Are Possible

Ben Graham invented value investing and is considered the father of security analysis. In his 1972 book, “The Intelligent Investor,” he suggested that investing works best when it is run as a business.

And lots of businesses are built on this kind of market-crushing performance: At least 46 U.S.-based financial services businesses earn more than 20% on their capital.

They typically measure their long-term returns in multiples, not just percentages.

And plenty of people – real, flesh-and-blood human beings – bank these returns on a regular basis, too.

One of my heroes, Andy Beal, consistently earns well over 20% a year on his bank’s capital. Seth Klarman, too, has exceeded the 20% mark for the bulk of his (long) career.

The truth is, individuals just like us who invested in key sectors of the real estate market back in 2008 averaged over 21% a year in the meantime.

If, as Wall Street says, it’s not possible to earn sustained high returns without taking ridiculous risks, then why are so many people doing it?

I have studied this “20 Percenters’ Club” for years now.

I have read everything written about them or by them. If they are required to file quarterly or annual reports, like the SEC Form 13F, for instance, I’ve read them.

What’s more, I’ve spoken with many of them over the years, and I’m here to tell you: Almost to a man (and woman), they are incredibly “intellectually generous.”

In other words, they will tell you exactly what they are doing and how they are achieving high returns. Besides, it’s not like they’re facing serious competition. Most folks would just discount what they’re saying and go back to chasing stocks or trying some magic asset allocation formula.

It’s simple: These 20 Percenters look to buy things for less than they’re worth and eventually sell them for “unreasonably” great prices. They own good companies purchased at “unreasonably” low prices. They buy world-class properties at bargain basement prices.

Interestingly, they ask, “What could go wrong?” first, and not, “How much can I make if everything goes right?”

They tend to favor investments that produce high cash flows and that can be reallocated to the areas offering the highest returns.

These high-earning investors like owning assets and projects that allow them to be, in essence, toll collectors.

They protect themselves from losses and take steps to insulate their affairs from day-to-day market concerns. Who needs to sweat whether the market’s up or down on any one day? This is “Big Picture” stuff; they focus on value, safety, and time, rather than lines on a chart or quarterly earnings projections.

In short, the “20 Percenters” think differently than most investors, and that difference in thinking has made them rich – filthy, stinkin’ rich.

You’re going to be hearing lots more about how to target (and, more importantly, achieve) these kinds of extraordinary, life-changing returns in the weeks ahead.

I’m not talking about wild-eyed, bet-the-farm speculation here. In fact, most of these investments pack a lower risk profile than index funds!

The “20 Percenters” are banking these kinds of gains already, and there’s no good reason why you can’t be one of them, no matter how old you are, no matter what kind of shape your retirement account (or lack thereof) is in right now.

Then you will have the kind of retirement lifestyle that’s worth the four-plus decades of blood, sweat, and tears that preceded your final day at work.

— Tim Melvin

[ad#mmpress]

Source: Money Morning