You’d be hard-pressed to find a sector of the economy that hasn’t been disrupted somehow by the rise of the Internet and related technologies.

Blockchain technology… streaming media… ultra-miniaturization… online shopping… “Big Data”… have all changed the way we live, of course, but they’ve radically altered the business landscape as well.

Now, we’ve heard a lot about the companies losing out in this new paradigm.

The “Retail Ice Age,” for instance, which has bankrupted traditional retailers and shuttered iconic stores, is front-page news right now.

What’s not headline material, however, is that the massive opportunities this shift is creating promise to be far, far more lucrative than retail or movie theaters ever were.

One industry, in particular, has exploded – I’ll show you in a minute.

It’s a classic ground-floor opportunity, still in its very early days, but I don’t expect it will take long for these gains to make news.

These Numbers Are Incredible

It’s clear that companies like Amazon and Netflix have already accomplished the “disruption.” That’s over, for the time being.

The name of the game now is growth. And it’s ramping up fast.

Streaming video subscription revenue in the United States is forecast to rise over 100% between 2013 and 2020, according to website Statista. It’s expected that, by the end of this year, video will represent 74% of all online traffic, with 55% of people reporting that they watch online videos daily.

This past July, Netflix announced its service had topped 100 million subscribers in 191 countries (would-be viewers in North Korea, Syria, the disputed Crimean Peninsula, and China are out luck… for now). They stream more than 125 million hours of content daily. In 2016, revenue reached $8.3 billion from streaming.

“Radio,” (though I’m willing to bet you probably don’t use an AM/FM unit outside of your car anymore) which nowadays is simple shorthand for streaming audio, is exploding, too.

Free Internet radio platform iHeartRadio recently topped 100 million registered users – a massive cohort just ripe for monetization. What’s more, in 2016, for the first time ever, better than 50% of U.S. music industry revenue came from streaming. Apple Music and Spotify took the lion’s share of that $3.9 billion windfall.

But the real growth story – the 8,000-pound gorilla – is Amazon, of course.

Some conspiracy theorists are even panicking, suggesting Amazon is going to “take over the world.”

To their credit, that’s not as crazy as it sounds; it’s already the largest clothing retailer in the United States. As of June, the company had reached more than 380,000 employees after adding over 110,000 in 2016 alone. In 2007 the total was 17,000.

Net sales in 2016 were $136 billion, though yielding a profit margin of just 1.7%, or $2.37 billion. This has caused no end of fretting among analysts – stuck in the 1990s, apparently – who just can’t seem to figure out how Amazon makes its money.

They’re looking in the wrong place.

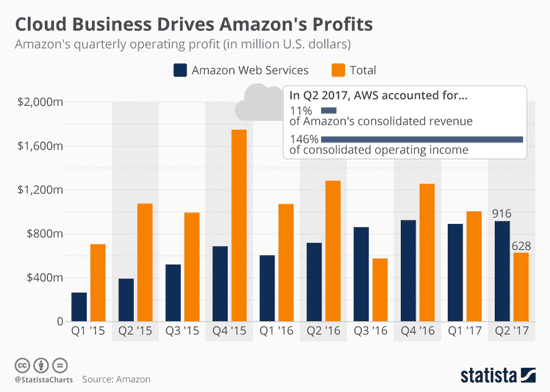

That’s because, for now at least, the “meat’s” not at Whole Foods – it’s in the cloud business.

That’s where profits are.

Amazon Web Services (AWS) is the leader in the cloud infrastructure market. CEO Jeff Bezos doesn’t advertise this, but very credible estimates from NextGov suggest that AWS may handle 70% of all Internet traffic at one point or another.

The rest of Amazon could hemorrhage money (and indeed, sometimes does). AWS actually represents more than 100% of profits, while it’s just 10% of revenue.

Now, I could easily extoll the virtues of owning Netflix, Apple, Facebook, or Amazon… but, as I mentioned, this streaming revolution has spawned a whole new business sector.

Now, I could easily extoll the virtues of owning Netflix, Apple, Facebook, or Amazon… but, as I mentioned, this streaming revolution has spawned a whole new business sector.

You see, globally, video traffic, like movie and TV streaming, is expect to soar nearly 300% by 2021, as Internet traffic as a whole jumps over 200%.

And the companies that facilitate that flow find themselves in the sweetest of sweet spots.

The World’s Best “Digital REIT”

Data centers are (mostly) large, nondescript buildings packed to bursting with the technology needed to move incomprehensibly large amounts of Internet traffic from A to B.

Not only do they help manage video streaming, but also e-commerce, cloud computing, and data storage – just about everything needed for these disruptive new players to function day to day… and to dominate the market.

In short, these companies can’t do much at all without data centers to rely on. And they need more of them. Lots more.

The amount of data stored in these centers is up a whopping 47% in just the last year.

Companies are increasingly in search of providers to facilitate and store their email, data, e-commerce, and streaming requirements.

DuPont Fabros Technology Inc. (NYSE: DFT) is one of the best. There are some extremely compelling reasons to own it.

The company is classified as a REIT (real estate investment trust), owning, acquiring, developing, operating, managing, and leasing large-scale data center facilities across the United States and Canada.

Its data centers are leased to IT companies, which use the facilities to house their computer servers. They also provide power, cooling, security and compliance, connectivity, and sustainability.

Of course, at $5.9 billion, DuPont Fabros’ market cap is nowhere near that of the FANG stocks I listed earlier.

Instead, I see DuPont Fabros as a way to buy those companies a decade earlier in their growth phase – the ground-floor opportunity you (and millions of other investors) likely missed out on.

DuPont Fabros’ P/E (price/earnings) ratio may look rich at 40, but it’s a downright bargain compared to Amazon. And it’s way more profitable.

DuPont Fabros also has thick profit margins of 26% and a revenue growth profile in the last quarter of 11.2%. The board, no doubt thrilled with this kind of performance, is currently paying folks like you an inflation-crushing 3% to own it.

I suggest you do so right away. It puts you dead center of a revolutionary, disruptive profit-making machine that’s totally unstoppable.

— Peter Krauth

[ad#mmpress]

Source: Money Morning