To call Venezuela “troubled” is a huge understatement. The oil-rich South American country is beset, really, by shortages of all kinds: spiraling inflation, a government that appears to grow more despotic and dysfunctional by the day, and of course, the raging civil unrest that comes along with these problems.

Tellingly – and critically – the Venezuelan bolivar fuerte has been devalued three times against the U.S. dollar over the past eight years alone, from Bs2.15 to $1, all the way down to Bs10 to $1.

This massive capital destruction binge was an attempt by late Venezuelan President Hugo Chavez to compensate for falling oil revenue.

Now, this is not to depress you or bring you up to speed on recent Venezuelan history.

Rather, this is a warning; one that Americans – especially American retirees – should pay close attention to… and we also have a stock recommendation that could see you off safe and sound while weak dollar policies wreak havoc with Americans’ wealth.

How Weak Monetary Policy Can Wreck Society

Riots, shortages, and a collapsing economy have put Venezuela in a tailspin, to be sure, and President Nicolás Maduro’s dissolution of the country’s National Assembly, which voided the opposition and gave him almost complete free rein, hasn’t even done Maduro much good.

But of all the forces rocking the OPEC member, perhaps none are as destructive and pernicious as inflation.

It’s rampant.

The International Monetary Fund (IMF) is forecasting a rise of 1,660% this year, and as much as 2,880% in 2018. March data from the nation’s central bank showed the government’s cash position is at a critical low, with $7.2 billion in debt and just $10.5 billion in foreign reserves. In early August, the bolivar hit an all-time low, plunging 32% in just a few hours.

The scary part is that, across the next few years, this story is likely to become familiar to many more people around the world.

At 300 billion barrels, Venezuela’s proven oil reserves are recognized as the world’s largest, even surpassing Saudi Arabia’s 266 billion barrels. However, that hasn’t been enough to save the emerging economy.

Granted, oil prices are way down from their record highs, but the state-owned oil company, Petróleos de Venezuela SA (PDVSA), has been hard-pressed to reinvest in any of its assets. Output has dwindled, and profits along with it.

Former President Chavez made a national pageant of repatriating the country’s central bank gold reserves, dissing dollars in the process. Then, in 2013, Venezuela’s central bank borrowed $1.6 billion from Goldman Sachs for seven years at 8% interest, posting $1.8 billion in gold as collateral held at the Bank of England.

Back in May, Goldman Sachs bought $2.8 billion worth of PDVSA bonds at a near 70% discount from face value, hoping to collect 19% interest in the meantime. By late June, Goldman cashed out $300 million of those bonds, selling to a small hedge fund consortium.

Back in May, Goldman Sachs bought $2.8 billion worth of PDVSA bonds at a near 70% discount from face value, hoping to collect 19% interest in the meantime. By late June, Goldman cashed out $300 million of those bonds, selling to a small hedge fund consortium.

Meanwhile, for the average Venezuelan, managing daily life has become increasingly unbearable, as it generally will when the money you left the house with at 8:00 a.m. is worth 70% as much by 2:00 p.m.

Government policies, like price controls and withholding U.S. dollars from importers, have led to and exacerbated widespread problems and hardship.

Now, here’s where things start getting uncomfortably close to home…

The Parallels Are Very Scary

The U.S. dollar is still highly sought after in many parts of the world. Some countries use the dollar itself as their currency, while others peg their currency to the dollar at a fixed exchange rate.

But that doesn’t offer much protection against dollar weakness – least of all for individuals.

The United States is the biggest debtor nation in history, and Trump seems to be just fine with that.

What’s more, from a policy standpoint, Trump has expressed enthusiasm for weakening the dollar, saying, “I like [Janet Yellen]. I like her demeanor. I think she’s done a good job. I’d like to see rates stay low. She’s always been – you know, she’s historically been a low-interest-rate person, a believer.”

He even told The Wall Street Journal that he likes low rates and a weak dollar, saying, “and frankly, other than the fact that it sounds good, lots of bad things happen with a strong dollar.”

I’d be willing to bet that tens of millions of American retirees looking for investment income are less than thrilled with a decade of persistently low rates and anemic spending power.

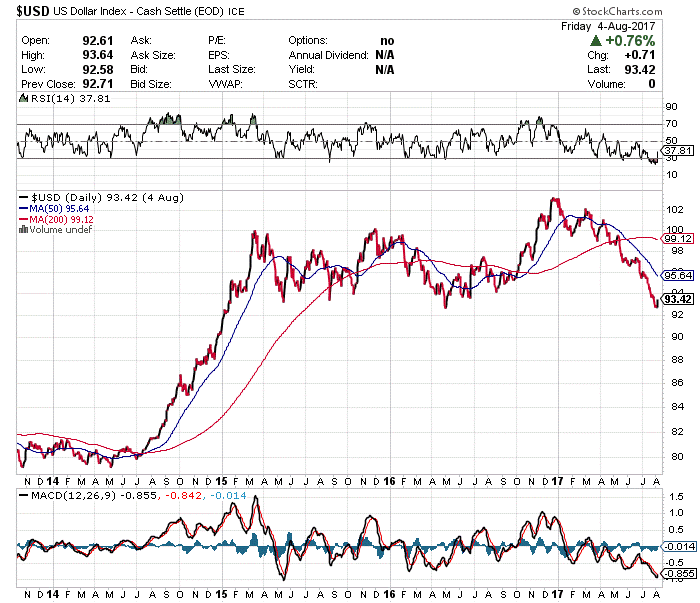

A weaker dollar makes U.S. exports more attractive in international markets, so don’t expect a stronger dollar policy any time soon. In fact, the dollar peaked just two months after Trump won the November election.

Since the start of 2017, the U.S. Dollar Index (DXY) has lost almost 10%. That means the buying power of the dollar is now just 90% of what it was seven months ago against a basket of major world currencies.

Since the start of 2017, the U.S. Dollar Index (DXY) has lost almost 10%. That means the buying power of the dollar is now just 90% of what it was seven months ago against a basket of major world currencies.

I know it’s hard to imagine the dollar suffering in the same way as the bolivar fuerte, but there is precedent. In late 18th-century America, the expression “not worth a continental” was popularized when the continental dollar was printed into oblivion to pay for the revolution.

Trump is just getting started, and if he completes his four-year mandate, the dollar is likely to drop further.

So here’s a viable option to counter the dramatically increasing odds of a much weaker dollar.

Here’s How to Get the Income You Need

Precious metals are well-known, effective hedges against falling currencies. They help protect purchasing power when paper money experiences inflation through printing.

One of the best ways to play this sector is through royalty/streaming companies.

Osisko Gold Royalties Ltd. (NYSE: OR) is a midsized precious metal royalty company with a portfolio of assets focused on North America. As part of its more than 130 royalties and streams, Osisko holds five top-tier assets, including a 5% Net Smelter Return (NSR) on the Canadian Malartic, Canada’s largest gold mine.

Beyond this, Osisko holds a significant interest in several public resource companies, including Osisko Mining, Osisko Metals, Falco Resources, and Barkerville Gold Mines.

The nearly $2 billion stock is up 26% year to date, sports a forward P/E of just 10.3, and yields a smart 1.26% – $0.04 a share – at its current price.

In short, Osisko Royalties offers a nice yield at an attractive price, while offering protection against inflation and massive upside potential.

As the U.S. dollar starts looking more and more like the Venezuelan bolivar, this company could be exactly what U.S. retirees are looking for to safeguard against the dangerous rising tide of inflation.

— Peter Krauth

[ad#mmpress]

Source: Money Morning