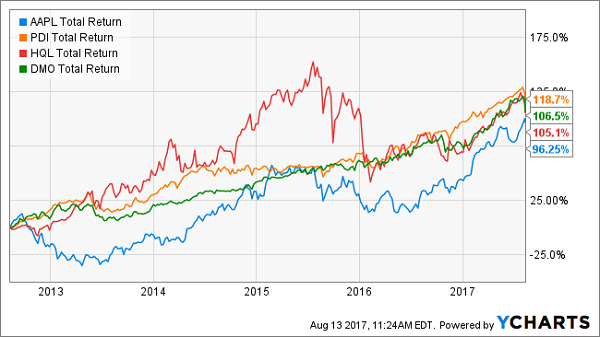

If you’ve held Apple (AAPL) for a long time, you’re probably feeling pretty smug. And you should—the stock is way up over just about any time period and has nearly doubled in the last five years:

Apple’s Sparkling Performance

Clearly, Apple is an amazing stock. But what if I told you we can top that 96.3% gain in the next five years?

Clearly, Apple is an amazing stock. But what if I told you we can top that 96.3% gain in the next five years?

All we have to do is go someplace most investors aren’t. I’m talking about high-yielding—and almost totally ignored—closed-end funds.

The three I want to show you today are the PIMCO Dynamic Income Fund (PDI), the Tekla Life Sciences Investors Fund (HQL) and the Western Asset Mortgage Defined Opportunity Fund (DMO).

Because here’s something that might surprise you—they’re all beating Apple, and not by a little bit.

Apple Gets Schooled

Before I get to why these funds are soaring, let me show you three reasons why it’s better to buy into them than Apple.

Before I get to why these funds are soaring, let me show you three reasons why it’s better to buy into them than Apple.

#1: You Get Paid Upfront

Let’s cut right to the chase. These funds are better because they pay out more in dividends.

Apple’s dividend yield is a measly 1.6%. So even if you own $1 million of Apple stock, you’d get just $1,333 in monthly cash income. That’s poverty wages for a millionaire—ridiculous!

These 3 funds are in another league entirely.

HQL pays a 9.9% dividend, and DMO is paying 11.3%. PDI pays a tad less, at 9%, but it also has a habit of paying massive special dividends at the end of the year. I’ve written before that PDI’s special dividends will likely shrink in the future, but even without them this fund boasts a massive cash payout.

And if you put all 3 of these income studs in a $1 million portfolio, you’d trigger $8,417 in monthly dividend payments (even better, two of these CEFs—PDI and DMO—actually pay dividends monthly, just like 4 other high-yield investments I recommended a couple months ago).

That’s a six-figure income that you can get passively—without selling a single stock! Apple can’t hold a candle to these funds’ massive payouts.

#2: Safety Through Diversification

With Apple, you’re buying a great company. But you’re just buying one company.

With PDI, HQL and DMO, you’re getting exposure to hundreds of companies. And while all of them are smaller than Apple, many of them are bargains because they get a lot less attention than Cupertino’s fruit company.

And this extra layer of safety goes beyond that.

Because all 3 funds buy some combination of stocks, bonds and private equity stakes—meaning there’s upside, some insulation from a market correction and exposure to investments that most folks just can’t buy. This broad base is a big reason for these funds’ gangbuster returns.

#3: They Can’t Wait to Put Cash in Your Pocket

One of the problems with companies like Apple is that it’s in no rush to return profits to investors. While Apple has a profit margin of 20.9%, investors are only getting that 1.6% dividend yield!

That’s partly because Apple wants to keep that money and invest it in new ventures. But it also means Apple has $257 billion in cash it isn’t using for anything—and it isn’t getting much of a return, considering interest rates are near zero!

That isn’t Apple’s fault; it’s a complicated story, but a mix of tax codes and an overvalued venture capital market make it hard for Apple to make a lot of savvy acquisitions.

The CEFs I prefer don’t have either problem. Since they focus on returning as much capital to investors as possible while still investing in growing ventures, we get a bigger portion of the fund’s profits than we’d get with Apple. Plus we get our share immediately in the form of cold, hard cash.

Finally, these funds are no slouches in a place where Apple fanboys and girls think the company has the market cornered: innovation. The people managing these funds are specialists who run them as if they were managing actual companies.

Tekla and Western Asset Management hire industry experts to make investments in very specialized and highly complicated sectors and assets—things your typical stock picker is not going to pick up on. That, again, makes their funds act a lot more like companies than diversified mutual funds or ETFs.

The bottom line?

I like to think of funds like these as Apple+. You’re getting access to top-notch experts making wise bets on the future, just like you would with Tim Cook’s company. But you’re also getting a far bigger income stream, much more diversification and superior returns. That’s why I like CEFs much more than regular stocks—and you should, too.

— Michael Foster

4 More High-Yield Buys With BIGGER Gains Ahead [sponsor]

These 3 funds are a great starting point on your CEF journey, but my 4 favorite buys are primed to pop for even more upside in the next 12 months.

I’m talking easy 20%+ price GAINS here!

Plus, if you make the 4 “one-click” CEF buys I’ll show you here, you’ll also get an outsized 7.6% income stream—a cash tidal wave almost 5 TIMES BIGGER than what your average Apple investor is scraping by on today!

Add it all up and you’re looking at a nearly 30% GAIN, with a big chunk of that in CASH.

I’ve put everything you need to know about these 4 stealth funds before you invest in a NEW special report—which is waiting for you now.

But I must warn you: the herd is starting to catch on to these 4 ignored retirement lifesavers. Over the last few weeks, their incredible discounts have started to narrow—and so have their dividend yields.

There’s still time to get in, but you must act NOW!

Don’t wait. Go right here and I’ll share the names, tickers, buy-up-to prices and my complete research on these incredible income (and capital gain) machines.

Source: Contrarian Outlook