Real estate investment trusts (REITs) are popular because of their high and reliable yields.

And Realty Income (NYSE: O) is one of the more popular REITs thanks to its steady dividends. But will the commercial real estate company be able to continue to provide the dependable dividends that investors have come to expect?

Its dividend-paying track record is spectacular.

It has paid a dividend every month for 47 years.

Realty Income has also raised the dividend for 77 straight quarters.

These days, the increases are tiny – often a fraction of a penny – though the dividend has grown by a compound annual growth rate of more than 5% over the past three years.

It currently pays a 4.47% dividend yield.

The company owns more than 5,000 properties in 49 states, with 98.5% occupancy. Its largest tenants are Walgreens, FedEx and LA Fitness.

Funds from operations (FFO) is a measure of cash flow used by REITs. Realty Income’s FFO has been steadily rising for years.

The company generates plenty of FFO to pay its dividend.

The company generates plenty of FFO to pay its dividend.

In 2016, it paid out $611 million in dividends, while generating $735 in FFO for an 83% payout ratio.

The payout ratio is the percentage of earnings or cash flow (I use cash flow or, in this case, FFO) that is paid out in dividends. Realty Income’s 83% payout ratio is a little higher than I prefer. I like to see the payout ratio at 75% or lower.

But considering that FFO is increasing every year and the company has an outstanding dividend-paying track record, I’m not at all concerned.

But considering that FFO is increasing every year and the company has an outstanding dividend-paying track record, I’m not at all concerned.

If the payout ratio starts getting closer to 100% or above, I might get a little more defensive, and SafetyNet Pro will downgrade the stock.

But for now, Realty Income’s dividend is very safe.

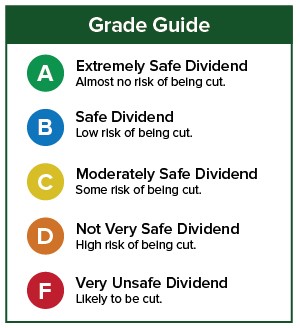

Dividend Safety Rating: A

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

Good investing,

Marc

[ad#wyatt-income]

Source: Wealthy Retirement