Since I reviewed Ford’s (NYSE: F) dividend safety a year ago, the stock has received an upgrade.

Last year, the rating was not particularly high due to declining cash flow and the fact that it eliminated its dividend in 2006.

The recent upgrade occurred because the elimination of the dividend aged out of the system.

One of the factors that SafetyNet Pro considers is the dividend history over the past 10 years. Last year, the 2006 dividend cut still counted toward the grade.

But just like an adult whose teenage delinquencies are expunged after years of good behavior, the cut is no longer on Ford’s SafetyNet Pro record.

The Financials

The company gets high marks for growing cash flow and a low payout ratio. The payout ratio is the percentage of free cash flow (or earnings) that is paid out in dividends.

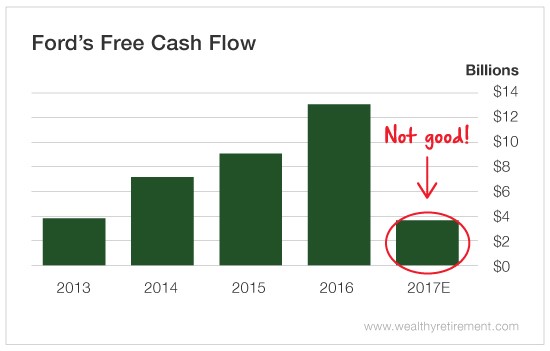

Over the past four years, free cash flow has nearly quadrupled from $3.85 billion to $12.8 billion.

However, this year, free cash flow is expected to plunge.

Free cash flow is projected to fall from $12.8 billion in 2016 to $3.7 billion this year. That’s lower than 2013’s total.

The culprit, in part, is lower sales expectations. This year, Ford’s revenue is forecast to be $142.8 billion, $9 billion less than last year.

Once this year’s lower free cash flow number is realized, that will mean negative free cash flow growth for the company, and its dividend safety rating will be hit.

Free cash flow growth is an important metric in assessing a company’s dividend safety rating.

Free cash flow growth is an important metric in assessing a company’s dividend safety rating.

Free cash flow is the measure of the cash that came into the company minus the cash that went out. It is the clearest indication of whether a company generated enough cash to pay its dividend.

At this snapshot in time, the dividend is safe. But once Ford reports a low free cash flow figure for 2017, the rating will be downgraded. We’ll have to see whether it drops just one peg or if the safety rating becomes dangerously low.

Dividend Safety Rating: B

Good investing,

Marc

[ad#agora]

Source: Wealthy Retirement