If you’re looking for more income, or to buy a stock at the price of your choosing, selling puts should be your strategy of choice.

This coming week I’m focusing on selling puts, the most basic options strategy and one of my cornerstone options strategies.

[ad#Google Adsense 336×280-IA]The strategy produces steady, consistent income and makes up the lion’s share of success in several of my portfolios.

As a refresher: Selling a put obligates you to buy shares of a stock or ETF at your chosen price if the put option is assigned.

First of all, let’s get to the most important aspect of selling puts.

You should never sell puts on something you wouldn’t want to own . . . enough said.

OK, now we can move on.

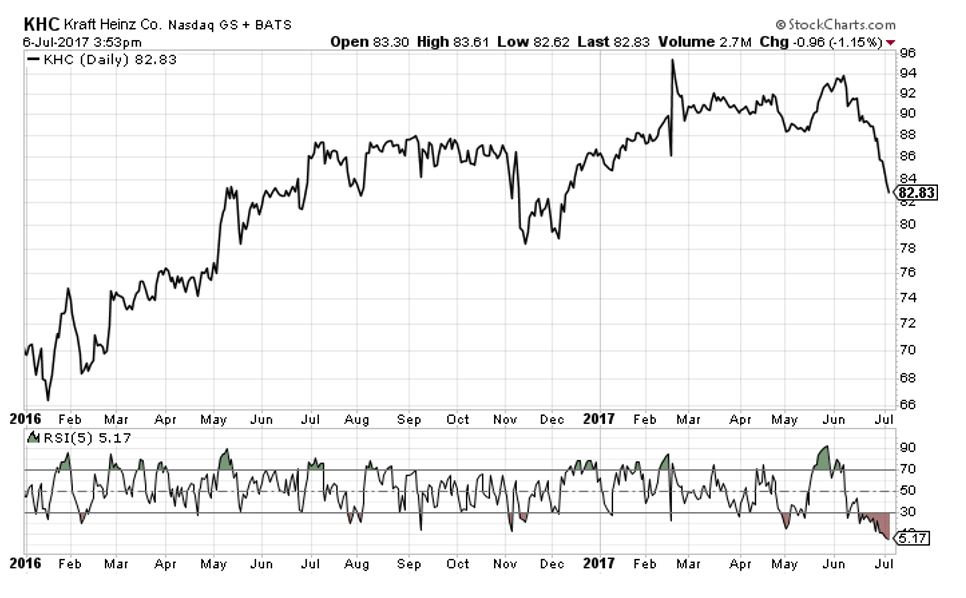

I was sifting through my charts of Warren Buffett’s top 15 holdings and discovered an interesting opportunity in Kraft Heinz (NYSE: KHC). If you look at the chart below, you’ll notice that KHC is in an oversold state on a short-term basis.

As an options trader, particularly one who prefers to sell options, this is the type of setup that I look for in a trade. The RSI is in an oversold state over several different time frames, (2) and (5), which means that there’s a good chance that a mean-reversion move or reprieve is right around the corner. As a result, I want to sell a few puts on this Buffett stock.

An Exercise in Selling Puts for Income: KHC

Again, selling a put obligates you to buy shares of a stock or ETF at your chosen short strike if the put option is assigned.

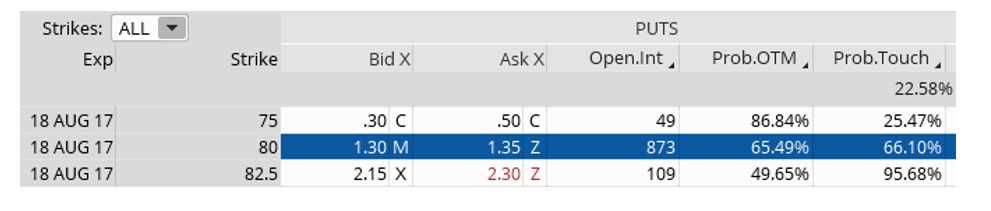

For example, let’s say you wanted to buy KHC, but not at the current price of $82.83. You prefer to pay $80.

By selling the August 80 puts you can bring in approximately $1.32, or $132 per contract. In this instance, you are selling the put with the intent of buying KHC for $80 if, at expiration in roughly 42 days, the stock is trading at or below $80.

By selling the August 80 puts you can bring in approximately $1.32, or $132 per contract. In this instance, you are selling the put with the intent of buying KHC for $80 if, at expiration in roughly 42 days, the stock is trading at or below $80.

If not cash-secured, selling puts only require 20% of the $8,000, or $1,600, but retirement accounts and certain brokers require the puts to be cash-secured. And in this case, that would be the $8,000.

Conservatively speaking, cash-secured, the return on the trade is 1.7% in 42 days, or 13.6% in income annually.

And if the puts were not cash-secured, the return would be significantly higher.

The $132 is ours to keep regardless of what occurs with KHC.

If the stock closes at August expiration above $80, we keep the $134 and oftentimes repeat the process by selling more puts, maybe at the 80 strike or possibly at a different strike price. It truly depends on where the stock is trading at the time we sell the puts and how much premium we wish to bring in.

If the stock trades for less than $80 at August expiration, we can either buy back the puts or allow assignment of the stock for $80 per contract or $8,000 (100 shares per put contract sold). Oftentimes when this occurs I will begin to sell covered calls on the stock so there is an ongoing source of income coming in. I call it the income cycle and I use this strategy in several of my portfolios.

But the fact is we are buying this Buffett stock at a discount . . . a price we are willing to pay for the stock. In this case, we can buy the stock for 5% less (includes our premium sold of 1.7%) than where it is currently trading. That’s right . . . 5% less than the current price of the stock and that’s if it assigned to us in 42 days . . . and each time we sell puts we lower the cost basis even more.

Whether you want a strategy that helps with a reliable source of steady income or a strategy that will help you buy stock at far cheaper prices, selling puts is a strategy all individual investors need to know to be truly successful.

— Andy Crowder

[ad#wyatt-generic]

Source: Wyatt Investment Research