I’ve called this “the greatest anomaly in finance.”

It’s a massive discrepancy – one that makes no sense.

Importantly, you can make a lot of money as the discrepancy goes away… And it will go away.

So what is this anomaly? Let me explain…

[ad#Google Adsense 336×280-IA]Many stocks trade in different places – whether on different stock exchanges or in different countries.

For example, Microsoft (MSFT) trades in Germany, just like it trades in the U.S.

This is not normally a big deal…

The price of Microsoft shares trading in Germany is typically the same as the shares trading in the U.S.

If a penny-or-two difference appears, computerized traders jump in to capitalize on that spread.

It’s a basic version of “arbitrage” – buying the cheaper stock and selling the more expensive one.

You and I would never do this, because there’s only a penny or two of profit when the opportunity appears. And thanks to computerized trading, the opportunity is typically gone as soon as it appears.

However, the story much different with one country’s stocks: China.

Right now, there’s a massive difference in the prices of the same companies trading in China and in Hong Kong. Today, as I write, the identical shares are (on average) 19% more expensive in China than they are in Hong Kong.

Said another way, the shares in Hong Kong need to rise by 19% to equal the price of their China-traded identical twins.

This is a crazy anomaly – the biggest anomaly in finance.

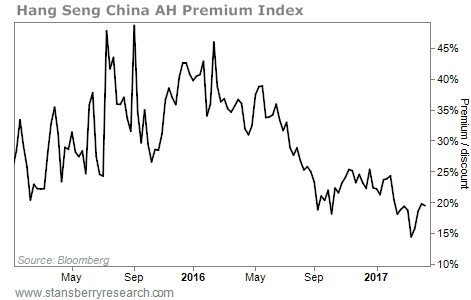

Here’s what the average price difference of A-shares over H-shares (called the “AH Premium”) looks like over time…

As you can see, the premium is shrinking…

As you can see, the premium is shrinking…

I started writing about this anomaly in 2015. Nobody talked about it that year… or even in 2016.

This year, finally, the Chinese have been piling in to take advantage of it… However, a considerable gap still exists. The current premium sits at 19%.

Ultimately, the Chinese premium should end up at zero. The gap should completely go away.

Just like Microsoft trading in the U.S. and in Germany, smart traders will arbitrage away this premium by forcing up the prices of the cheap listings – and forcing down the prices of the expensive listings.

The simplest way for you to take advantage of this is to buy the iShares China Large-Cap Fund (FXI).

It’s the biggest China exchange-traded fund… and the easiest way to enter this trade.

Three of FXI’s top five holdings are dual-listed in Hong Kong and China. These are massive businesses, including the largest bank in the world. And while the premiums have narrowed considerably, they still exist.

I am incredibly bullish on Chinese shares right now. And taking advantage of the AH Premium is just one of the many smart ways to get exposure to China today.

I highly recommend you own China – now. FXI is the simplest way for you to do it…

Good investing,

Steve

[ad#stansberry-ps]

Source: Daily Wealth