It’s not easy to find great yields in bank stocks these days.

The big boys like JPMorgan Chase (NYSE: JPM) and Wells Fargo (NYSE: WFC) yield less than 3%.

[ad#Google Adsense 336×280-IA]To find better yields, you have to go smaller – to community banks.

New York Community Bancorp (NYSE: NYCB) sports a robust 5% yield. But the stock and dividend have had some trouble lately.

Let’s look at whether its divided is safe.

Last year, as the bank planned its merger with Astoria Financial (NYSE: AF), it refinanced its debt and raised money by offering stock. As a result, the company lowered its quarterly dividend to $0.17 per share from $0.25.

Then in December, the stock began a four-month slide after it announced the merger would not go through.

The good news for shareholders is that the dividend appears safe.

Like Money in the Bank

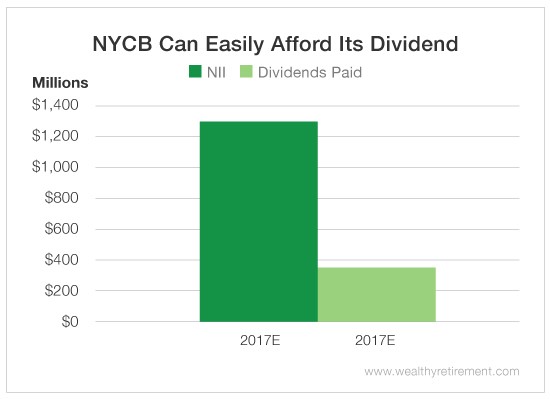

Last year, New York Community Bancorp’s net interest income (NII) was $1.29 billion.

NII is the difference between what a bank earns from lending money to borrowers and what it pays depositors. It’s the best measure of a bank’s performance. It’s similar to cash flow in that there are no noncash items in its formula.

The bank paid out $330.8 million in dividends.

This year, NII is projected to be flat at $1.29 billion again. Dividends paid should rise to $346.8 million.

If that forecast is accurate, New York Community Bancorp will pay out only 27% of its NII in dividends. That’s a very low payout ratio.

Considering the company cut its dividend for a merger that’s not happening and has a low payout ratio, I wouldn’t be surprised if its dividend is raised back to the previous $0.25 per share.

The only blemish on the bank’s dividend safety rating is its dividend cut in 2016. Cuts don’t often happen in isolation. Once a company reduces its dividend, it’s more likely to do so again.

The only blemish on the bank’s dividend safety rating is its dividend cut in 2016. Cuts don’t often happen in isolation. Once a company reduces its dividend, it’s more likely to do so again.

In New York Community Bancorp’s case, the dividend had been stable since 1994.

It lowered its dividend to finance the now-failed merger, but I’d be surprised if this cut is the beginning of a slippery slope of lower payouts.

Considering how much more money the company takes in than it pays out, New York Community Bancorp’s dividend is safe.

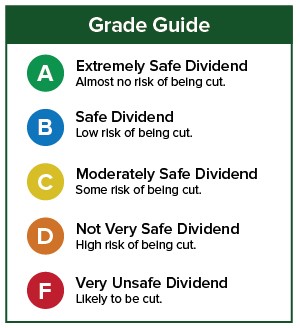

Dividend Safety Rating: B

Good investing,

Marc

[ad#IPM-article]

Source: Wealthy Retirement