Dividend-focused investors tend to fall into either one of two distinct and dissimilar camps. Traditional dividend growth investing (DGI) is to own blue chip shares of large corporations. These are low yield stocks with long histories of dividend growth. The annual dividend increases will help generate a total return of growing dividends and share price increases.

The other strategy is to invest in high-yield stocks. Those that pay 6%, 8% or more with the current yield pretty close to the expected return. In my newsletters The Dividend Hunter and Automatic Income Machine, I advise that investors need a balance of both approaches. Sometimes, when looking at two similar stocks, one is just better than the other.

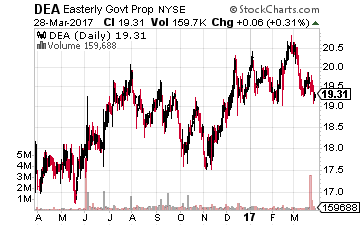

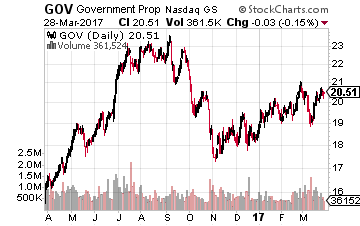

Government Properties Income Trust (Nasdaq:GOV) and Easterly Government Properties Inc. (NYSE:DEA) are the two real estate investment trusts (REITs) exclusively focused on owning properties leased to government agencies.

Government Properties Income Trust (Nasdaq:GOV) and Easterly Government Properties Inc. (NYSE:DEA) are the two real estate investment trusts (REITs) exclusively focused on owning properties leased to government agencies.

With tenants of the highest ability to pay the rent, these two REITs have pretty much guaranteed revenues.

However, with an 8% current yield, GOV pays nearly twice the dividend return as does DEA, which yields 5%.

At first glance, it seems like the higher yield is the way to go if you are receiving dividends backed by federal government guaranteed payments.

At first glance, it seems like the higher yield is the way to go if you are receiving dividends backed by federal government guaranteed payments.

However, you get a different picture as to why GOV yields so much more if you dig a little deeper. Here are the pertinent factors.

Dividend Cash Flow Coverage: REITs disclose free cash flow as funds from operations (FFO) or adjusted FFO.

As an investor, you want to first make sure the AFFO per share is more than the current dividend rate.

[ad#Google Adsense 336×280-IA]Second it really helps if the cash flow per share is growing.

For 2016, GOV reported normalized FFO of $2.36 per share.

This cash flow provided good coverage of $1.72 annual dividend.

However, the full year FFO was lower than the $2.39 per share reported for 2015.

For 2016, DEA reported AFFO of $1.17 per share.

The company paid $0.92 per share in dividends.

DEA was not a public company for all of 2015, but has given 2017 FFO per share guidance that is 10% higher than last year.

Dividend Growth: GOV has not increased its quarterly dividend rate since 2012. DEA went public with a February 2015 IPO and has already increased its dividend three times with a total of 14% growth from the initial dividend rate. The higher 2017 FFO guidance gives confidence there will be meaningful dividend growth again this year.

Other Factors: GOV is managed by a third-party management company which also manages several other publicly traded REITs.

Other Factors: GOV is managed by a third-party management company which also manages several other publicly traded REITs.

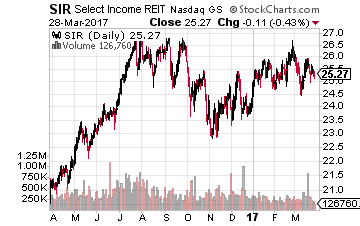

In fact, GOV has a very large investment in another of those managed REITs, Select Income REIT (Nasdaq:SIR).

The SIR investment is not closely related to government leasing business model of GOV.

The management team has given the appearance of working for management fees rather than increasing shareholder value.

GOV is a company that seems to be living off the rent from older properties.

DEA has been growth-focused right from the IPO. The company has given guidance on how much it would spend on acquisitions and has hit those goals. Most importantly, DEA focuses on acquiring buildings that will be used by the growth agencies of the federal government such as the VA and Homeland Security.

The results: In this faceoff, the lower yield but growing dividend REIT has far outperformed the shares of its high-yield but slowly eroding business REIT contemporary. This chart shows that, since its IPO, the DEA share price is up 25% not including dividends. The GOV share price is down by 10%. With dividends projected to grow, you can expect DEA to continue to outperform.

— Tim Plaehn

Sponsored Link: In case you are curious, I first recommended DEA to my Dividend Hunter newsletter subscribers in March 2016 and the stock (since then) has produced a 16% total return. Very acceptable for one of the safest REITs when looking at the business model.

Owning high-yield stocks with secure cash flow streams like DEA allows me and my subscribers to stop worrying about the daily gyrations of the stock market because we earn consistent returns, paid in the form of cash. It’s so easy, all you have to do is buy shares in the stocks that I recommend and research and watch as they deposit money into your brokerage account multiple times a year.

My subscribers and I regularly collect big dividend payments that give us financial certainty in an uncertain world, and only the most financially secure high-yield income stocks make it onto the recommendation list for my newsletter, The Dividend Hunter.

Right now, there are over 20 high-yield stocks available through my Monthly Dividend Paycheck Calendar, a system for generating a recurring monthly income stream from the market’s most stable high-yield stocks.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 6 paychecks every month and in some months up to 14 paychecks from reliable high-yield stocks built to last a lifetime.

This unique tool will set you up to receive a more predictable dividend stock income stream that you can count on every month instead of just once a quarter like most other investors. Joining my calendar by Tuesday, April 4th will give you the opportunity to claim an extra $2,191 in dividend payouts by April 28th.

The Calendar tells you when you need to own the stock, when to expect your next payout, and how much you can make from these low-risk, buy and hold stocks paying upwards of 12%, 13%, even 18%. I’ve done all the research and hard work, you just have to pick the stocks and how much you want to get paid.

The next critical date is Tuesday, April 4th (it’s closer than you think), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $2,191 in payouts by April 28th, but only if you’re on the list before April 4th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Source: Investors Alley