In the world of investing, many ideas are so widely accepted that they go unquestioned. But conventional thinking is often wrong.

Here’s one piece of conventional investing wisdom we often hear: In times of panic, gold is a safe haven.

Gold in your portfolio can help insure against losses when the stock market falls.

[ad#Google Adsense 336×280-IA]As it turns out, this piece of conventional wisdom is correct. A recent study proved it…

Two researchers in Ireland recently wrote a paper entitled “Reassessing the Role of Precious Metals as Safe Havens – What Colour Is Your Haven and Why?” They concluded that relative to many other assets, in many countries, precious metals act as safe havens in turbulent markets.

This is because gold marches to the beat of its own drum… especially during times of stress…

The researchers confirmed that gold is uncorrelated with most other financial assets. When two assets have a positive correlation (approaching a value of 1), their prices tend to move in the same direction. When assets have a negative correlation (approaching negative 1), they tend to move in opposite directions. A correlation close to zero means two assets move independently.

As you can see in the chart below, gold’s correlation with other assets is very low. That’s exactly why gold works so well in a portfolio when markets are weak…

This paper confirms decades of academic research that gold and other precious metals are uncorrelated, both during normal times and during times of economic stress. Gold is a hedge – its price doesn’t usually follow other assets during normal times. It is also a safe haven – during abnormal times, when the prices of other assets crash, precious metals prices tend to rise.

The researchers studied different kinds of economic and market events that cause precious metals to become safe havens. They identified three general types of market-stress indicators: financial market stress, political stress, and consumer sentiment.

They found that political and policy risk is “a positive and robust determinant across countries when precious metals are safe havens against stock and bond markets tail events.”

In other words, precious metals tend to rise the most – offering the strongest safe-haven protection – during market distress triggered by government policy uncertainty.

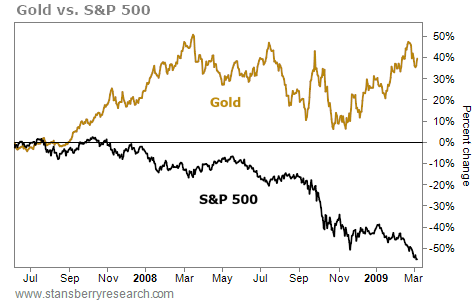

To see the value that gold holds during economic earthquakes, consider the 2007-2008 global financial crisis…

From June 2007, when the crisis first broke, to the March 2009 bottom, many global stock markets went down more than 50%. And the S&P 500 dropped 55%.

However, during that period, the price of gold rose from about $670 to $938, for a gain of about 40%. You can see this from the chart below…

Why aren’t, say, oil or wheat considered safe-haven assets?

The main reason is that physical gold has been used as a currency for thousands of years – whereas paper, or “fiat money,” is a historically recent experiment. In 1971, the U.S. abandoned the gold standard – and was the last country to do so. Since then, all global currencies are backed by nothing more than faith in the government that prints the money.

Thus, when uncertainty about global economic policy rises and faith in government falls, gold – as the unofficial world currency – rises. Contrary to paper currencies, gold is a tangible asset which cannot be printed or destroyed. To quote another piece of (true) conventional wisdom, gold is a “currency of last resort.”

Fear among investors is nearing all-time lows, according to the Volatility Index. This is in sharp contrast to rising uncertainty related to economic policy in the world.

Now is a good time to purchase some gold insurance for your portfolio.

Good investing,

Kim Iskyan

[ad#stansberry-ps]

Source: Daily Wealth