Looking for a reliable benchmark for stock returns in the next decade?

I’ve got one for you: 7.1%.

I say “reliable” because that’s what the S&P 500 has returned, in price growth and dividends, over the last 10 years.

[ad#Google Adsense 336×280-IA]And with that timeframe including the worst crash in living history, we can take it as a conservative benchmark for long-term stock returns for the next decade or longer.

Seven percent is great, especially when you’re only getting 1% in a bank account or CD.

But there are two problems here.

The first is drawdowns. Over half of that return comes in the form of price growth, which means it’s a paper gain unless you sell your shares.

If you need to tap your stock investments during a market correction or panic, you’ve got a problem: you’ll end up selling at a loss, just to get the cash you need.

And that will erode your capital, making your actual return much worse than what you’d get from a buy-and-hold strategy.

This is why most financial advisors recommend that you only put money in the stock market that you won’t need for a long time.

It’s sage advice, but in the real world, it’s not good enough. We want investments that will enrich us and give us a reliable income stream without having to worry about cashing out at the wrong time.

This is the idea behind our No-Withdrawal Portfolio.

The strategy is simple: find best-of-breed high-yield investments that provide a dividend payout of 6% or more (ideally around 8%), so we can reliably liquidate that 7.1% annualized gain every year without destroying our principal. You just can’t do this by investing in the S&P 500.

But with high-yield investments, it’s not only possible; it’s easy.

To show you how, I’m going to take just three high-yield assets from different parts of the market. In reality, the No-Withdrawal Portfolio is much more diversified than this, but the income stream these three investments give us is pretty much the same.

We’ll take one real estate investment trust (REIT), W.P. Carey (WPC); one BDC, Main Street Capital (MAIN); and one bond-focused closed-end fund (CEF), Western Asset Mortgage Defined Opportunity Fund (DMO).

Already, you can see the diversification. We’re exposed to real estate, mid-sized US businesses in various industries, and debt markets. This approach results in a higher income stream, higher returns and better capital preservation than just investing in the S&P 500.

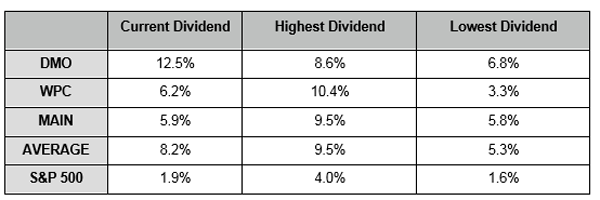

First, let’s look at dividends over the past decade:

10 Years of Outstanding Payouts

Note that this three-stock portfolio always has a higher average yield than the S&P 500.

While the lowest average yield isn’t enough to get our desired 7.1% payout, the current average is, and it’s still below the highest yield the fund has ever paid out, so buying into these funds now and waiting a decade will get us the income we need. Plus, we also know we’re not buying at a market top, since the current yield is far higher than its low point.

Great news, but what about our capital?

Our original investment is not going to go down. In fact, each of these stocks is worth more than it was a year ago—an important consideration for high-yield investments because it tells us we’re not sacrificing our principal to get that income stream.

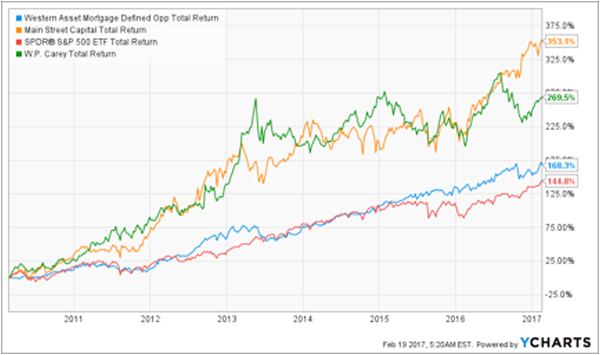

No Capital Erosion Here

This chart looks discouraging, since only MAIN outperformed the S&P 500. However, when we include dividends in the total return on our initial investment, the story changes completely.

High Yields Trounce the S&P 500

Think about that for a moment: we’re not only getting a higher income stream—which means we don’t have to ever about selling off a stock to turn our profits into cash—but we’re also getting a higher overall profit.

[ad#Google Adsense 336×280-IA]Our high-yield approach has protected our capital, provided more liquidity over the term of our investment and given us a higher profit.

Note that the three high-yield stocks’ outperformance begins early in 2010 and just gets stronger as time goes on.

So does this mean you should buy MAIN, WPC and DMO right now?

Not exactly.

Main Street is a great BDC, but it’s trading at a whopping 69% premium to its net asset value.

What’s more, its NAV went down 2.2% in the last three months, so management isn’t exactly churning out shareholder value right now.

Similarly, DMO is trading 13.6% above its NAV. Considering this fund traded at a discount to NAV less than 12 months ago, there have been much better times to jump in.

Finally, WPC is a great REIT, but it isn’t the best. Funds from operations (FFO) were sharply rising in the early 2010s but have flat-lined in the last couple of years, and few analysts are expecting FFO to go up much more. Without cash flow growth, WPC’s dividend growth is also under pressure.

That doesn’t mean these are poor choices. They’re great buys at the right time … it’s just that now isn’t that time.

— Michael Foster

Sponsored Link: But it is the right time to jump into other high-yield choices, such as the 6 we’ve selected for you in the “No-Withdrawal” retirement portfolio I mentioned above.

These picks hand you a dividend yield that tops the S&P 500’s entire yearly return! I’m talking about a safe 8.0% payout—so you’re clobbering the index straight away, not including the double-digit price upside we see in the next 12 months.

That bulletproof income stream also lets you ride out any 2008-style meltdown, because while everyone else is panic selling into a crash, you’ll be quietly pocketing your steady dividend payouts while the market gets back on its feet.

With trade tensions heating up and Obama-era policies crumbling in Washington, I fully expect a market tantrum soon. These 6 stocks are your insurance policy. Click here and I’ll share their names and ticker symbols and give you our complete strategy for the coming critical months now.

Source: Contrarian Outlook