There’s a lot of uncertainty about future profits in the healthcare sector.

[ad#Google Adsense 336×280-IA]President-elect Trump wants to repeal Obamacare and lower drug prices.

But there have been no details on how he or Congress will achieve that.

Both of those actions would hurt the sector, particularly drugmakers.

On the other hand, Congress’ new 21st Century Cures Act, signed by President Obama last month, helps drug companies bring their products to market faster, which is a positive.

(The 21st Century Cures Act is a major profit catalyst for select biotech companies that develop critical drugs and therapies. It’s something I’ll be watching closely – in the weeks leading up to Trump’s inauguration and during his first 100 days in office – as his other healthcare initiatives unfold. Stay tuned for more.)

So 2017 should be an interesting year for the healthcare sector.

But one thing you won’t have to worry about is the safety of Novartis’ (NYSE: NVS) dividend.

The Swiss drug giant’s product portfolio includes leukemia fighter Gleevec, antifungal Lamisil and Ritalin, which helps treat attention deficit disorder.

Novartis pays a dividend only once per year, usually in February, though it hasn’t declared its next dividend yet.

Based on last year’s $2.76 per share payout, the stock yields 3.8%.

Shareholders relying on that annual dividend have nothing to worry about.

Strong and Growing

Novartis is expected to generate $10 billion in free cash flow in 2016. That figure is forecast to steadily increase to more than $14 billion in 2019.

Once the final numbers are in for 2016, Novartis will likely have paid out 66% of its free cash flow in dividends. The payout ratio is the percentage of earnings or cash flow that is paid out in dividends. I use cash flow as my basis.

Next year, the payout ratio is projected to decline to 63%.

I prefer payout ratios under 75%. That way, I’m confident the company can continue to pay its dividend – even if cash flow declines.

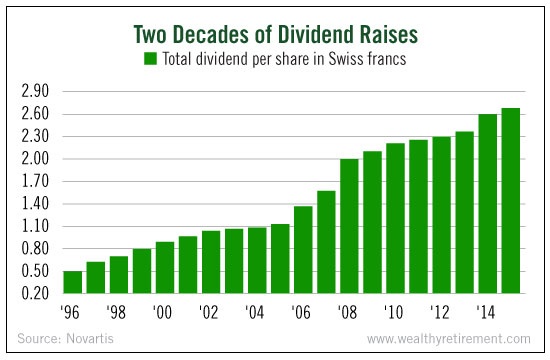

Novartis has an excellent dividend-paying track record, raising its distribution every year for 19 years with no cuts.

Keep in mind, the dividend is paid in Swiss francs. Due to currency fluctuations, American investors may not have always seen a raise.

But that’s not the company’s fault. It raises its payout to shareholders ever year.

American healthcare policy could impact Novartis’ numbers.

Lower drug prices would hurt revenue, earnings and cash flow.

Lower drug prices would hurt revenue, earnings and cash flow.

However, I don’t expect sweeping changes that would drastically reduce Novartis’ business.

Remember, it’s a global company. The United States isn’t its only market.

Even in a worst-case scenario, the company has enough room to sustain its dividend without a cut.

In an uncertain world, Novartis’ dividend is something you can be sure of.

Dividend Safety Rating: A

Good investing,

Marc

[ad#agora]

Source: Wealthy Retirement