First-level investors mistakenly think that real estate investment trust (REIT) profits will be hurt if rates rise. In three instances, they’re dead wrong – and missing out on big, secure dividends with upside to boot.

At these REITs, top insiders – who of course know better than armchair observers – are currently buying up their own shares like crazy.

[ad#Google Adsense 336×280-IA]While corporate insiders may sell stock for many reasons, they only buy because they believe the payout is safe and price is likely to rise.

In the short run, the “rates up, REITs down” theory puts on quite the show.

If you hold REITs in your portfolio, I can tell you how it’s trading (up or down) on any given day by considering only one number: the 10-Year Treasury Rate.

When the 10-Year’s yield rises, REITs usually fall.

And when its yield drops, REITs usually rally. This relationship tends to hold up over multiple days, weeks and even months:

A Short-Run See Saw Between REITs and T-Bill Yields

But as time passes, this counterbalance falls apart.

But as time passes, this counterbalance falls apart.

The theory goes that because REITs borrow money to grow their property empires, they need cheap cash. And while easy money is certainly favorable, it isn’t a “must have” criterion for the landlord. They will simply raise the rent when the lease is up for renewal, passing on their higher borrowing costs to their tenants.

Senior execs know when their firms are ready to raise the rent – and the most confident ones are right now gobbling up their own shares for their personal accounts! Here are three REITs where insiders are putting their money where their mouths are.

3 REITs With Big Insider Buying

DDR Corp’s (DDR) C-level executive Alexander Otto has been enthusiastically adding to his already-massive pile of shares this month. He’s been buying alongside other insiders – combined they’ve purchased over 531,000 shares (about $8 million worth) for their personal accounts.

DDR owns 352 malls across the U.S. Lately it’s been a better buy than popular (and often overvalued) retail REIT Realty Income (O). DDR has delivered 138% payout growth over the last five years, more than triple O’s 39%. Its execs are taking advantage of an all-time high in their stock’s current yield:

DDR Insiders Buy Their Yield “Breakout”

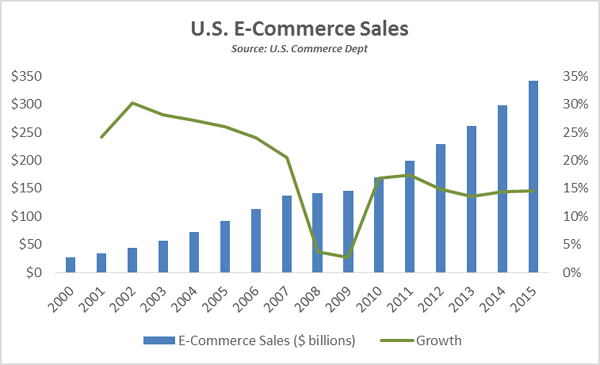

Stag Industrial (STAG) owns, operates and rents 290 standalone industrial buildings, most of which are warehouses or distribution centers. These properties are in hot demand thanks to the e-commerce megatrend (think about all the online gifts purchased this holiday season – most of them will ship from a warehouse):

Stag Industrial (STAG) owns, operates and rents 290 standalone industrial buildings, most of which are warehouses or distribution centers. These properties are in hot demand thanks to the e-commerce megatrend (think about all the online gifts purchased this holiday season – most of them will ship from a warehouse):

E-Commerce Sales Booming in America

Insiders have taken advantage of share price weakness throughout 2016 to load up their personal accounts with STAG stock. Over the past 12 months, they’ve purchased more than 46,000 shares.

Insiders have taken advantage of share price weakness throughout 2016 to load up their personal accounts with STAG stock. Over the past 12 months, they’ve purchased more than 46,000 shares.

Hudson Pacific Properties (HPP) meanwhile has seen even more furious buying. Insiders have purchased 800,000 shares (about 0.67% of float) over the past year. The company hiked its dividend by 60% in late 2015, and management remains bullish.

HPP acquires and develops posh office spaces on the West Coast, focusing on Silicon Valley, Seattle and Los Angeles. These business markets are booming, and HPP’s insiders are excited to personally profit from this big trend.

— Brett Owens

And These 3 CEOs Are Buying Their Own Recession-Proof Stock [sponsor]

As I alluded to earlier, while I like insider buying, I love seeing the guy at the top of the food chain putting his personal money where his mouth is.

And today, three CEOs are backing up their personal trucks and buying as much stock in their REITs as they can get their hands on!

I don’t blame them. All three businesses are recession-proof, and should continue to cruise no matter what happens in Trump’s first 100 days or beyond. These companies have captive, growing audiences – and they’ll be able to continue raising the rent without a problem.

And best of all, these stocks pay current yields up to 9%. They are cornerstones of my “no withdrawal” portfolio, which lets retirees and near-retirees generate enough income from dividends that they never have to sell a share of stock.

I’m sure you’ve considered this strategy. Maybe you’re dismayed that it’s impossible to execute with rates near historic lows. After all, with paltry dividends, there’s not enough income to live off.

That’s why a different approach – a contrarian one – is needed today. We must locate yields that are 7% or 8% or higher, and also make sure they’re secure. And what better way to do this than to follow CEOs buying their own out-of-favor, high yielding shares!

I’d love to share the names and tickers of these three insider-loved recession-proof REITs with you. Click here and I’ll explain in my full analysis – and I’ll also outline my entire “no withdrawal” strategy so that you can live off dividends alone.

Source: Contrarian Outlook