Trump won.

Some people are happy. Some people are acting like someone shot their dog. What happens now?

Well, my answer flies in the face of virtually every modern economist and pundit on CNBC…

[ad#Google Adsense 336×280-IA]Virtually everyone believes that government spending and/or tax cuts will have a powerfully positive effect on our economy.

The people cheering believe that Trump’s wall (his announced infrastructure spending), his tax cuts, and his estimated $6 trillion budget deficit over four years will create winners in the stock market and wealth for our nation.

In some limited ways, that will prove to be true. The Pentagon, for example, is the world’s largest consumer. It buys more oil than any other entity.

And if Trump builds a wall across our southern border, he’s going to buy a lot of steel.

But in other, far more important ways, the idea that government spending and government debt is a positive force in the economy is completely wrong. Fatally wrong…

As longtime readers know, I believe we’re approaching an important new credit-default cycle, which will create the greatest legal transfer of wealth in history. Investors in highly leveraged equities will be wiped out… But investors who can anticipate this massive wave of corporate defaults will make a fortune. And that’s my goal – to help you understand why this cycle is inevitable, so you can position yourself to profit from these events.

I want to make sure you understand… no matter who is president, no matter which party is in power… the only thing our government can do about a credit crisis is make it worse.

You only need to understand two economic ideas to see through the media and know what’s really going to happen next.

The first concept is easy: It’s the declining marginal utility of debt.

This won’t surprise anyone who has ever owned a business or used a credit card. At first, small amounts of debt create large percentage changes in spending and investment. But, as debts add assets and matching liabilities to your balance sheet, additional debts make a smaller and smaller percentage change in growth.

And as your debts (like our government’s) tally toward $20 trillion (or more than 100% of GDP), the marginal utility of additional debt can actually become negative.

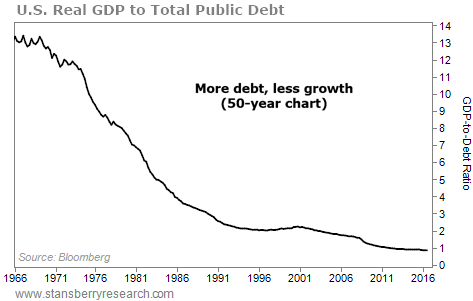

Just look at the following chart. We’ve taken actual U.S. GDP (the total production of our economy each year) and divided it by total public debt. You can see, as spending and debts grew over time, each dollar of additional debt led to less and less growth in GDP…

This isn’t controversial or surprising. Mainstream economists tend to ignore the marginal utility of debt… But they don’t deny it’s true.

What follows, however, is extremely controversial.

A growing number of academic economists have found that contrary to all conventional Keynesian economic theory, government deficit spending where debt-to-GDP is already more than 70% actually hurts the economy over time. Here’s economist Lacy Hunt…

Based on academic research, the best evidence suggests the [government expenditure] multiplier is -0.01, which means that an additional dollar of deficit spending will reduce private GDP by $1.01, resulting in a one-cent decline in real GDP.

The deficit spending provides a transitory boost to economic activity, but the initial effect is more than reversed in time. Within no more than three years the economy is worse off on a net basis.

While Trump’s wall-building and tax cuts can temporarily boost GDP, within three years, the net impact of his spending will cut into GDP at a rate roughly equal to 1% of total government spending. This is completely counterintuitive.

Despite the large number of different academic studies that prove a negative government-spending multiplier exists across multiple countries and time periods, many people can’t accept the idea.

But look at how government spending has changed over time. Hunt points out that since the early 1970s, “mandatory” government spending (on social programs like Medicare and Social Security) has grown from being roughly 50/50 with discretionary government spending (like the Pentagon) to being almost 70% of government spending. The point is, these kinds of transfer payments can’t produce any wealth. They’re simply a redistribution of income that’s being produced elsewhere in our economy.

An even more fundamental explanation… research shows that a negative multiplier only exists when we have a large public debt burden – more than 70% of GDP, according to most studies.

Studies also suggest that the negative multiplier increases with debt load, but in a non-linear way. This can only be explained by the Austrian School of Economics ideas about game theory (as we discussed yesterday): As individuals in an economy begin to fear a monetary collapse, they act in ways that disrupt things even more – like buying gold, fleeing a currency, or simply withdrawing from the legal economy.

When you put these ideas together – the declining marginal utility of additional government debt, the negative multiplier of government spending, and the non-linear impact of massive government debt burdens – it’s hard to believe that the president can do anything to alter the course of our ongoing credit-default cycle. The only prediction that’s consistent with sound economic theory is that the government is going to make this default cycle a lot worse.

Or… to summarize… it’s not likely that a government that’s facing its own $20 trillion debt burden is going to be able to do much to help the unwinding of $1 trillion to $2 trillion in private obligations over the next three to five years.

Regards,

Porter Stansberry

[ad#stansberry-ps]

Source: Daily Wealth