The Waltons, Wal-Mart’s founding family, are the richest family in the U.S. And they’re getting richer every year.

This year, they’ll take in more than $1 billion in combined income. And next year, they’ll earn even more…

[ad#Google Adsense 336×280-IA]The Waltons and their heirs are set up to live very comfortably for their entire lives. But the secret to the Waltons’ generational wealth isn’t really a secret at all.

It’s a strategy near and dear to our hearts here at Wealthy Retirement… dividend reinvestment.

Want to build an income stream that’ll last several lifetimes? It’s simple. Don’t cash those dividend checks – reinvest them instead. The more shares you buy today, the larger your dividend check will be tomorrow.

It’s the power of compounding at work. And thanks to that power, any family – rich or poor – can create an infrastructure of generational wealth like the Waltons have.

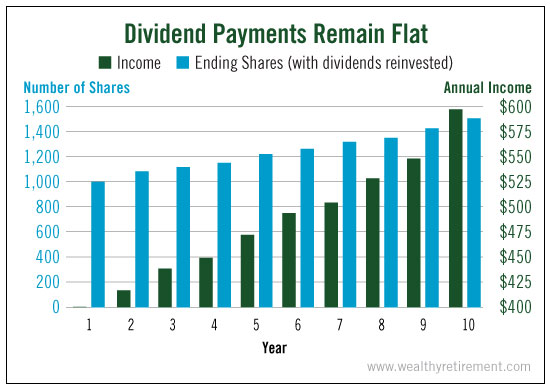

For example, if you buy 1,000 shares of a $10 stock with a 4% yield, you’ll receive $400 in dividends that year. If you reinvest that $400 (and the stock price stays the same), you’ll have bought yourself 40 more shares for a total of 1,040 at the end of the year.

The great part is your new shares pay dividends, too.

Assuming the stock price and dividend payments stay the same, you’ll receive $416 in dividends the following year. With reinvestment, your position will grow to 1,081 shares.

After 10 years, you’ll own about 1,429 shares and will have generated $592 in annual income.

But if you want to really juice up your dividend machine, invest in stocks that raise their dividend payouts every single year.

The Oxford Club’s Chief Income Strategist Marc Lichtenfeld calls them “Perpetual Dividend Raisers.”

Companies with consistent dividend growth are the fuel that’ll rev up your compounding engine. Just take a look at the next example…

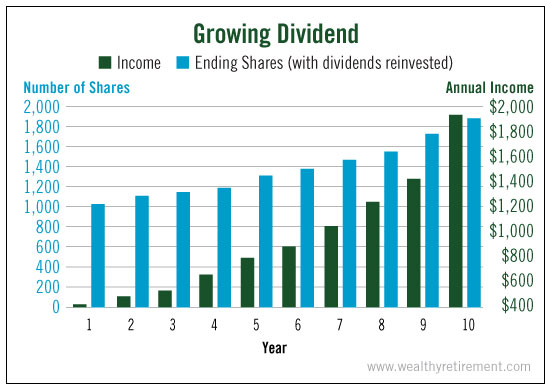

Let’s say the $10 stock above raised its dividend by 10% each year. For the sake of simplicity, let’s also assume the stock price stays flat.

By the end of the second year, you’ll have collected $458 in dividends. With reinvestment, your position will grow to 1,085 shares!

The key to your compounding wealth? Your increasing number of shares that continue to pay dividends over the years.

After just a decade of reinvestment, your position will grow to 1,852 shares, which will pay you an annual income of $1,922.

That’s nearly 3.4 times more income than the first example – all because the company raised its dividend by 10% per year!

Turbo-charged dividend growth is the “secret sauce” behind Marc’s Oxford Income Letter recommendations.

His 10-11-12 System teaches you how to reinvest your rising payments from Perpetual Dividend Raisers. It’s designed to deliver 11% yields and/or 12% average annual total returns within 10 years.

If you want to grow your future income – and hold stocks that have a history of paying healthy, rising dividends – you should also look for stocks that’ll continue generating plenty of cash flow each year to support future dividend growth.

We’ve said it before: Compounding is truly the eighth wonder of the world.

So warm up your compounding engine, and get your portfolio growing. It’s the only time-proven way to win the retirement income race.

And, by doing so, you’ll give your family a head start, too.

Good investing,

Kristin

[ad#IPM-article]

Source: Wealthy Retirement