With the major stock market indexes recently setting new record highs, many investors are worried about a downturn in share prices. When I make presentations, such as the one I gave at last week’s San Francisco MoneyShow, I point out that the market will always go down at some point and then always recover.

Keeping that in mind, there are ways to be in the stock market while staying more conservative and focusing on building a stable dividend income stream.

Investing in stocks for income leads me to a search for the safest dividend payers.

[ad#Google Adsense 336×280-IA]It’s easier to hang in there during market volatility when you know your dividend checks will continue to arrive.

The triple net lease real estate investment trusts (REITs) are often touted for their “bond-like” attributes and have the most secure dividends compared to the rest of the REIT sector.

This means the stronger triple net REITs have both businesses and dividend histories that resemble the safe principal and interest payments from a high-quality bond.

With a triple net lease, the company renting the property –the tenant– is responsible for all of the expenses associated with the property. The property owner’s primary job is to collect the rent checks. The net lease REITs own standalone buildings such as drug stores, convenience stores, casual and fast food restaurants, and other types of retail stores.

Leases are typically long-term, with 20 to 25 year long contracts. Leases also have annual rent escalators. Net lease REITs typically acquire properties through a sale/leaseback transaction with the current owner and occupier of a building. To reiterate, here are the benefits and safety factors that define the net lease REITs:

- Triple net lease contracts mean the REIT does not experience unexpected extra expenses.

- Decades long leases provide a very predictable revenue stream.

- Rent escalators ensure that revenue stream will grow every year.

- These REITs typically own thousands of properties and have diversified revenues.

- Sale/leaseback acquisitions mean the REIT does not have to find tenants for empty properties.

Because of these factors, within the small group of net lease REITs you have companies with long histories of steady and growing dividend payments. These stocks pay dividends you can count on for years into the future. Here are three REITs that give you “bond-like” safety that will let you sleep well at night, no matter what is happening in the stock market.

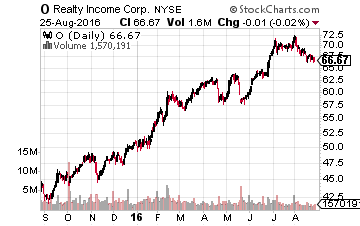

Realty Income Corp (NYSE: O) is the benchmark of how the net lease REIT model should operate. The REIT owns over 4,600 properties, and the properties have about 250 different tenant companies covering 50 different industries.

Realty Income Corp (NYSE: O) is the benchmark of how the net lease REIT model should operate. The REIT owns over 4,600 properties, and the properties have about 250 different tenant companies covering 50 different industries.

Realty Income is a monthly dividend stock and has paid over 550 (45 years) of consecutive monthly dividends.

The dividend rate has been increased every quarter for the last 19 years. Average dividend growth has been about 5% per year. O currently yields 3.6%.

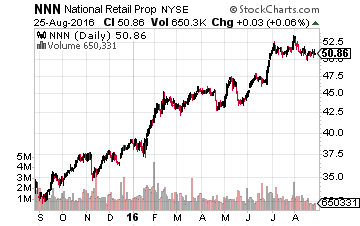

National Retail Properties, Inc. (NYSE: NNN) owns over 2,400 single tenant net lease retail properties located in 48 states. This REIT has one of the longest streaks of dividend increases out of the entire stock market. The NNN dividend has grown for 27 consecutive years. Historic dividend growth has been about 4% compounded annually. The stock currently yields 3.6%.

National Retail Properties, Inc. (NYSE: NNN) owns over 2,400 single tenant net lease retail properties located in 48 states. This REIT has one of the longest streaks of dividend increases out of the entire stock market. The NNN dividend has grown for 27 consecutive years. Historic dividend growth has been about 4% compounded annually. The stock currently yields 3.6%.

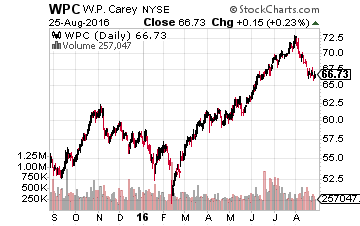

W.P. Carey (NYSE: WPC) went public in 1998, originally organized as a publicly traded partnership. The company converted to REIT status in 2012., and the company owns over 900 properties with 227 different tenant companies. W.P. Carey also generates significant fee-based revenue as the asset manager for a series of non-public REITs.

W.P. Carey (NYSE: WPC) went public in 1998, originally organized as a publicly traded partnership. The company converted to REIT status in 2012., and the company owns over 900 properties with 227 different tenant companies. W.P. Carey also generates significant fee-based revenue as the asset manager for a series of non-public REITs.

The company’s portfolio is more diversified than the other two REITs discussed here and includes industrial, office, and self-storage properties. About one-third of the assets owned are located in Europe.

The WPC dividend has increased every year since the 1998 IPO, with an average 8% annual growth rate over the last 10 years. The stock currently yields 5.8%.

— Tim Plaehn

[ad#ia-tim]

Source: Investors Alley