Last week hedge funds revealed what stocks they bought and sold during the second quarter. Let’s dive into the information and see what interesting purchases or sales we can find.

A lot of the media is talking about Apple (NASDAQ: AAPL) and why the largest stock in the market has fallen out of favor with hedge funds.

[ad#Google Adsense 336×280-IA]Hedge funds dumped over $5 billion worth of Apple stock last quarter even when Warren Buffett upped his stake by over 50%.

Regardless of who’s right in the Apple battle, there’s a lot going on in the hedge fund world that investors need to be paying attention to.

One of the big takeaways is that hedge funds still have a lot of money invested in stocks. The top funds now have about $150 billion invested in equities, an increase of 6% from the first quarter.

More importantly is that they’re investing in fewer, more select, securities. The top fund managers decreased their total positions to 399 in the second quarter, a near 5% decrease from the previous quarter. This sets a new record for the fewest stock positions held since 2014.

Hedge funds might be being a bit more selective as we find ourselves in an uncertain economic environment, but it is too early to tell what will happen, and with all that in mind, here’s the top hedge fund buys from the second quarter:

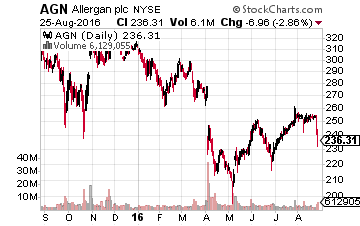

Allergan (NYSE: AGN) has been a major hedge fund buy for a number of quarters, but buying could ramp up further as the shares are down 22% in 2016.

Allergan (NYSE: AGN) has been a major hedge fund buy for a number of quarters, but buying could ramp up further as the shares are down 22% in 2016.

Hedge funds took notice and started buying up more shares of the beaten down drugmaker now that it trades at a further discount.

To start, the highest paid hedge fund manager in the business, David Tepper, who runs Appaloosa Management, has upped his stake in Allergan. His fund has more than quadrupled its stake in this drug maker and now has it as a top five holding.

Seth Klarman of The Baupost Group, famed value investor, also upped his stake in Allergan last quarter. Then there’s Elliott Management upping its stake as well as Passport Capital adding Allergan as a new position. Then, of course, there’s the chief of all activists, Carl Icahn, who took a new stake in Allergan last quarter. With all of the value-minded funds buying into this name it might be time to take a look and see just how much Allergan might be undervalued.

The upside for Allergan is that it’s selling its generic business to Teva (NYSE: TEVA), which will bring in over $30 billion in cash, which the drug company can use for buybacks or a major acquisition, such as the buying of competitor Biogen (NASDAQ: BIIB). For now, it plans to pay down debt and do a $5 billion stock buyback. While most of the biotech and pharma sector stocks are just now recovering from the long bear market that swept through the sector, Allergan might offer even more compelling value at these levels. Many big name hedge funds seem to think so.

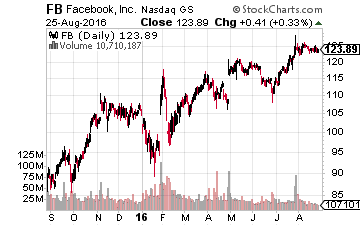

Facebook (NASDAQ: FB) saw investors continue to flock to the social media leader even though shares are enjoying a solid run this year.

Facebook (NASDAQ: FB) saw investors continue to flock to the social media leader even though shares are enjoying a solid run this year.

The stock is up 18% in 2016 and nearly 50% in the last year. To start, Third Point, ran by Dan Loeb, took a new Facebook stake and now has it in its top five holdings.

As well, Moore Capital ran by the underrated Louis Bacon, has upped its stake in Facebook. And John Paulson, known for his major subprime bet, also upped his stake. So, what are the reasons hedge funds have fallen in love with Facebook?

Despite being 12-years old, Facebook is finding new ways to grow. Thanks to increased mobile ad revenue growth as its suite of applications – including Whatsapp, Messenger and Instagram – continue to grow Facebook has seen better than expected earnings growth. Facebook is definitely taking mobile advertising dollars away from old-guard and vanguard tech companies alike.

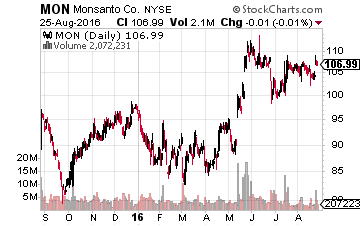

Corvex Management, which is an activist hedge fund managed by Carl Icahn protege Keith Meister, added a new stake in Monsanto (NYSE: MON) last quarter.

Corvex Management, which is an activist hedge fund managed by Carl Icahn protege Keith Meister, added a new stake in Monsanto (NYSE: MON) last quarter.

Also, Elliott Management, a fellow activist fund, took a new stake in Monsanto at that time as well. Eton Park Capital also took a new stake. So, what’s causing the sudden influx of activist attention?

The company has taken a lot of heat for its genetically modified seeds, but that does not change the fact that there will always be a growing amount of mouths that need feeding – a huge tailwind for Monsanto.

The seed company also makes the key weed killer brand Roundup, which has been around since the 70s. With Roundup and its seeds, Monsanto helps farmers boost their crop yields, allowing farmers to earn more money without having to farm new land.

Monsanto will benefit over the long-term from rising incomes and the middle class, where the demand for protein and grain will also increase. Even with all of the ethical issues surrounding Monsanto, there seems to be some strong long-term tailwinds in place for this multi-national conglomerate.

But for all the buying that was done, there was also plenty of selling. Now, here are the top three hedge fund sells:

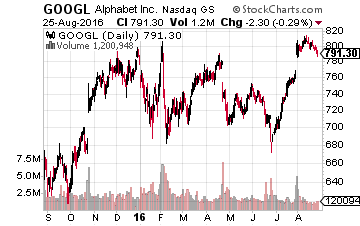

First is the Internet giant Google (NASDAQ: GOOGL); a number of big name hedge funds started “giving” up on the $540 billion market cap tech company last quarter.

First is the Internet giant Google (NASDAQ: GOOGL); a number of big name hedge funds started “giving” up on the $540 billion market cap tech company last quarter.

Why? Well for starters, the stock is up a paltry 2% this year. Hedge funds are most likely tired of mediocre performance and think they can earn better returns elsewhere in the market.

Stanley Druckenmiller, who now runs Duquesne Capital as a family hedge fund, has put up some of the best returns in the business. His fund dumped all its Google shares last quarter. Then there’s a slew of other funds either cutting or dumping their stakes, including Corvex Management, Moore Capital, and Third Point.

The bear thesis is that Google is struggling to compete with the likes of Amazon (NASDAQ: AMZN)’s AWS in the cloud market. But there’s also the shift toward mobile that is putting pressure on Google’s strong hold in advertising. In particular, the move away from desktop browsing has opened the door for the likes of Facebook to steal some of the markets share in ad spending. While I don’t believe this should sound any alarms for long-term Google investors, I can surmise that these hedge funds think Google will not outperform the market over the intermediate term.

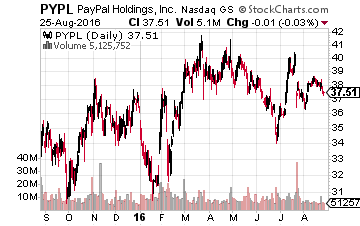

While Seth Klarman of Baupost was buying up Allergan shares last, he was selling PayPal (NASDAQ: PYPL) at the same time.

While Seth Klarman of Baupost was buying up Allergan shares last, he was selling PayPal (NASDAQ: PYPL) at the same time.

The other major fund that was dumping its PayPal stake was Carl Icahn’s. PayPal has been a mediocre performer this year – up less than 4% – as competition in the payments industry continues to heat up.

And its presence in the physical stock and brick-and-mortar space remains limited. One of PayPal’s planned growth avenues, small business lending, will continue to meet resistance from the growth of online lenders like OnDeck (NASDAQ: ONDK). It seems that PayPal might be running out of ammo to fight off the intense competition in its industry.

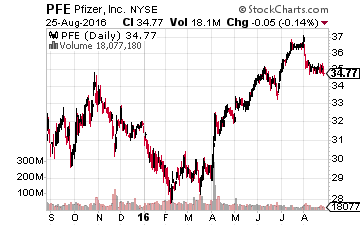

While funds are loving the pharma play Allergan, they’re “hating” Pfizer (NYSE: PFE). JANA Partners, activist fund ran by Barry Rosenstein, dumped its entire stake in Pfizer last quarter.

While funds are loving the pharma play Allergan, they’re “hating” Pfizer (NYSE: PFE). JANA Partners, activist fund ran by Barry Rosenstein, dumped its entire stake in Pfizer last quarter.

Elliott Management was also dumping its Pfizer stake and Passport capital cut its stake by nearly 90%.

There was a thesis that Pfizer might breakup, but this is taking longer than expected — and may not happen at all per the company. So, funds are now exiting over the worry that Pfizer is too big to grow.

— Tim Plaehn

[ad#ia-tim]

Source: Investors Alley