Vanguard just closed its most popular dividend fund to new money. If you’re not already in, I’m afraid you’re out of luck.

But I’ve got a backdoor way to duplicate – and even best – its winning income strategy. We’ll talk specifics in a minute, including stocks to buy now. But first, let’s discuss this dividend investing strategy to appreciate why it works so well in all market environments.

[ad#Google Adsense 336×280-IA]In a world with no shortage of financial worries, the Vanguard Dividend Growth Fund (VDIGX) is the surest long-term bet you can make with a single click of the mouse.

It’s a dividend strategy that I plow 100% of my 401(K) contributions into (as I have to choose from a set list of funds – but at least I have one that always wins over time.)

VDIGX owns the strongest businesses with ever-rising profits driving ever-rising dividends.

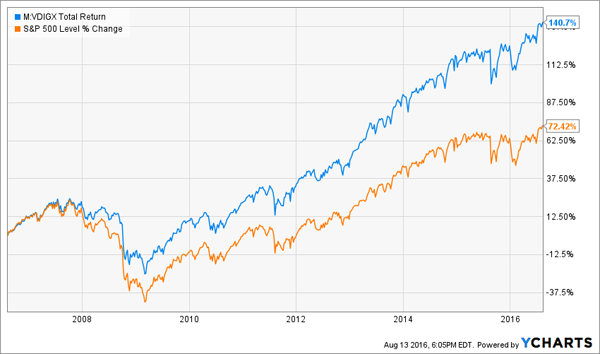

As a result, it’s doubled the market’s return over the last 10 years:

Dividend Growth Doubles Up the Market

Funds like VDIGX are good options for investors who don’t have the patience or ability to buy individual stocks. But you have the know-how to build your own portfolio – and secure even better returns.

Funds like VDIGX are good options for investors who don’t have the patience or ability to buy individual stocks. But you have the know-how to build your own portfolio – and secure even better returns.

Plus, you and I have a big advantage over Vanguard. We don’t have to deploy $29 billion in assets! If we did, we’d be forced to buy mostly large cap issues.

Instead, we can take advantage of our nimble size to grow our capital and payouts more quickly by buying faster growing dividend payers.

A Dividend Growth Strategy for Double-Digit Gains

Over the long haul, your stock returns will equal the current yield you’re netting today plus your annual dividend growth in the years ahead.

It’s that simple.

Over time, investors tend pay the same current yields for certain stocks. For example, check out VDIGX’s top 3 holdings – Microsoft (MSFT), Costco (COST) and Medtronic (MDT). For the last five years, their yields have been amazingly consistent:

The Years Change, the Yields Stay the Same

But this doesn’t mean their prices have stayed the same. In fact, these stocks have soared higher by 160% or more thanks to big dividend growth over the same time period!

But this doesn’t mean their prices have stayed the same. In fact, these stocks have soared higher by 160% or more thanks to big dividend growth over the same time period!

Dividend Growth Drives 160% to 206% Total Returns

Costco was the laggard with “only” 64% dividend growth over the past five years – though that doesn’t count two big special dividends paid in 2012 and 2015. Medtronic bumped its payout by 65% while Microsoft boosted its dividend by 80% over the five-year period.

Costco was the laggard with “only” 64% dividend growth over the past five years – though that doesn’t count two big special dividends paid in 2012 and 2015. Medtronic bumped its payout by 65% while Microsoft boosted its dividend by 80% over the five-year period.

Vanguard’s portfolio manager Donald Kilbride isn’t exactly performing brain surgery here. He’s simply buying good businesses that throw off enough excess cash that they can increase their dividends by double-digits annually. These payout gains translate directly to stock price gains – which is why dividend growers outperform all other payout policies over the long run.

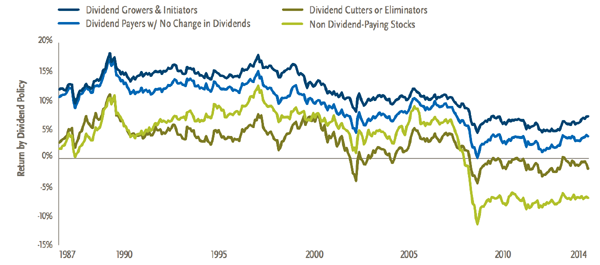

According to Ned Davis Research, since 1987, perennial dividend growers have returned 10.1% annually. They’ve outperformed static dividend payers, non-dividend paying firms and dividend cutters or eliminators.

Dividend Growers Outperform, Returning 10.1% Annually

Over the last five years, VDIGX has performed even better – it’s returned nearly 15% annually (103% in total) despite relatively stagnant economies in the U.S and abroad. An ideal investing strategy for a slow growth world.

Over the last five years, VDIGX has performed even better – it’s returned nearly 15% annually (103% in total) despite relatively stagnant economies in the U.S and abroad. An ideal investing strategy for a slow growth world.

Beware the Dividend Aristocrats, Though

Dividend aristocrats – companies that have raised their payouts for 25 consecutive years – are deservedly admired, respected and loved by investors. They’ve been dividend growers for decades.

That does NOT mean we should buy them, however. At least not now.

First-level thinkers pay up for past glories and multi-decade track records. But a storied shareholder past is no guarantee of future returns – especially if you pay too much for the privilege to own the company.

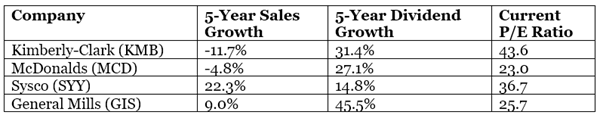

Let’s take four aristocrats – Kimberly-Clark (KMB), McDonald’s (MCD), Sysco (SYY) and General Mills (GIS). Their best growth days are behind them, though you’d never know it looking at their valuations. Here are their sales and dividend growth over the past five years, along with their current price-to-earnings (P/E) ratios:

How can dividends skyrocket when sales stagnate? It’s not pretty. These has-beens have resorted to artificial measures. They boosted their payout ratios and debt levels to keep up appearances.

How can dividends skyrocket when sales stagnate? It’s not pretty. These has-beens have resorted to artificial measures. They boosted their payout ratios and debt levels to keep up appearances.

Increasingly Plastic Payouts

The surface-level tactics “worked” over the last decade: these four stocks performed good to great. While the S&P 500 returned 72%, they rang up returns ranging from 158% (Sysco) to 372% (McDonald’s).

The surface-level tactics “worked” over the last decade: these four stocks performed good to great. While the S&P 500 returned 72%, they rang up returns ranging from 158% (Sysco) to 372% (McDonald’s).

But today they’re a decade older… 73% more expensive (average P/E of 32.3 now versus 18.7 then) … and are paying out a much higher percentage of profits as dividends today. Which means there’s less room for future dividend increases.

Oh, and their yields languish at multi-year lows today:

A Bear Market in Aristocrat Yields

I prefer to buy my dividend growers when their stocks are cheap and their best growth is ahead of them. Today it’s difficult to find blue chip names that fit the bill right now. The Fed’s “low rates for longer” policy has inspired investors to bid up the popular names.

I prefer to buy my dividend growers when their stocks are cheap and their best growth is ahead of them. Today it’s difficult to find blue chip names that fit the bill right now. The Fed’s “low rates for longer” policy has inspired investors to bid up the popular names.

— Brett Owens

Sponsored Link: But the real growth isn’t with the stalwarts anyway – it’s with the up-and-comers. The stocks that Donald Kilbride can’t buy for VDIGX because he has too many billions to deploy!

So instead of fawning over fading aristocrats like the first-level types, we can instead buy dividend growth stocks with their best years ahead of them. And I have a gorgeous dividend diva I’d like to introduce you to – three, actually – while they are still relatively young, and cheap dates to boot!

My favorite dividend grower already pays a gaudy 6.8% today. And it increases its payout not just every year, but every single quarter. If you buy shares today, you’ll be earning a 10%+ cash yield on your initial investment in no time.

Best thing is, this company’s business model is bulletproof. You see, no matter what happens to the price of oil, the outcome of this year’s election, or even China or the Fed, there’s one sure economic bet in America:

The country will be older in the future than it is now, and demand for healthcare services is set to skyrocket.

In fact, by 2024, national healthcare expenditures are expected to climb to $5.43 trillion, or about 20% of GDP. This firm is capitalizing on this trend, and growing its already-big 6.8% dividend literally every 3 months. Plus, shares have easy 20% upside from here or better, as they’re trading for just 10-times cash flow.

Click here and I’ll give you [more information on the] two stocks that are capitalizing on the biggest demographic shift in U.S. history.

Source: Contrarian Outlook