The big Wall Street stock analysis firms are starting to make strong buy recommendations on selected stocks in the beaten down energy infrastructure sector.

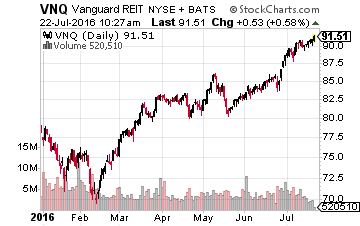

On the flip side, equity REITs have been the hot stock sector over the last few months and for 2016 to date.

[ad#Google Adsense 336×280-IA]Now may be the time to make a strategic portfolio shift by selling some of your REITs to lock in some profits and buying energy infrastructure stocks to generate a higher current yield and dividend growth.

Both equity (property owning) REITs and energy infrastructure stocks offer similar investment opportunities.

Both types typically pay out a majority of cash flow as dividends/distributions, and with the better companies, investors will see those dividends grow over time.

The energy infrastructure group consists primarily of businesses organized as master limited partnerships (MLPs). The combination of above average current yield and growing dividend rates should produce above average total returns. At various times in their respective market cycles, both REITs and MLPs have done just that.

The REIT sector hit a bull market high in late January 2015 and then the group went into a steady decline that bottomed in early September, about 20% below the peak earlier that year.

The REIT sector hit a bull market high in late January 2015 and then the group went into a steady decline that bottomed in early September, about 20% below the peak earlier that year.

REITs tested the bottom again during the January-February 2016 correction.

Since the February trough, REITs have gained over 25% plus dividend earnings.

The REIT index and ETF values have now exceeded the January 2015 highs. Investors who bought REITs any time between late last summer and through February of this year are sitting on very nice gains.

The flip side of higher prices for dividend paying stocks is a lower current yield. For example, the Vanguard REIT Index Fund (NYSE: VNQ) website reports a current unadjusted effective yield of less than 3.5%. Six months ago, the yield was around 4.25%. Going forward, the total returns from REITs will be lower just because of the lower current yield.

The energy infrastructure MLPs are emerging from a bear market driven by the crash in energy commodity prices that started in the Fall of 2014. The drop in both energy prices and onshore oil and gas production hit the MLP and related companies sector hard. MLP index values dropped by more than 50% and a significant number of companies were forced to reduce or suspend distribution payments.

Now, a year-and-a-half after the energy bear market started, we have a much-changed group of energy infrastructure companies. A handful of the largest, most financially secure companies have proven they can grow revenues and distributions through one of the worst periods in the sector’s history. As we move forward, I expect these companies to start picking off the assets of their less strong competitors.

The portfolio shift involves selling some of your REIT positions that have gained a lot in share value and replace them with comparable –using financial strength and dividend growth– but higher-yielding MLPs. Here is an example:

Investor favorite REIT Realty Income Corp (NYSE: O) has gained 50% in the last year.

Investor favorite REIT Realty Income Corp (NYSE: O) has gained 50% in the last year.

The current yield is now just 3.4%.

Realty Income has a decades-long history of dividend growth, and the conservatively run company can be counted on to grow the dividend by 4% to 5% per year.

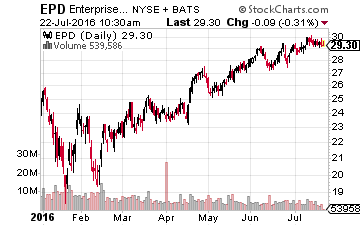

With this strategy, this REIT would be sold and replaced with Enterprise Products Partners LP (NYSE: EPD). This MLP is the largest, most financially secure of the energy midstream services companies.

In several respects, EPD is even financially stronger than Realty Income. Enterprise Product Partners has a long history of increasing its distribution every quarter, with annual payout growth of right around 5%.

However, the MLP now yields 5.4%, a full 2% more than the REIT. With similar dividend growth rates, EPD will provide superior total returns until the yield differential disappears or reverses.

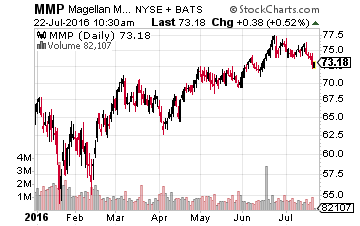

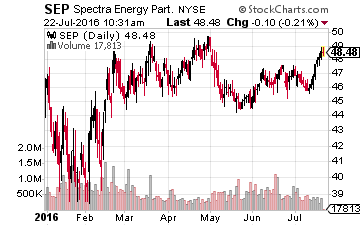

Here are two more MLPs that are currently being highlighted as Buys from Wall Street analysts.

Here are two more MLPs that are currently being highlighted as Buys from Wall Street analysts.

Review their yields and projected dividend growth rates against the REITs in your portfolio and make exchanges if it will improve your return prospects.

Magellan Midstream Partners, LP (NYSE: MMP) is primarily a refined energy products pipeline company.

The current yield is 4.4%. The MMP distribution is forecast to grow by 9% per year for the next several years.

Spectra Energy Partners, LP (NYSE: SEP) owns natural gas pipelines and storage assets.

Spectra Energy Partners, LP (NYSE: SEP) owns natural gas pipelines and storage assets.

This large-cap MLP currently yields 5.4%.

Distributions are expected to grow by 7% per year.

I make it a habit of only hunting down and recommending the most stable companies that regularly increase their dividends, and this is the strategy that I use most often to produce superior results, no matter if the market moves up or down in the shorter term.

The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

— Tim Plaehn

[ad#ia-tim]

Source: Investors Alley