As I write, the yield on the 10-year German bund has just dropped into negative territory for the first time.

On our side of the Atlantic, the yield on the 10-year U.S. Treasury note has just dropped to 1.6%.

[ad#Google Adsense 336×280-IA]The yield on the 10-year note hasn’t been this low since late 2012. Before that, it was never this low.

Interest income offered by low-risk bonds is paltry at best. If you want meaningful interest income, you have to venture far out on the risk curve.

You could buy shares of SPDR Barclays Capital High Yield Bond ETF (NYSEArca: JNK) and receive a 6.4% yield.

But you’re hardly buying a stable bond investment.

Consider the price performance of the high-yield bond ETF with that of a quality business development company stock, such as Ares Capital Corp. (NASDAQ: ARCC), which owns a portfolio of high-yield loans. With Ares, you get a risk profile that’s similar to that of the Barclays ETF. You also get a better yield. Ares’ dividend yield is 440 basis points better than Barclays’ interest yield.

Price Performance: Ares Capital vs. SPDR Barclays Capital High Yield Bond ETF

Source: StockCharts.com

But what if you could find decent yield in a low-risk bond? Would it be worthwhile to incorporate this investment into your long-term income portfolio?

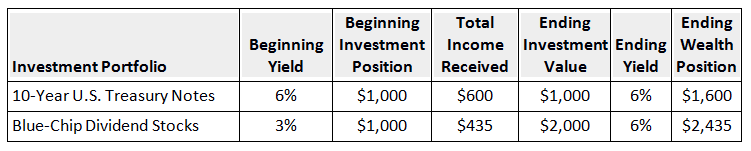

Let’s assume that you were to buy $1,000 worth of 10-year Treasury notes (10 notes) that yielded 6% (as you could in 2000). You buy the notes when issued and hold them to maturity.

The first year, you’d collect $60 in interest, and you’d collect $60 in interest every year thereafter. After 10 years, you’d have collected $600 in total interest.

Now, let’s assume that you take the same $1,000 and invest it in a portfolio of blue-chip dividend-growth stocks that yield 3%. Let’s also assume that the portfolio’s dividends increase 8% annually and that the share price of the stocks in the portfolio are normally priced to yield 3%.

The first year, your stock portfolio would pay $30 in dividends, half that of the interest payments offered by the portfolio of 10-year Treasury notes. The second year, your stock portfolio would pay $32.40 in annual dividends; the third year, it would pay $35 in annual dividends.

By year 10, your stock portfolio would pay $60 in annual dividends. In total, you would have collected $435 in dividends.

So, over the 10-year investing period, it appears the 10-year Treasury note has the advantage. It certainly has an income advantage.

Appearances can be deceiving, though. I said that the stocks that comprised the portfolio would be priced to yield 3%. If investors price $60 to yield 3%, the stock portfolio would be valued at $2,000 in year 10 – twice the initial investment. The Treasury note investor’s initial $1,000 would still be worth $1,000.

To start the 11th year, the stock investor is in a superior wealth position compared to the 10-year Treasury note investor. The wealth discrepancy widens from there.

At the end of 20 years, the 10-year Treasury note investor will have collected $1,200 in total interest; the stock investor will have collected $1,372 in dividends. At the end of 30 years, the 10-year Treasury note investor will have collected $1,800 in interest; the dividend investor will have collected $3,398 in dividends.

At the end of 30 years, the 10-Treasury note investor’s initial $1,000 is still worth $1,000. The stock investor’s initial $1,000, in contrast, is worth $9,300.

My example is simplified, to be sure. Investing is rarely so linear. I’ve ignored recessions, interest-rate changes, and time value of money as it relates to the timing and size of income payments.

That said, if you examine the share-price and dividend-growth history of many blue-chip stocks – Exxon Mobil (NYSE: XOM), Johnson & Johnson (NYSE: JNJ), Altria Group (NYSE: MO), McDonald’s (NYSE: MCD), etc. – you’ll find that my example isn’t far off the mark.

Whether interest rates are low or high, stocks are a hard income investment to beat over the long haul.

— Steve Mauzy

[ad#wyatt-income]

Source: Wyatt Investment Research