Platinum prices are out of whack today… and it’s giving traders a great buying opportunity.

As my colleague Ben Morris noted [on March 22], platinum typically trades at a premium to gold.

[ad#Google Adsense 336×280-IA]But in January 2015, that all changed…

Back then, gold started to trade for more than platinum.

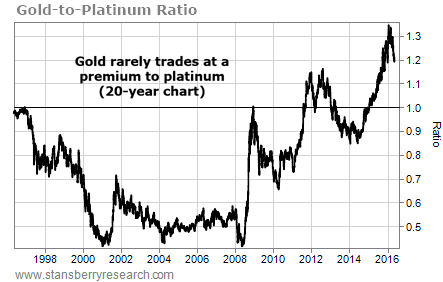

We can see this at work by looking at the gold-to-platinum ratio, which shows how many ounces of gold it takes to buy a single ounce of platinum.

As you can see in the following chart, gold has only traded for more than platinum a couple of times over the last 20 years…

Platinum has started to move back to parity with gold. Since peaking at 1.34 at the beginning of the year, the ratio has begun to revert to its historical norm.

We’ve seen some similar moves when comparing gold with silver. We highlighted a peak in the gold-to-silver ratio [on March 5] and again [on May 5].

The moves in the gold-to-platinum ratio aren’t the same, but they’re similar. In short, like silver, platinum is outperforming gold. That’s good for platinum stocks…

And as you might imagine, these companies have benefited from the recent outperformance. You can see how some of these stocks have done this year…

Most of the world’s platinum is produced in Africa. More than 75% of last year’s platinum production was from South Africa and Zimbabwe.

In fact, platinum and palladium producer Stillwater Mining (SWC) is the only U.S.-based producer on the list above. It slid to start the year, but is up 73% since bottoming on January 19.

The prices of the products Stillwater sells have only increased since the end of the quarter. This should lead to better sales going forward. In addition, its costs have fallen from last year. This too should bolster its share price in the near term.

It’s not too late to ride the platinum trend.

Good investing,

Brian Weepie

[ad#stansberry-ps]

Source: Growth Stock Wire