High yielding dividend stocks are an appetizing part of any portfolio and it’s easy to see why.

They act as risk moderators, balancing out a portfolio and amplifying gains over time. But stocks are a lot like the surface of a placid lake with torrential currents underneath that may not be obvious at a glance.

[ad#Google Adsense 336×280-IA]Sometimes a juicy high yielding dividend stock isn’t all its cracked up to be and unwary investors snap up the bait only to realize their mistake after it’s too late.

Remember the old adage, “if it looks too good to be true, then it probably is.”

But before you start questioning all high yield stocks, there are telltale signs that a dividend yield could be all smoke and mirrors.

One big clue is the dividend payout ratio – the percentage of earnings returned to shareholders in the form of dividends.

A low ratio means the stock has plenty of room to keep paying out a dividend or even increase the yield if the company so wished. Conversely, a high payout ratio may be unsustainable putting the dividend yield in danger of being cut in order to maintain profitability.

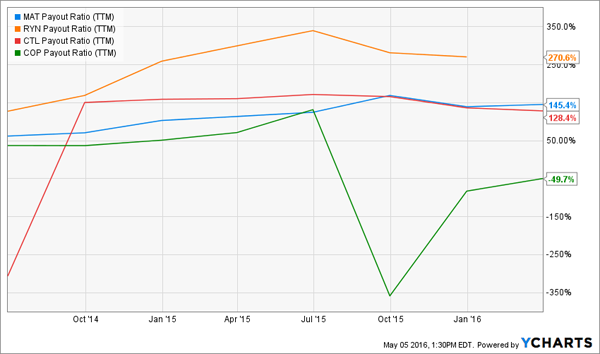

Today, we’re going to look at five high yielding stocks that look like their dividends could be in trouble with high payout ratios and a slow enough growth rate that makes it impossible for earnings to catch up. However, one stock defies the rules making it an attractive pick-up despite what it looks like on the surface.

A victim of the oil crisis, ConocoPhillips (COP) is a company that’s past due for another dividend cut. The company has been posting losses and aggressively cutting spending in an attempt to reverse course, but any type of dividend payment is simply exacerbating losses when there aren’t any positive earnings to speak of. Management has been trying to keep investors positive about the dividend but 4th quarter losses of $3.5 billion meant another cut by 60%.

The only reason it’s still even paying a dividend is largely thanks to big cutback in stock buybacks and sales of ancillary divisions. In fact, the company isn’t expected to be cash flow positive again until the first quarter of 2017 – in the meantime though, the dividend is keeping the company from gaining any bullish momentum.

Rayonier (RYN) is a lumber production company who’s stock performance this year belies the company’s underlying problems. Year-to-date the stock is up over 12% and it’s 4% dividend yield looks like a great deal for interested investors. However the payout ratio is an astonishing 271% and this is after cuts have reduced the dividend to just half its quarterly payout as of 2014.

Last year, the company cut its quarterly dividend from $0.30 a share to $0.25 but its extremely high payout ratio means that if the company wants to stay afloat, it will likely need to make more aggressive cuts in the future. Furthermore, higher volatility in timber prices present an additional headwind for Rayonier to battle.

Another deceptive stock, Mattel (MAT), the toy maker known for its Barbie brand, has enjoyed year-to-date gains of nearly 16%. It also offers investors a dividend yield of 4.9% but with a payout ratio of 176%, you might want to hold off pulling the trigger on this trade just yet. Barbie sales fell 3% worldwide according to recent company reports while it’s “other girls” division saw a loss of 62%.

The company’s been struggling to meet expectations with sales even letting go of its Disney Princess toy line in an attempt to boost profitability but based on last quarters dismal earnings miss of more than -75%, this dividend is definitely on the chopping block.

Telecommunications has been one of the highest performing sectors in the market for more than a year now, but CenturyLink (CTL) appears to be the one company in that space that doesn’t seem to be on the same page as its peers. The stock appears to be doing well like many others on our list up 25% year-to-date.

It also has a high dividend yield of 7% but the payout ratio of 135% puts this dividend in jeopardy. Management’s been having problems too with four senior executives leaving in 2015. Dividend cuts aren’t anything new with this company either. In 2013, it slashed its dividend by 26% when its payout ratio hit 168%.

Payout Ratios Above 100%, or Worse, Negative

Finally we have Agrium (AGU), an agricultural chemical company that’s in value territory right now. The company is heavily tied to corn which is expected to face challenges this year with vast production ramp ups in the US, Brazil, and Argentina.

However the stock appears to have all the bad news priced in leaving it with plenty of upside if corn prices don’t drop as much as expected. The stock also offers a nice treat for investors willing to wait with a yield of 4.1% and a payout ratio of just 49% giving the company plenty of wiggle room to continue payments far into the future.

Agrium’s Big Dividend Growth

— Brett Owens

Sponsored Link: I like Agrium here, but I love three “slam dunk” income plays even more. Their dividends are twice as high – 8%, 8.4% and 11% – with payouts back by secure cash flows. Plus, these issues have easy 7-15% additional price upside thanks to temporary discounts in their share prices. The “Bond God” Jeffrey Gundlach recently raved about them – click here and I’ll share what he said, along with more information on these big income payers.

Source: Contrarian Outlook