A forest fire is raging in Alberta, Canada.

And it’s taking 800,000 barrels of oil offline per day.

[ad#Google Adsense 336×280-IA]That’s huge news. And yet, despite a loss of more than 18% of Canada’s total oil production, it barely moved the needle for oil prices. That’s how much oil we have today.

Let me explain…

Right now, a 30-square-mile area around Fort McMurray in Alberta is experiencing a forest fire. Fort McMurray is the hub for Canada’s tar-sands region. It’s where all the workers live.

Unfortunately, the city has one road in and out.

Once Highway 63 gets cut off, the city becomes isolated and vulnerable. Right now, officials have evacuated the entire city’s 88,000-person population. The massive fire is ravaging suburbs and has already destroyed 1,600 buildings.

Energy companies have shut down pipelines and relocated personnel while the fire destroys the boreal forest that covers the region.

But like I said, despite losing 800,000 barrels of oil per day, oil prices have hardly flinched.

You see, since January, roughly 2 million barrels a day of oil production have come offline, according to analysts at the Financial Times. That includes an oil workers’ strike in Kuwait that shut down more than 60% of the country’s crude-oil production last month.

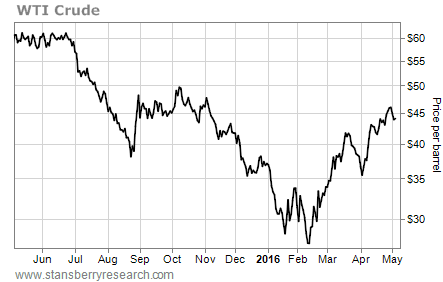

Here’s how the oil price reacted…

As you can see in the chart above, the price of West Texas Intermediate (“WTI”) crude – the U.S. benchmark for oil prices – bottomed in February at $26.19 per barrel. Since then, it’s up 68%. That’s a big move in percentage terms… but prices continue to stay low enough that oil producers are still in trouble.

And with this massive forest fire taking another 800,000 barrels a day off the market, we should have seen oil prices rising this week… but we haven’t. When a major catastrophe like this doesn’t move the needle, things are dire.

It shows how out of balance the fundamental supply-and-demand relationship is. Supply is still far too high… So I don’t see oil prices climbing this year.

Even with massive cost-cutting, most publicly traded oil companies can’t turn a profit at current prices. And as we’ve told you, low oil prices have pushed some oil companies toward bankruptcy.

Don’t let the recent uptick in oil prices fool you. Things are still bad for producers… and more bankruptcies are around the corner.

Good investing,

Matt Badiali

[ad#stansberry-ps]

Source: Growth Stock Wire