The market has staged an impressive rally over the past few months after deep early losses incurred in the beginning weeks of 2016. The fears around the high-yield credit markets and other myriad “worst case” concerns about a hard landing in China or even a global recession have not materialized.

Oil that was nearing $25 a barrel at the nadir of the descent has rebounded back into the mid-$40s.

[ad#Google Adsense 336×280-IA]While not even near the over $100 a barrel price that existed for years, this rise has improved sentiment and stock prices in the energy sector as well as many emerging markets.

It has also lowered the volatility in our markets as well.

One big tell that the market was overcorrecting early in the year was insider buying activity, which hit a multi-year high a few months ago when stocks were selling off.

The fact that so many corporate directors and high-level management thought their equities were undervalued was a tip-off that things were not as bad as the market was portraying. It also looks like the correct view given the recent broad-based rally in the stock market.

However, after this big rise the market does feel more than fairly valued given we are in the fourth quarter in a row of declining profits within the S&P 500 year-over-year and the second quarter looks poised to run that streak to five. So, which stocks still look good to insiders despite the recent rally in the market? Well, after the deep bear market in biotech, which looks like it has recently ended, there is some significant insider buying still going on in the small and mid-cap names in that sector. Here are a few that look attractive to me at current levels.

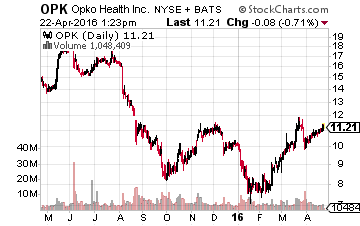

Let’s start with Opko Health (NYSE: OPK), a biopharmaceutical and diagnostic concern down here in Miami that I have mentioned before and that continues to show strength after a recent and temporary setback.

Let’s start with Opko Health (NYSE: OPK), a biopharmaceutical and diagnostic concern down here in Miami that I have mentioned before and that continues to show strength after a recent and temporary setback.

Insiders have bought over two million shares of this stock over the past six months in over five dozen different transactions.

That buying continues and is mainly led by noted biotech billionaire and entrepreneur Dr. Phillip Frost.

The stock is back above $11.00 a share after getting below $8.00 a share in February. Revenues should more than double this year to over $1 billion and the company should move from small losses to a solid profit in FY2017.

If and when its compound Rayaldee is approved for one aspect of chronic kidney disease, which looks likely, expect the shares to move up further. The company’s business consists of the nation’s third-largest clinical laboratory with a core genetic testing business as well as an expanding biologic product portfolio and solid late-stage pipeline.

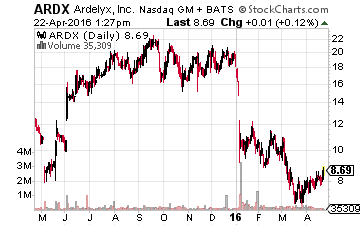

Ardelyx (NYSE: ARDX) is another biopharma stock I recently came across that has an attractive pipeline and significant insider buying.

Ardelyx (NYSE: ARDX) is another biopharma stock I recently came across that has an attractive pipeline and significant insider buying.

This company has a $300 million market capitalization and focuses on developing and commercializing minimally-systemic therapeutics for the gastrointestinal (GI) tract to treat GI and cardio-renal diseases.

Its primary compound is being developed as a possible treatment for constipation-predominant irritable bowel syndrome (IBS-C) and for the treatment of hyperphosphatemia in chronic kidney disease patients on dialysis. Two Phase III trials were initiated for the treatment of IBS-C in the fourth quarter of 2015. A second Phase 2b study for hyperphosphatemia, which is an elevated level of phosphate in the blood, was initiated around the same time.

Its second lead compound is in Phase II trials as a possible treatment against hyperkalemia and looks promising. Earlier this year the company did a $75 million secondary offering early this year to raise the necessary funding for development.

Insiders bought most of the secondary offering, which is rare, and have made some small purchases on the open market since. Given the company could have as many as three New Drug Applications (NDA) by the end of 2017 for addressable markets, I can see the logic behind such enthusiasm, especially with the stock at a little less than $9.00 a share.

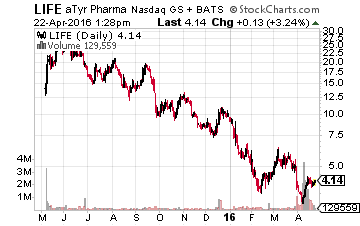

Moving way out on the risk scale we end with a small San Diego based biotech concern named aTyr Pharma (NASDAQ: LIFE) which has the memorable ticker symbol of LIFE.

Moving way out on the risk scale we end with a small San Diego based biotech concern named aTyr Pharma (NASDAQ: LIFE) which has the memorable ticker symbol of LIFE.

Two things intrigued me around this small cap when it popped up on my radar screen over the past few days.

First, several insiders have bought almost 400,000 shares recently. Second, the cash on its balance sheet is roughly equal to the market capitalization of the company, a rare quinella for track racing fans.

LIFE is what I call a “busted IPO”. The company came public in May of last year and soon was above $25.00 a share. After the hyperbole of its IPO wore off and investors moved on to the next hot thing, the shares declined and now sell at just $4.00 a share. LIFE engages in the discovery and clinical development of innovative medicines for patients suffering from severe and rare diseases using its knowledge of Physiocrine biology, a newly discovered set of physiological modulators.

The company has a very early stage pipeline and the firm did have some turnover in the executive suite earlier this year. However, given the insider buying, cash on the balance sheet, and at one-time price targets as high as $42.00 a share from analysts, I picked up a few shares last week and now have the company on my watch list. Insiders seem to be signaling the company might someday live up to the initial expectations of the market when it came public.

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley

Positions: Long ARDX, LIFE, OPK