It’s known as a stock for widows and orphans, but that’s an unfair label to slap on a company with a great track record of raising dividends…

AT&T (NYSE: T) may not be the most exciting stock in the world, but it has delivered for shareholders, and its dividends have been a huge part of that. Over the past 25 years, the stock price climbed 179%… but when you include the dividends, the total return was 711%.

In 1984, “Ma Bell,” as it was affectionately known, was broken up by the government and forced to spin off its regional phone companies, or “Baby Bells.” Since then, the company has raised its dividend every year – an impressive 32-year streak.

[ad#Google Adsense 336×280-IA]Given AT&T’s attractive 5% yield today, shareholders may be wondering if this dividend stalwart can continue to pay and raise the dividend for years to come.

Let’s dig in and find out.

We want to see if, along with that impressive three decade-plus history of annual dividend raises, the company generates enough cash flow to pay the dividend.

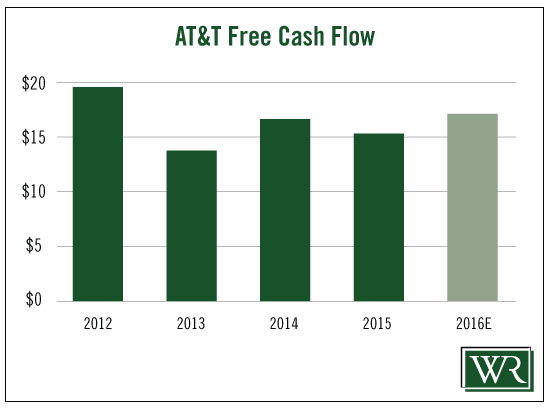

Free cash flow has actually declined over the past three years, from $19.7 billion in 2012 to $15.4 billion last year.

That’s not good. Generally, we want to see cash flow growth so that the company has plenty of room to pay and raise the dividend.

However, in 2016, free cash flow is expected to climb to $17.3 billion.

Last year, AT&T paid out $10.2 billion in dividends. That gives us a payout ratio of 64%. The payout ratio is the amount paid in dividends divided by earnings or cash flow. I use cash flow because it is a more accurate measure of a company’s ability to pay dividends.

Last year, AT&T paid out $10.2 billion in dividends. That gives us a payout ratio of 64%. The payout ratio is the amount paid in dividends divided by earnings or cash flow. I use cash flow because it is a more accurate measure of a company’s ability to pay dividends.

Anything under 75% gives me added confidence that the dividend can continue to be paid.

That way, even if a company’s free cash flow slips, it should have enough to pay shareholders the dividend they expect.

That way, even if a company’s free cash flow slips, it should have enough to pay shareholders the dividend they expect.

And with cash flow projected to grow in 2016, there should be plenty of cash, so there is no reason to think the dividend is in jeopardy.

The only reason AT&T doesn’t get my highest rating is free cash flow has fallen over the past three years.

But if next year’s forecast comes in as expected, we should see an upgrade in 2017.

In the meantime, given the company’s track record of annual dividend increases and its ability to generate more than enough cash flow, I have no concerns about AT&T’s ability to pay its dividend.

Dividend Safety Rating: B

— Marc Lichtenfeld

[ad#wyatt-income]

Source: Wealthy Retirement