I started the New Year with a non-sanguine view of the market.

I started the New Year with a non-sanguine view of the market.

With this outlook, my portfolio had a 30% allocation to cash to begin 2016.

As stocks fell through most of the first month and a half of the year, I incrementally bought the dip.

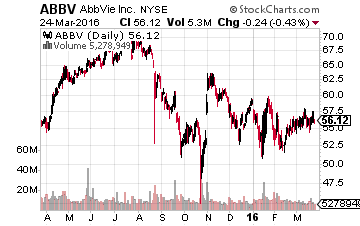

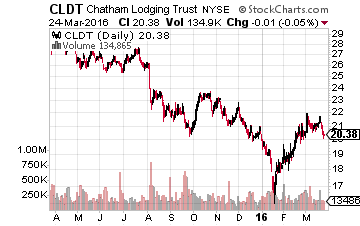

I added to my core stakes in cheap blue chip stocks with large dividend yields such as AbbVie (NYSE: ABBV) and Chatham Lodging Trust (NASDAQ: CLDT ), an undervalued high-yield lodging REIT.

I added to my core stakes in cheap blue chip stocks with large dividend yields such as AbbVie (NYSE: ABBV) and Chatham Lodging Trust (NASDAQ: CLDT ), an undervalued high-yield lodging REIT.

By mid-February, my cash allocation was down to just over 10%.

That strategy paid dividends over the past month or so as the S&P 500 gained for five straight weeks before losing some ground last week.

However, I have grown increasingly cautious as stocks have continued to claw their way back to even from deep early losses to start the year. My cash position is back to 15% and climbing as I have taken some profits.

I sold out stakes in some stocks like Yahoo (NASDAQ: YHOO) that have had nice runs but now seem to have limited upside because they do not provide significant dividend payments.

Why have I turned cautious again? There are a number of reasons for my pessimism regarding if the market can continue climbing in any significant way.

[ad#Google Adsense 336×280-IA]First, a couple of core pillars that have powered the rally seem to be fading away. One being oil recently hitting its highs for the year at just over $41 a barrel.

However, crude pulled back from those levels because of the glut of oil in storage, anemic global growth, and no agreement from OPEC to cut production.

Even at their highs of the year, oil prices are not sufficient to prevent myriad bankruptcies among small and even mid-tier shale producers.

This will continue to be an overhang on the high-yield credit markets whose spike in volatility roiled equities at the beginning of the year.

Another tailwind of late has been the Federal Reserve finally bowing to reality and reducing their forecast of four quarter point hikes in interest rates for 2016 to just two. These dovish comments helped power the recent rally in equities. The market is currently placing a less than one in five chance that the central bank raises rates when they meet in April.

However, investors might be too optimistic that rate hikes are off the table for the first half of the year. Part of the reason markets were down last week was the St. Louis Fed president and voting member of the Federal Open Market Committee (FOMC) started to make hawkish comments which seem to indicate another rate hike may happen sooner than what is currently into the market. This has caused the dollar to rise against major currencies and has been a key factor why the rally in oil and commodities started to fade some last week.

After an over 10% rally off multi-year lows, emerging markets have started to head lower as momentum starts to go out of the rally in oil and commodities. Growth in China continues to be at the lowest levels in a quarter century and the days of 10% plus growth seems gone for good. Elsewhere in Asia, Japan’s economy is contracting as Abenomics looks like another failed attempt to revive growth in the Land of the Rising Sun after two “lost” decades.

In Europe, the heinous suicide bombings in Brussels has brought new worries about escalating terrorism and adds to the divineness that the largest migration wave since WWII mhas brought to the continent. It also elevated the chances that the U.K. could vote to leave the European Union in a referendum in late June. Such an outcome would roil both the equity and currency markets. Worries that Britain could leave the union has already caused the Pound to hit 15-month lows against the Euro.

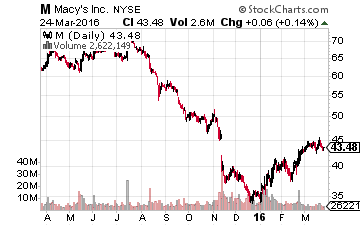

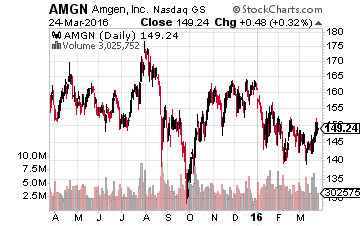

My game plan is to continue to incrementally build up cash if the stock market resumes its rally. If equities do head down significantly I still have my “shopping list” of cheap, large cap stocks that provide nice dividend yields such as Amgen (NASDAQ: AMGN) and Macy’s (NYSE: M).

My game plan is to continue to incrementally build up cash if the stock market resumes its rally. If equities do head down significantly I still have my “shopping list” of cheap, large cap stocks that provide nice dividend yields such as Amgen (NASDAQ: AMGN) and Macy’s (NYSE: M).

I know this is hardly an inspirational message as we get ready for a new trading week.

I know this is hardly an inspirational message as we get ready for a new trading week.

However, given what looks like a market that most likely will remain in some sort of trading range until we get much stronger indications that worldwide economic activity is actually improving; I think it is the most prudent strategy at the moment.

There seems to be more risk on the downside at the moment after a nice rally and as that rise looks like it has run its course at least for the time being.

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley

Positions: Long ABBV, AMGN, CLDT, and M