It was like trying to board the subway at rush hour. I tried to make space for the new arrivals, but there was nowhere to move.

I just got back from the 2016 Prospectors and Developers Association of Canada (PDAC) Convention. Each year, this mining conference brings more than 20,000 attendees to Toronto to learn about all things resource-related. It’s the largest of its kind in the world.

The vibe of the conference was different this year. Attendance was way down. Far fewer companies were telling their stories… far fewer service providers were selling their expertise… and there was far less buzz surrounding the attendees.

[ad#Google Adsense 336×280-IA]That is, except for one group of presentations…

As always, the gold and silver companies’ presentations were busy… but I could always find a seat.

The same with the presentations from the royalty and base metals companies.

But attendance for one of the resource presentations was overflowing.

And no one was leaving between companies.

I had to watch from the doorway.

That resource was uranium.

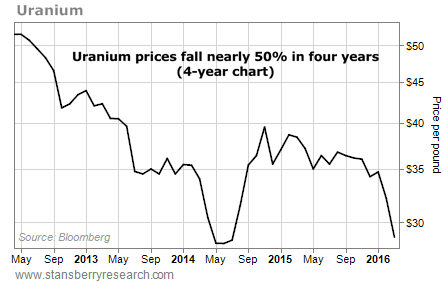

It was a sight to behold, considering how poorly uranium has been doing lately. Take a look at its recent price action…

If you weren’t at the PDAC conference, you would assume that no one cares about uranium today. After all, the sector has yet to recover from the Fukushima nuclear power plant accident that happened five years ago. Back then, an earthquake caused a tsunami, which led to three nuclear meltdowns and the release of radioactive material… the largest nuclear disaster since Chernobyl in 1986.

If you weren’t at the PDAC conference, you would assume that no one cares about uranium today. After all, the sector has yet to recover from the Fukushima nuclear power plant accident that happened five years ago. Back then, an earthquake caused a tsunami, which led to three nuclear meltdowns and the release of radioactive material… the largest nuclear disaster since Chernobyl in 1986.

But even though uranium prices are down, we still use uranium to generate electricity in nuclear reactors. The World Nuclear Association (WNA) estimates we’ll use more than 65,000 metric tons – nearly 170 million pounds – in 2016.

Earlier this month, the WNA reported that China has 30 nuclear plants in operation and 24 others under construction. To put this into perspective, China owns about 7% of the world’s nuclear reactors… but it’s responsible for 37% of the reactors that are currently under construction.

And more are coming. The country currently generates 26.8 gigawatts of nuclear power. The reactors being built will double that output. By 2030, the country plans to generate 150 gigawatts.

To put that into perspective, the entire world currently produces 384 gigawatts. China plans to produce nearly 40% of that amount itself in less than 15 years.

Several other countries are building, too. The U.S., Russia, the United Arab Emirates, India, South Korea, and Japan are all building more than three gigawatts of additional nuclear capacity right now.

So… what should you do as an investor? At the PDAC conference, the presentations with the most attendees were Fission Uranium (FCU.TO) and NexGen Energy (NXE.V). Both companies have huge deposits of more than 100 million pounds in Canada’s Athabasca Basin, which has higher-grade uranium than anywhere else in the world.

These two companies will see their share prices explode higher when uranium prices recover. If you’re looking to add some uranium to your portfolio, these companies are a great place to start.

Good investing,

Brian Weepie

[ad#stansberry-ps]

Source: Growth Stock Wire