Interest in gold is heating up. But nobody is paying attention to its cheaper cousin, silver.

Over the last three months, nearly $6 billion has flowed into the largest gold exchange-traded fund (“ETF”) – the SPDR Gold Shares Fund (GLD). Meanwhile, money has flowed out of the largest silver ETF, the iShares Silver Trust (SLV).

[ad#Google Adsense 336×280-IA]Investors are pushing to buy gold… but they’re still not interested in buying silver.

As I’ll explain in today’s essay, people ignoring silver are making a big mistake…

Since 1990, the average gold-to-silver ratio has been 66.

In other words, over the last 26 years, you could buy an average of 66 ounces of silver with one ounce of gold.

But the ratio has gone haywire lately.

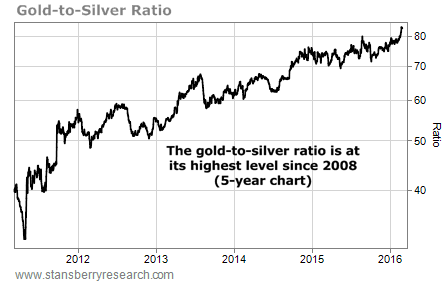

As you can see from the chart below, the gold-to-silver ratio recently hit 80…

Reaching this level is rare… It has only happened four times since 1996. Today, the ratio is above 80 for the first time since October 2008.

Reaching this level is rare… It has only happened four times since 1996. Today, the ratio is above 80 for the first time since October 2008.

In the months and years that followed, the price of silver outperformed the price of gold. Over six months, silver beat gold by nearly six times. Over a three-year period, silver more than doubled gold’s returns…

Prior to October 2008, the ratio hadn’t eclipsed 80 since May 2003. Again, silver topped gold over both the short and long term. Two years later, silver prices had outperformed gold prices by more than four times…

Prior to October 2008, the ratio hadn’t eclipsed 80 since May 2003. Again, silver topped gold over both the short and long term. Two years later, silver prices had outperformed gold prices by more than four times…

Before May 2003, the ratio hadn’t hit 80 since November 1996. Gold prices quickly sunk, but silver prices rose slightly over the months and years that followed…

Before May 2003, the ratio hadn’t hit 80 since November 1996. Gold prices quickly sunk, but silver prices rose slightly over the months and years that followed…

The last three times the gold-to-silver ratio reached today’s levels, silver generated positive returns over the next year or two. It’s realistic to think that will happen again today.

The last three times the gold-to-silver ratio reached today’s levels, silver generated positive returns over the next year or two. It’s realistic to think that will happen again today.

Today, gold and silver trade for around $1,255 and $15.15 an ounce, respectively. If the gold-to-silver ratio simply returns to its average of 66, silver would be worth around $19 an ounce – a 25% gain from here.

If you’re looking to buy precious metals today, history suggests silver is your best bet.

Good investing,

Brian Weepie

[ad#stansberry-ps]

Source: Growth Stock Wire