In the big REIT world, there is a small sub-sector that does well in all economic conditions but does especially well during times when the average Joe is struggling economically. When folks lose their jobs or homes, the self-storage industry is there to provide a low-cost storage solution until these individuals get back on their feet.

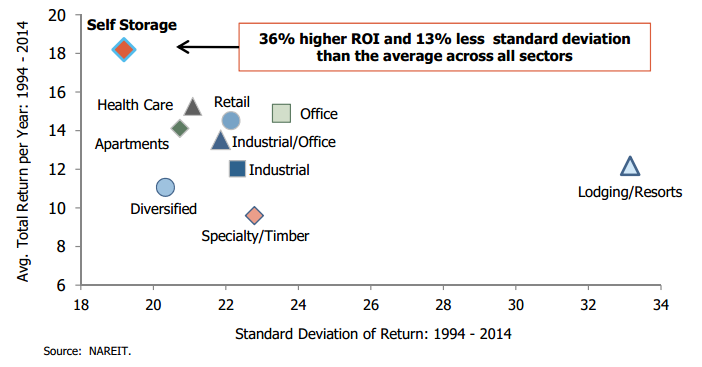

Actually, self-storage has been a top performing commercial real estate sector through the full range of the economic cycle. This chart shows that, over the 20-year period from 1994 to 2014, the REITs in this sector have both out-performed and done so with lower volatility in comparison to the other REIT sectors.

Several factors will allow the self-storage companies to continue to provide excellent total returns for investors. The primary growth driver will be the ongoing opportunities for consolidation.

There are over 50,000 self-storage properties in the U.S. with 30,000 different owners.

[ad#Google Adsense 336×280-IA]The five publicly traded self-storage REITs own just 14% of the total self-storage space.

The public self-storage companies are the name brands that attract storage users.

When one of these companies buys privately owned units, they can quickly improve efficiencies and marketing through their integrated systems.

For the private owner of self-storage properties a deal to sell can be a win-win. The self-storage REITs can afford to pay the owner a premium price.

The purchaser can then take over the properties, install their national marketing and management systems to improve the profitability above the levels possible for a private owner.

Self-storage REIT shares should be viewed as total return investments. Current yields are not high but historic and projected dividend growth rates are. The accelerating dividend will fuel capital gains and add in the dividends earned and you will get market-beating total returns. While the sector has just a few stocks, you can choose from a diverse group that has investment grade, large-cap, and multi-national companies to a recent IPO that is growing rapidly.

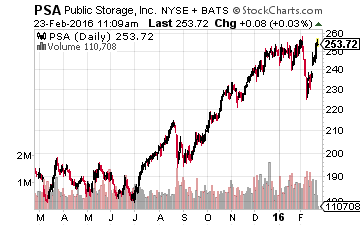

Public Storage (NYSE: PSA) is the premium self-storage REIT.

Public Storage (NYSE: PSA) is the premium self-storage REIT.

The company has been public since 1980 and has a $45 billion market cap.

Public Storage owns 2,200 facilities, located in 38 states and seven European countries.PSA has produced annual dividend growth rates of 9.5%, 9.7% and 8.3% for EXR the last five, ten, and 25 years, respectively.

That is a tremendous level of consistency. PSA shares currently yield 2.7%.

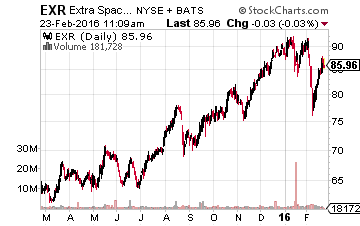

Extra Space Storage, Inc. (NYSE: EXR) is also a large-cap REIT with $10.8 billion of market value. Extra Space Storage went public with an August 2004 IPO.

Extra Space Storage, Inc. (NYSE: EXR) is also a large-cap REIT with $10.8 billion of market value. Extra Space Storage went public with an August 2004 IPO.

The company wholly owns 750 properties, is in a joint venture with 250 more facilities, and provides management services for another 350.

This REIT strives for aggressive growth and has doubled its number of properties in just the last seven years. The EXR dividend has an average annual growth rate of 9.4% for the last 10 years. However, over the last five years, the dividend has been increased at a 41% compound annual rate. The shares yield 2.7%.

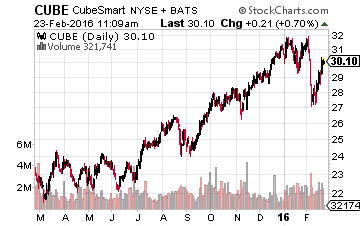

CubeSmart (NYSE: CUBE) is a $5.3 billion CUBEmarket cap REIT that has also been publicly traded since 2004.

CubeSmart (NYSE: CUBE) is a $5.3 billion CUBEmarket cap REIT that has also been publicly traded since 2004.

The company owns 438 facilities and manages another 190. CubeSmart did not start paying a dividend until the 2011 third quarter. Since then the quarterly payout has tripled, from $0.07 per share up to the current $0.21 quarterly dividend rate. CUBE yields 2.8%.

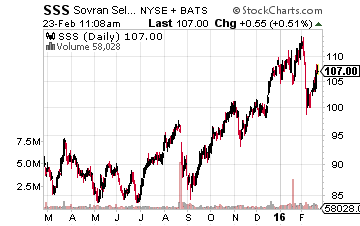

Sovran Self Storage Inc (NYSE: SSS) is a $4.25 billion market cap REIT that has been public since 1995.The company owns and operates over 500 self-storage facilities under the Uncle Bob’s Self Storage brand name.

Sovran Self Storage Inc (NYSE: SSS) is a $4.25 billion market cap REIT that has been public since 1995.The company owns and operates over 500 self-storage facilities under the Uncle Bob’s Self Storage brand name.

The Sovran dividend has grown by 2.8% annually over the last 10 years and been increased by an average 12.2% annual growth rate over the last five years. SSS shares currently yield 3.2%.

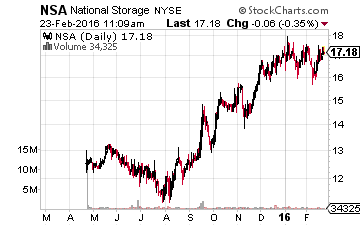

National Storage Affiliates Trust (NYSE: NSA) is the new kid in the sector, coming to market with an April 2015 IPO.

National Storage Affiliates Trust (NYSE: NSA) is the new kid in the sector, coming to market with an April 2015 IPO.

The company owns 277 properties and has a market cap of $790 million. The company was formed by several long-time self-storage executives with a goal of rapid growth by acquiring properties in the top 100 metropolitan areas for growth.

National Storage affiliates did increase its dividend by 5.2% after just its second full quarter as a public company. The NSA shares yield 4.6%.

You can gauge the dividend growth potential of these self-storage REITs by checking the quarter-over-quarter and year-over-year funds from operations (FFO) per share growth rates. The cash flow growth numbers will give you a good guide for future dividend increases.

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

— Tim Plaehn

[ad#ia-tim]

Source: Investors Alley

Position: Long EXR