It was a nice run while it lasted.

From 2010 through late 2014, energy master limited partnerships (MLPs) were the hottest income investment going.

When a barrel of oil was regularly quoted in triple digits, investors could count on MLP distributions that faithfully yielded 8%. What’s more, investors could count on a rising stream of distributions that would frequently lift yields into double digits.oil income investors

[ad#Google Adsense 336×280-IA]But if anything is constant, it’s change.

Today, you’ll find a slew of energy MLPs that yield nothing because distributions have been eliminated.

You’ll also find a slew of energy MLPs that yield 15%, 20%, or more.

The former have unit prices quoted in cents.

The latter suffer from depressed unit prices, which have driven up the yield on the current distribution.

In today’s world of sub-$30 per barrel oil, many energy MLPs find that expenses outrun revenue. The paradigm becomes even more problematic when expenses outrun revenue and you have little in the way of retained earnings.

MLPs pay out nearly all earnings to investors; little is left in the till for a rainy day. This means that MLPs must continually tap credit and equity markets to fund capital expenditures and to grow. That’s a problem when lenders are unwilling to lend and buyers are unwilling to buy feebly priced units.

That said, it’s worth highlighting the fact that not all MLPs are alike. The vast majority are energy partnerships, but there is more than one type of energy partnership. Some MLPs are downstream operators, some are midstream, and some are upstream. The distinction matters, because the pain is unevenly distributed.

The pain is most acute among the upstream MLPs. These MLPs locate, drill, and extract the raw oil and natural gas. These MLPs are most sensitive to spot market prices. The distribution, and therefore the unit price, mirrors oil and natural gas prices.

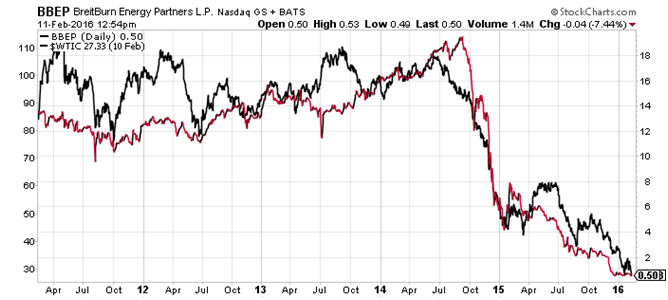

Breitburn Energy Partners (NASDAQ: BBEP) is the poster child of upstream MLP pain. As the price of crude has gone, so too has gone Breitburn’s fortunes: An $18 per unit price has given way to a $0.50 per unit price; a $2 per unit annual distribution has given way to nothing.

Given their precarious financial structure (high debt) and oil-price uncertainty, it’s best to leave the upstream MLPs to more adventurous investors.

Given their precarious financial structure (high debt) and oil-price uncertainty, it’s best to leave the upstream MLPs to more adventurous investors.

This still leaves the midstream and downstream MLPs. The midstream MLPs ship and store oil and natural gas. The large pipeline companies are the obvious midstream MLPs. Here, income opportunity can still be found. In this segment you’ll find a plethora of double-digit yields. Many of these MLPs have seen two-thirds of their unit value lopped off over the past year. Yields of 15% to 20% are the norm.

In this midstream segment, the potential reward can be worth the risk. Pipeline MLPs are a step removed from spot energy prices. Most of what flows through their pipes and into their storage tanks is paid for under negotiated contracts. Cash flow is more predictable compared to the downstream operators. Both Plains All American Pipeline (NYSE: PAA) and Energy Transfer Partners (NYSE: ETP) pay a distribution that yields nearly 20%. Both MLPs have professed support for their current distribution.

If we float downstream, we’ll find MLPs that refine crude and distribute the byproducts to retailers. These refinery MLPs may or may not be impacted by current oil prices. The crack spread – the spread between crude oil and its refined outputs – matters much more to these refinery MLPs than the absolute price of oil. If the crack spread remains sufficiently wide, it’s possible to still make money and support a high-yield distribution with low oil prices. Calumet Specialty Products (NASDAQ: CLMT) is one downstream MLP proving that’s indeed the case.

So, no, I don’t think it’s time for income investors to abandon all MLPs. It is time, though, to be much more discriminatory when picking an MLP.

— Stephen Mauzy

[ad#wyatt-income]

Source: Wyatt Investor Research