A couple of weeks back, I suggested nervous investors consider adding contra-investments to their portfolio. Inverse ETFs were the focus. When the stock market indexes move one way, inverse ETFs move the other, thus reducing portfolio volatility.

The ProShares Short S&P500 ETF (NYSEArca: SH) is negatively correlated with the S&P 500. My contra-investment article was published on Dec. 16. Since then, the S&P 500 has lost 3.8% of its value; ProShares Short S&P500 shares have gained 3.7%.

[ad#Google Adsense 336×280-IA]You could theoretically remove all portfolio volatility with contra-investment ETFs.

If you did, you’d also theoretically remove all possibility of generating a portfolio return.

You want to assume some market risk in order to generate some portfolio return.

Lunches aren’t free.

Gold is another contra-investment.

Gold is imperfectly correlated with stocks.

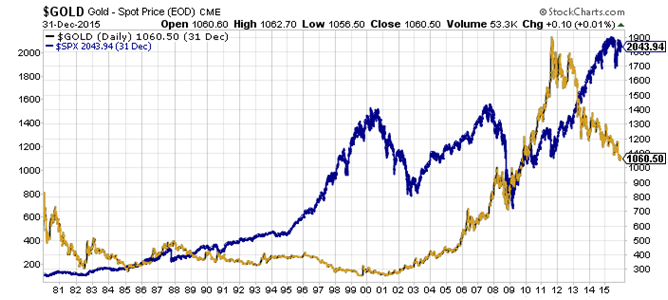

In fact, it’s frequently negatively correlated with stocks (like inverse ETFs) as the chart below revels. Gold removes portfolio volatility, but it also generates a return on its own that complements stock-market returns. Over the past 45 years, gold has produced a 7.7% average annual return.

Of course, an average annual return isn’t the return of any specific year. Gold has been a lousy asset to own over the past three years. No one thumps his chest over a 47% loss at a cocktail party. But since Jan. 1, gold has been a good asset to own. Gold is up nearly 2%.

Of course, an average annual return isn’t the return of any specific year. Gold has been a lousy asset to own over the past three years. No one thumps his chest over a 47% loss at a cocktail party. But since Jan. 1, gold has been a good asset to own. Gold is up nearly 2%.

Gold has the opportunity to be a good asset to own beyond the nascent days of 2016. Gold is seen as a haven. Its value frequently rises during heightened geopolitical and financial uncertainty. We certainly have both these days.

News of North Korea’s resident maniac and tyrant-in-chief Kim Jong-un putatively blowing up hydrogen bombs follows heightened fears that Saudi Arabia and Iran could bomb each other. Concurrently, impending data releases from China are likely to show economic activity continuing to slow. China’s major stock market indexes are down over 10% in the past week. More investors fear that China could drag the world into a recession. The fears are not unfounded.

Meanwhile, China is adding to its gold reserves. In the second half of 2015, China bought more than 100 tonnes of gold. More purchases by the world’s sixth-largest official gold hoarder would at the least provide a price support for gold.

Gold Investments

If you want to accumulate your own gold hoard, you could buy and take physical delivery from a dealer. You could also buy a gold ETF like the SPDR Gold Trust ETF (NYSEArca: GLD).

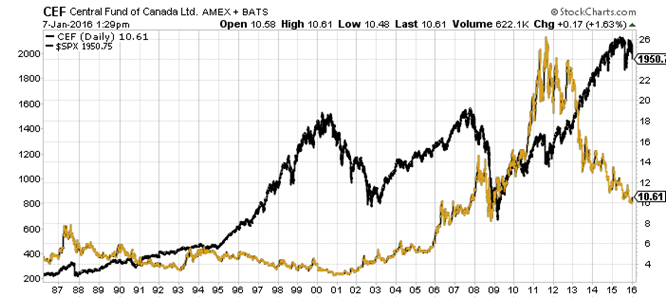

The Central Fund of Canada (NYSE: CEF) is another option, and one I prefer. CEF owns 1.7 million ounces of gold. It also owns 76.9 million ounces of silver. CEF has one mission: To provide a secure, convenient, low-cost, exchange-traded investment for investors interested in holding gold and silver bullion for long-term appreciation.

The market value of CEF’s bullion holdings is split 63.2% for gold and 36.7% for silver. The remainder is cash and other net assets. Yes, CEF is not a pure gold play, but it offers the same contra-investment benefits of gold. Plus, it offers its own return potential.

Ease of entry is another attraction. CEF’s low share price – around $10.50 – enables most investors to get gold exposure, and to get it in round lots (increments of 100 shares). An ounce of gold costs $1,100. The SPDR Gold Trust ETF shares in contrast sell close to $106 each.

Ease of entry is another attraction. CEF’s low share price – around $10.50 – enables most investors to get gold exposure, and to get it in round lots (increments of 100 shares). An ounce of gold costs $1,100. The SPDR Gold Trust ETF shares in contrast sell close to $106 each.

Better yet, CEF shares are on sale. Net asset value (NAV) is $11.51 per share; CEF shares are priced at around $10.50 each. Not only can you buy the benefits of gold, you can buy the benefits on the cheap. CEF shares trade at a 9% discount to the gold and silver bullion it holds. Buying dollar bills for $0.91 each isn’t such a bad strategy either.

— Stephen Mauzy

How to Generate 5%, 10%, 15% and More—Every Month—No Matter What the Market Does! [sponsored ad]

This Wednesday, January 13th, Wyatt Research’s Andy Crowder will reveal his detailed plans for generating steady income in 2016, including: strategies for generating 5% to 13% gains every month… how to make 10.4% in just 7 days… and how to generate 36% a year – from a stock paying just 2%… and much more.

Plus, you’ll receive at least THREE free action- trades you can execute immediately! Click here to RSVP and secure your seat – before this event fills up!

Source: Wyatt Investment Research