When a stock plummets 25% in seven trading sessions, shareholders get nervous. So it’s not surprising that I received several requests to take a look at the dividend safety of propane distributor Ferrellgas Partners (NYSE: FGP).

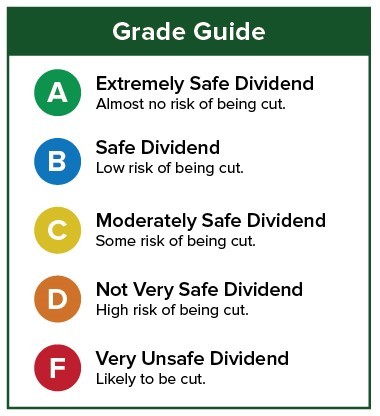

I gave the limited partnership an “A” rating back in March because of the company’s stellar track record of paying a $0.50 quarterly dividend since 1994 – even when the company did not generate enough distributable cash flow (DCF) to cover the dividend.

[ad#Google Adsense 336×280-IA]While that’s not ideal, the company’s devotion to the dividend suggests that management will find a way to pay shareholders no matter what.

The stock had been slipping lately, but it fell off a cliff after reporting disappointing fiscal first quarter (ending in October) results.

Revenue of $471.2 million widely missed the consensus estimate of $552 million.

Nevertheless, sales were still up 6.7% over last year.

Investors weren’t soothed by management reaffirming guidance for 2016.

Over the past 12 months, DCF was $189.4 million, more than the $175.5 million that was distributed to shareholders – a distribution coverage ratio of 1.08. In other words, for every $1 in distributions, the company generated $1.08 in DCF.

The most recent quarter wasn’t quite as comforting. The company generated only $11 million in DCF while paying out $51.4 million in distributions. In other words, it didn’t come close to covering its dividend during the quarter.

The results were hurt by some one-time charges and a higher interest expense, both related to acquisitions.

But in September, the distributor of Blue Rhino propane did something unexpected. After 21 years of paying a $0.50 quarterly dividend, despite the soft commodities market, Ferrellgas raised its dividend to $0.5125 per share.

Going forward, Wall Street expects the company to be able to cover its dividend with no problem.

The two analysts that have submitted estimates expect DCF of $2.41 and $2.64 for fiscal 2016, which ends in July. Even if the company misses the lower estimate by $0.10 or even $0.20, DCF will still be ample enough to cover the $2.05 per share annual dividend.

Ferrellgas’ CEO clearly isn’t worried.

Ferrellgas’ CEO clearly isn’t worried.

On Friday, he purchased 20,000 shares at $15.78 in the open market, spending more than $315,000 of his own money.

The recent stock price plunge means Ferrellgas currently yields 13.6%.

I am a bit concerned about the most recent quarter’s results.

But considering the forecasts for next year and the company’s stellar dividend-paying track record, until I see more evidence that cash flow will not cover the dividend, my “A” rating is intact.

Dividend Safety Rating: A

Hoping your longs go up and your shorts go down,

Marc

[ad#IPM-article]

Source: Wealthy Retirement