I think it might be a side-effect of the intense focus on market sectors, indexes, and the various types of index funds, rather than individual stocks, as the reason why companies that do not fit into a certain box are mispriced by the investing community.

In the high-yield stock world, I love to find and get surprised by companies that are extremely financially solid and are priced to pay very high yields.

In the high-yield stock world, I love to find and get surprised by companies that are extremely financially solid and are priced to pay very high yields.

Ship Finance International (NYSE: SFL) is one of those companies that scares uninformed dividend investors and makes lots of money for those who understand the company.

Ship Finance operates as the financial intermediary for shipping companies that want to add to their fleets. The company becomes the owner of ships, which are then purchased with financing or taken on long-term leases by Ship Finance’s customers.

[ad#Google Adsense 336×280-IA]The fleet includes all of the major types of vessels, including container ships, oil tankers, dry bulk, and offshore drilling rigs.

In most cases, Ship Finance has a signed client lease agreement in place when it acquires a new vessel.

The company is conservatively managed and has paid a dividend every quarter since it went public in 2004.

In response to the 2007-2008 financial crisis which severely affected the shipping sector, Ship Finance reduced its dividend rate by 50% in the fourth quarter of 2008.

Cash flow remained sufficient to support the higher dividend, but the company wanted to conserve cash as the industry and global economy worked itself out of the financial crisis and resulting recession.

Starting in 2010, Ship Finance started to grow the dividend, with 11 increases over the last five years, totaling 50% growth in the quarterly payout to investors over the last half decade.

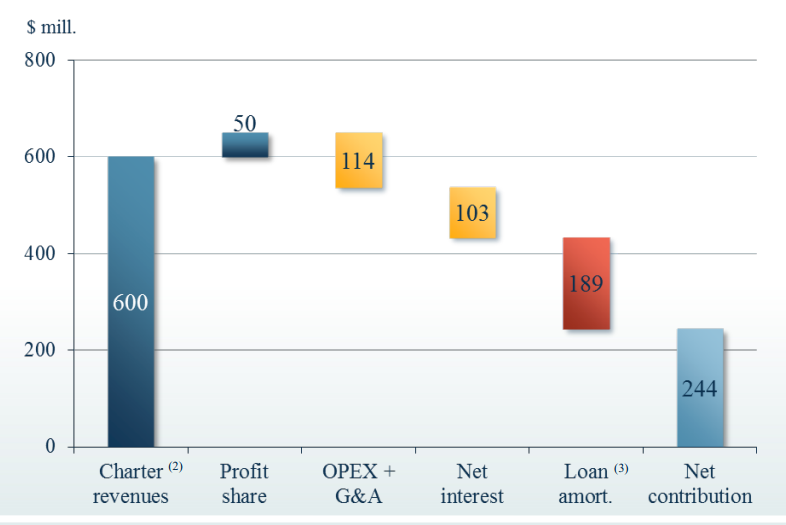

What seems to trouble investors is that it appears that Ship Finance barely generates enough cash to support the dividend rate. Over the last four quarters, reported earnings were $1.84 per share and dividends totaled $1.74 per share. However, in the case of Ship Finance, earnings per share are a poor measure of the cash flow generated by the company. This chart from the third quarter earnings presentation shows more accurately the cash in and cash out of the Ship Finance business:

This chart covers the last twelve months. You can see that out of $650 million in revenue, after expenses Ship Finance produced $244 million of free cash flow (the Net Contribution bar). With 119 million shares outstanding, the dividends paid over the same period were $207 million. Ship Finance had $37 million of excess cash flow above the dividends paid. If we roll back one year in time, the one-year free cash flow through the 2014 third quarter was $186 million.

This chart covers the last twelve months. You can see that out of $650 million in revenue, after expenses Ship Finance produced $244 million of free cash flow (the Net Contribution bar). With 119 million shares outstanding, the dividends paid over the same period were $207 million. Ship Finance had $37 million of excess cash flow above the dividends paid. If we roll back one year in time, the one-year free cash flow through the 2014 third quarter was $186 million.

Bottom line, Ship Finance has grown its cash flow by 31% in the last year and has increased the dividend rate by just 10%. This is a company that can continue to grow its dividend and grow the cash flow coverage of the dividend. However, the market does not see this side of Ship Finance, and the shares are priced to yield 10.5%. This is one of the safest double-digit yields you will find anywhere in the investing universe.

Finding companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and consistent dividend growth in stocks is what has given me the most consistent gains out of any strategy that I have tried.

— Tim Plaehn

[ad#ia-tim]

Source: Investors Alley