Conventional wisdom is that “rising water raises all boats” but that’s not always the case.

In fact, not a single one of the four stocks we’ve targeted as being ripe for a fall has gone along for the ride despite the fact that the S&P 500 tacked on 8.8% last month and the Dow moved higher by 9.15% over the same time frame.

All four of the companies I told you were ripe for failure are down double digits since I brought them to your attention as short candidates: Zoe’s Kitchen Inc. (NYSE:ZOE), Twitter Inc. (NYSE:TWTR), GoPro Inc. (NasdaqGS:GPRO), and Shake Shack Inc. (NYSE:SHAK).

[ad#Google Adsense 336×280-IA]Today I want to briefly check in on each and, of course, tell you how to position your money.

It’s not too late to get on board and you haven’t missed the trade.

These stocks still have plenty of downside ahead.

Here’s what you need to know about how to play the situation .

Total Wealth Stock to Short # 1: Twitter Inc. (NYSE:TWTR)

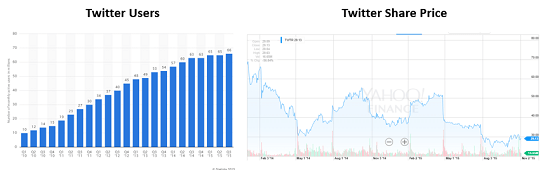

Twitter reported Q3/2015 earnings last Thursday, and they were just bad enough to finally open up analysts’ eyes to the reality we’ve been discussing for months here at Total Wealth.

Everything comes down to two elements – disappointing growth and weak revenue forecasts.

The company still posted an after tax loss of $132 million, its Q4 projections are lackluster at best, and the company added only 4 million users even as U.S. user growth remained almost totally flat in Q3. The cost of “ad-engagement” fell 39% year over year.

The company still posted an after tax loss of $132 million, its Q4 projections are lackluster at best, and the company added only 4 million users even as U.S. user growth remained almost totally flat in Q3. The cost of “ad-engagement” fell 39% year over year.

For once, headlines were almost on point as the stock took a 13% hit in afterhours trading:

…What If the Twitter Growth Everyone Is Hoping for Never Comes? – Fortune

…Twitter Investors have a New Worry About Twitter’s Ad Revenue, and The Stock is Getting Creamed – Business Insider

…Twitter Tumbles After Warning – San Jose Mercury News

At the risk of sounding like a broken record, “hope” is not a viable investment strategy and never has been. Much of Twitter’s appeal – I would say all – was based on nothing more than hope the stock would march to social media dominance and, hopefully, figure out a way to monetize 300 million users along the way. That simply isn’t happening.

No matter which way you cut it, Twitter is still fundamentally flawed because it can be replaced at the click of a mouse. More than a billion people have tried the company and left.

All the “hope” in the world won’t help Twitter if it cannot transformer the users it does manage to keep into a viable revenue stream – an existential threat to the company I called attention to back in January that’s still valid today.

I didn’t hear anything from Twitter’s C-suite during the last call that makes me think the company will succeed. Heck, there wasn’t even anything to get excited about, at least not to me anyway.

If you acted on my January 23 recommendation, congratulations on the double-digit profits you’ve had the chance to capture. If you’re just joining us, it’s not too late to get in on the trade.

I think Twitter’s on borrowed time.

Total Wealth Stock to Short #2: Shake Shack Inc. (NYSE:SHAK)

Shake Shack Inc. (NYSE:SHAK) reports earnings on November 5 and the markets have high positive expectations given that the fledgling burger joint has posted positive earnings surprises every quarter since it IPO’d on January 30, 2015. I think the company will “beat” again.

Yet, I still think the company is overdone.

The deal breaker for Shake Shack – at least in my book anyway – is that it’s always carried an insanely high and unjustifiable valuation.

When I first pointed this out to you on May 22, Shake Shack was about to close at $92.86/share for the day, giving it a capitalization of nearly $3.25 billion. To put this in perspective, that made the company worth roughly 4% of McDonald’s despite having 0.17% of McDonald’s presence in the U.S. alone!

Worse, the price to earnings ratio was approximately 1200x earnings, compared the S&P 500 average of 15.54 at the time, meaning that Shake Shack was approximately 77 times more expensive than the typical S&P 500 stock.

And now? Shake Shack has taken a tumble as I warned it would, and closed yesterday’s trading session at $48.63/share near a post IPO low. Even so, it’s still trading at a premium valuation. There’s no way the company can grow into these numbers over the short term.

As much as I love the food, I think Shake Shack stock still has more room to the downside.

Evidently, company insiders agree with this assessment. Several key insiders have sold millions of dollars in stock and appear to be making ready to sell more. Two spurts of insider selling have pushed the stock down since its last earnings report in August, pummeling shares by 16% in a single day last summer when the company issued a secondary offering that would allow insiders to unload 4 million shares. Last month a similar filing allowed insiders the chance to get out, this time giving them the opportunity to ditch 26 million shares.

It’s one of the clearest signs yet that company confidantes don’t believe the hype and that you shouldn’t either. Again, even if the numbers are good and even if there’s a short term pop in share prices.

Congratulations are in order if you’re following along and enjoying the 47% return since I suggested you “short the Shack” last May. By comparison, the S&P 500 is off 5%.

Total Wealth Stock to Short #3: GoPro Inc. (NasdaqGS:GPRO)

When I labeled the stock as another Wall Street darling to short, GoPro was about to close at $31.22/share, and it closed yesterday at $25.00/share, meaning readers who followed along are now sitting on a 19.92% gain. That’s an annualized return of more than 199.2%.

If you’re tempted to make a contrarian buy, I’d think twice. GoPro remains a one trick pony.

Worse, news broke Tuesday that it’s being sued by Polaroid’s maker for possible patent infringements related to its cubicle cameras.

And that’s on top of intensifying competition from Xiaomi, Apple, and plenty of smaller and nimbler companies that are creating innovative image-enhancing technologies that steadily undermine what GoPro has on offer.

At this point, I’m more convinced than I was in September that GoPro’s real future is as an acquisition target – and that’s why I recommend you have a lowball order of $20/share in place to capitalize of the opportunity when it arrives. If you haven’t shorted the company already, it’s not too late to do so if you plan to “cover” – meaning buy your shares back and exit the trade at that price point.

Total Wealth Stock to Short #4: Zoe’s Kitchen Inc. (NYSE:ZOES)

Zoe’s Pizza Kitchen Inc. (NYSE:ZOES), the hip Mediterranean dining restaurant that’s been heralded as “the next Chipotle” had a lofty price-to-earnings (PE) ratio of 1,192 when I brought it to your attention on July 29. It’s since fallen out of orbit and your return is a healthy 16.81% in barely three months if you’re following along as directed.

In early September, the company reported net income that represented a staggering 89% drop-off from Q2/2014 levels, according to the company’s latest earnings report.

The return on equity, a key profitability metric that tells you how efficiently a company can generate profits from shareholder investments, fell to only 0.39% while the return on assets tumbled to 0.25%.

Revenue, though, told a better story, rising 30% year-over-year. However, the chain’s expansion continues to be anemic, opening just seven new company-owned restaurants in the quarter, in contrast to Chipotle’s 53 newly opened restaurants in Q3/2015.

It’s been very clear to me for some time now that Zoe’s will never live up to the Chipotle comparisons which, interestingly, CEO Kevin Miles all but admitted in the latest earnings conference. “We remain confident that we can successfully operate over 1,600 restaurants in the U.S. over the long term,” he told investors, “bringing the Mediterranean lifestyle and Southern hospitality to guests across the country.”

Chipotle isn’t content to rest on its laurels with 1,800 restaurants, much less the 1,600 Miles envisions. And whether or not ZOES hits the target on November 19 when it posts Q3 results is immaterial. Traders will inevitably bring Zoe’s stock price in line with a more reasonable valuation that reflects its business aspirations rather than those of Chipotle.

In closing, never forget that stock prices ultimately follow earnings over time.

That’s why it makes sense to focus your efforts on companies with the most robust earnings and ignore (or short) those that are struggling like the companies I’ve profiled again today.

Until next time,

Keith

[ad#mmpress]

Source: Total Wealth