I don’t smoke, nor do I intend to.

I get peevish when a thoughtless smoker lights up and his externality engulfs my head. You can even say that I hold a degree of enmity toward cigarette smokers (just the thoughtless ones).

On the other hand, I have an affinity for cigarette manufacturers.

An investment in one of the large manufacturers is the closest thing to a sure bet.

[ad#Google Adsense 336×280-IA]A dollar invested in a large cigarette company is a dollar well invested.

Reynolds American (NYSE: RAI), maker of Camel and Doral; British American Tobacco (NYSE: BTI), known for the Lucky Strike and Pall Mall brands; and Philip Morris International (NYSE: PM), the non-U.S. producer of Marlboro, are all deserving of investor dollars.

All three generate high returns on invested capital and all three are reliable sources of investment income.

But if my choice were limited to one tobacco company, Altria Group (NYSE: MO) would be the one. From 1957 (the first year for the S&P 500) through 2003, Altria was the top performer of all the S&P component stocks. Over that time, it generated a 19.75% average annual return, according to data compiled by Wharton School professor Jeremy Siegel.

Reinvested dividends are part of the total-return equation. Those dividends have increased annually for 46 consecutive years.

Times change, and Altria circa 1957 isn’t the Altria of today. In 2008, Altria split itself when it spun off its international operations, Philip Morris International, to shareholders. Altria spun off PMI to place its foreign operations outside the reach of U.S. regulators.

Investors had reservations. The perception was that PMI would be the growth (and, therefore, the high return) investment. PMI was the seed; Altria was the husk that would whither in the shrinking U.S. cigarette market. The days of 20% average annual returns appeared to be over for Altria.

Except they weren’t. Perception and reality failed to coalesce. In 2008, an Altria investment would have been the more profitable investment of the two. The record remained intact.

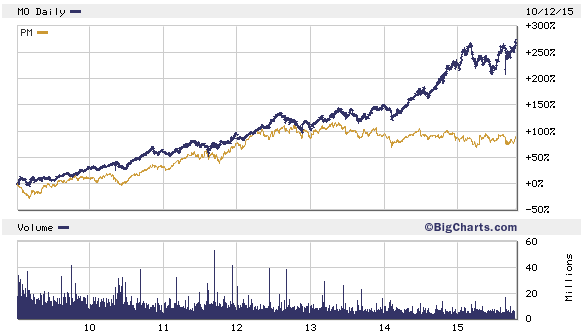

Altria Group and Philip Morris International Share Price Appreciation

No one should be surprised. Altria’s established ethos is to generate return on investment. Prior to the PMI spinoff, Altria had already begun jettisoning non-core, low-return tobacco investments. Kraft Foods was distributed to Altria shareholders in 2007.

Around the same time, Altria began pursuing high-return tobacco investments. In 2009, Altria bought UST Inc. for $10.4 billion. The UST acquisition brought the two leading smokeless tobacco brands – Skoal and Copenhagen – into the fold. The smokeless segment is the growth segment in tobacco.

Altria continued to generate earnings, dividend, and even revenue growth. Investors were still seeing 20% average annual returns on their investment.

Not all major non-tobacco investments were jettisoned, though. Altria retained its 27% ownership stake in beer giant SABMiller (OTC: SBMRY), which is up 270% since 2008. This week, SABMiller agreed to be acquired by rival Anheuser-Busch InBev (NYSE: BUD) for $106 billion.

The SABMiller-InBev deal required Altria’s approval. SABMiller had rejected four previous offers from InBev before Altria finally gave a nod. Altria is expected to receive $59 per share – in cash and restricted stock – for its 27% stake. Altria investors should expect to see a ramp up in share buybacks and dividend payouts.

Four years ago, I recommended Altria to High Yield Wealth readers. Since then, Altria shares have generated a 135% total return. Believing lightning could strike twice, I recommended Altria shares to Personal Wealth Advisor readers 16 months ago. Since then, Altria shares have generated a 44% total return.

Do I expect lightning to strike a third time? Yes, and a fourth, a fifth, a sixth, and a ….

— Steve Mauzy

[ad#wyatt-income]

Source: Wyatt Investment Research