There is no doubt that the coal industry has not been kind to dividend investors. Producers are dealing with decreased demand, environmental regulations and lower-priced coal alternatives. It’s been a perfect storm.

The price of coal, like most commodities, has been in a free fall. And so have these companies’ dividends.

[ad#Google Adsense 336×280-IA]In January, coal producer Walter Energy Inc. (NYSE: WLT) suspended its quarterly dividend.

That same month, Peabody Energy Corporation (NYSE: BTU) cut its dividend from $0.085 to a quarter of a penny after it posted its fifth straight quarterly loss.

In February, Arch Coal Inc. (NYSE: ACI) eliminated the $0.01 dividend it had been paying since 1997 as well.

Should we expect the same from Alliance Resource Partners?

If not, what’s different?

There’s No Business Like the Coal Business

Not all coal producers are created equal. While the coal sector has faced some serious pricing pressures, Alliance Resource Partners (Nasdaq: ARLP) has managed to produce remarkable growth in revenue and cash flow. Unlike its competitors, the MLP’s income-focused investors have been rewarded handsomely.

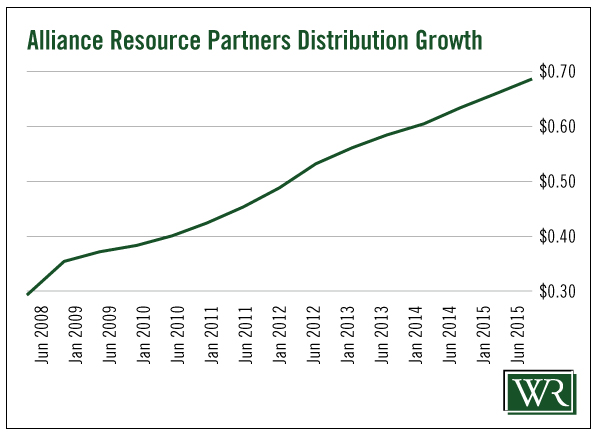

Like I said before, Alliance Resource Partners is an MLP. MLPs pay distributions, not dividends. This means the MLP must return the lion’s share of its cash flow to investors. Impressively, it has increased its distributions for the last 29 quarters.

Nevertheless, the stock is down over 40% this year.

It seems like Mr. Market is pricing in a distribution reduction. In order to assess whether or not this trend will continue or, at the very least, not reverse, we have to look at the MLP’s distributable cash flow (DCF). DCF is the metric we use to determine if an MLP has enough cash to pay out the distribution.

For more information on MLPs and how they work, you can read Marc’s article here.

“Coal” Hard Cash

Coal prices are down, but Alliance Resource Partners’ DCF is up. That’s because, unlike its competitors, Alliance Resource Partners “locks in” the prices its customers pay for coal under long-term contracts well in advance. And the company has most of its coal volumes for this year and next locked in.

So, even if coal prices continue to erode, Alliance Resource Partners will not be forced to produce coal at a loss. This is how the company has been able to maintain profitability despite lackluster coal prices. And, more importantly, grow its DCF.

In 2014, Alliance Resource Partners generated DCF of $547.2 million, up 20.8% from $452.8 million in 2013. The MLP distributed $317 million to unit holders, giving the company a payout ratio of 57.9%. That’s well below Marc’s 75% comfort threshold and gives Alliance Resource Partners plenty of room to grow the distribution even if DCF growth stalls.

It looks like 2015 is shaping up nicely as well. In the first quarter, the company reported DCF of $135.9 million, up 6.4% from the first quarter of last year. Alliance Resource Partners paid out $84.4 million to its unit holders. With a payout ratio of 62%, the distribution is in good shape.

The company has taken measures, including reducing coal production and capital expenditures, to ensure DCF growth continues.

While revenue may be down, Wall Street expects Alliance Resource Partners’ full-year 2015 DCF to be flat to slightly up from last year.

While revenue may be down, Wall Street expects Alliance Resource Partners’ full-year 2015 DCF to be flat to slightly up from last year.

This leaves plenty of room for the company’s current distribution to continue.

A Diamond in the Rough

Emerging Trends Strategist Matthew Carr wrote in March 2014, “Alliance Resource Partners offers a tremendous opportunity for income investors.”

It looks like he is still right.

Even with continued depressed coal prices in the back half of 2015, this 10.5% yield is safe for now. It may even still have room to grow.

Dividend Safety Rating: A

Good investing,

Kristin

[ad#IPM-article]

Source: Wealthy Retirement