The market continues to grind higher within a narrow trading range over the past three months despite punk first quarter GDP numbers, rising interest rates, and little earnings growth in the first half of the year.

One of the forces driving this slow upward march is the huge amount of deal-making that has occurred so far this year as companies struggle to generate organic growth and have the balance sheets to lock in low interest rates for their purchases.

Mergers and acquisitions are close to pre-financial crisis levels for the first time in 2015, as vast sums of cheap credit, tax policy, and a slow global recovery is sending companies searching for deals again.

[ad#Google Adsense 336×280-IA]Although worrying as these levels of activity are always found closer to tops of markets than bottoms they will continue to be a positive tailwind for the market as long as these deals continue to be done.

Plus, if a stock in your portfolio gets bought out, it is usually for a nice premium over the current share price. Something that nobody has ever complained about.

It seems every week there are several new acquisitions announced. Activity is especially booming in the biopharma and tech sectors.

Avago Technologies (NASDAQ: AVGO) $37 billion merger with Broadcom (NASDAQ: BRCM) announced last month will be the largest chip sector deal in history when complete. Corporations are holding lots of cash, and in this low earnings growth market it makes sense for corporations to turn to M&A. It is a clever way for them to boost earnings.

My own portfolio has benefited from this activity as three companies I owned have been taken out at large premiums over the past year. These include Avanir Phamaceuticals (NASDAQ: AVNR) which provided a 215% return in five months within the Small Cap Gems portfolio. So which companies will be purchased next? Here a couple of names that to me make logical acquisition targets.

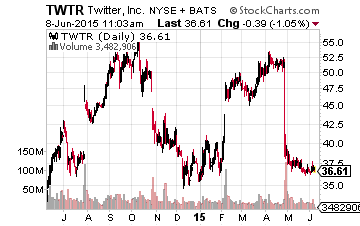

Let’s start with Twitter (NASDAQ: TWTR) whose stock price has been under pressure of late but seems to have support around the $35 level.

Let’s start with Twitter (NASDAQ: TWTR) whose stock price has been under pressure of late but seems to have support around the $35 level.

The service has become ubiquitous across the developed world and is being used in a variety of different ways including as a de facto news feeds for tens of millions of users.

Unfortunately the company’s huge growth in users and traffic has not translated into the earnings trajectory investors had been hoping for to this point and the stock has paid the price for their disappointment recently. Some activists are calling for a change of leadership at Twitter as a result.

Given the turmoil at the company the environment seems ripe for Google (NASDAQ: GOOGL) to come a calling. Search, especially mobile traffic, seems to be in early stages of migrating away from the search giant. Major online presences like Facebook (NASDAQ: FB) and Amazon (NASDAQ: AMZN) have their own growing internal search engines which more and more individuals are using, and the same can be said about Twitter.

Obviously Facebook and Amazon are way too big for Google to gobble up but Twitter could be had for $30 billion to $35 billion even with a significant premium. Twitter would also be a better strategic fit and Google could purchase it just with its cash holdings. The combination seems so logical that I would actually be surprised if Google does not make a run for Twitter in the foreseeable future.

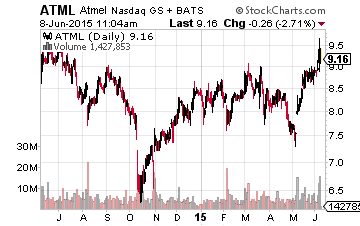

Staying in tech but looking at smaller possible acquisitions, chip maker Atmel (NASDAQ: ATML) with a market capitalization of just $4 billion makes an interesting possibility.

Staying in tech but looking at smaller possible acquisitions, chip maker Atmel (NASDAQ: ATML) with a market capitalization of just $4 billion makes an interesting possibility.

The company has a desirable product portfolio with two different architectures.

Atmel also has one of the oldest and most efficient fabrication plants in the world, which would offer a potential acquirer significant economies of scale leading to gross margin accretion for firms with modern manufacturing capacity.

As a standalone play, the stock offers good value here as well in an overbought market. Earnings are increasing at around a 20% pace and the stock has a five year projected PEG of just 1. Add in $200 million in net cash on the balance sheet and an almost two percent yield and valuation looks solid with a possible acquisition kicker thrown in.

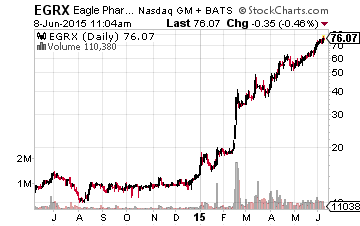

Last up is a small biopharma named Eagle Pharmaceuticals (NASDAQ: EGRX) which is up more than 400% since being identified in Small Cap Gems in mid-December.

Last up is a small biopharma named Eagle Pharmaceuticals (NASDAQ: EGRX) which is up more than 400% since being identified in Small Cap Gems in mid-December.

The stock has been on a rocket ride since it signed a transformation global licensing and collaboration deal with generic drug giant Teva Pharmaceuticals (NASDAQ: TEVA) for Eagle’s bendamustine hydrochloride rapid infusion product for the treatment of chronic lymphocytic leukemia and indolent B-cell non-Hodgkin lymphoma.

Eagle then was granted approval by the FDA for this product two months later.

Eagle received an upfront cash payment of $30 million and should also receive up to $90 million in additional milestone payments now that the drug is approved. In addition, Eagle will receive double-digit royalties on net sales of the product which is an improved version of Treanda which has annual sales of nearly $800 million.

Teva acquired Treanda when it purchased the drug maker Cephalon. The company has also made a bid for Mylan (NASDAQ: MYL), the third largest generic drug maker. Given Eagle’s profits are expected to increase seven-fold to over $5.50 a share in FY2016 as the result of these recent developments and Teva’s acquisitive nature don’t be surprised if Teva bids for Eagle given its paltry market capitalization of just $1.2 billion, especially on the back of its recently announced licensing deal.

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley

Positions: Long EGRX