Sentiment on equities has taken a definite turn to the cautious side over the past couple of weeks.

First quarter GDP growth estimates continue to come down and now stand just over a very tepid one percent on an annual basis.

[ad#Google Adsense 336×280-IA]JP Morgan has the economy only growing 0.6% in the opening quarter of the year.

Investors have also been treated to a poor recent durable goods report and other disappointing economic readings leading up to a dismal jobs report that came out on Good Friday which showed the weakest job growth in 15 months.

As bad as this news is, I am still finding solid earnings growth and reasonable valuations in the large cap space which will help protect your portfolio from the impacts of the news I just mentioned.

Some of the recent economic weakness is justifiably attributed to a cold winter that descended upon the country especially in the northeast where Boston had record snowfall for the season. However, optimistic projections of 3.5% or better GDP growth that were prevalent at the start of 2015 seem increasingly to contain more than a little bit of “hopium” at the moment.

The market is much more vulnerable to a pullback than it has been in quite a while. Equities came into the New Year trading at 18 times trailing earnings, a premium to historical valuations. In an era of ultra-low interest rates, some premium would be warranted provided investors could expect solid earnings growth in 2015 and the lack of attractive alternative investments right now.

Unfortunately, earnings are not growing. Both the first and second quarters are projected to see year-over-year profit declines among companies in the S&P 500. A strengthening dollar, falling profits across the energy sector, and teetering global demand are the main culprits behind these dismal first half earnings forecasts. Earnings growth should return in the second half of a year to some extent, but will investors hold the market at these levels in the meantime?

I would not be surprised to see at least a five percent decline in equities before the close of the first half of the year, and a larger pull back cannot be ruled out. I have a larger than normal 20% allocation to cash within my portfolio in anticipation of lower entry points in the months ahead. I plan to tilt using that “dry powder” on any decline to large cap Blue Chip Gems in the defensive healthcare sector. The sector is still seeing solid earnings growth, is minimally impacted by the strong dollar and many firms are still sporting reasonable valuations even while easily outperforming the overall market over the past few years.

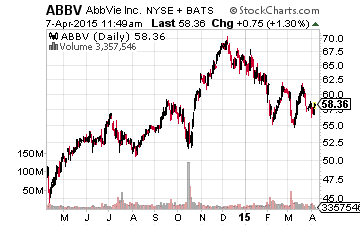

AbbVie (NYSE: ABBV) is a good starting point and is offering an attractive entry point as it has pulled back recently on the news of a $20 billion dollar acquisition to pick up biotech Pharmacyclics (NASDAQ: PCYC).

AbbVie (NYSE: ABBV) is a good starting point and is offering an attractive entry point as it has pulled back recently on the news of a $20 billion dollar acquisition to pick up biotech Pharmacyclics (NASDAQ: PCYC).

One of the first things that stands out about this large biopharma company is its high dividend yield of 3.6%.

The company is also showing good earnings growth. Profits per share look set to improve some 30% this year and 10% to 15% in FY2016. The stock goes for 11.5 times next year’s consensus earnings. This is a big discount to the overall market especially considering the large dividend yield.

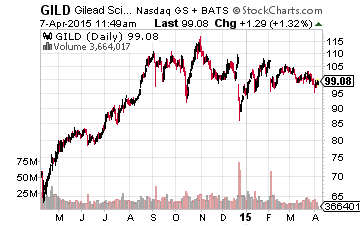

Next up is Gilead Sciences (NASDAQ: GILD), a biotech juggernaut that belongs in every large cap growth portfolio, even though the stock has been stuck in a narrow trading range over the past nine months.

Next up is Gilead Sciences (NASDAQ: GILD), a biotech juggernaut that belongs in every large cap growth portfolio, even though the stock has been stuck in a narrow trading range over the past nine months.

Thanks to its stranglehold on the HIV and Hepatitis C spaces, the company is a cash flow machine.

Gilead should throw off some $15 billion in free cash flow this year giving it a cash flow yield of approximately 10%.

A good portion of that free cash flow will go to reward investors in the years ahead. The company will start paying a dividend for the first time in 2015 and plans to buy back some $15 billion in stock over the next several years. The company should be able to grow earnings 10% to 15% annually over the next few years and goes for under 11 times forward earnings.

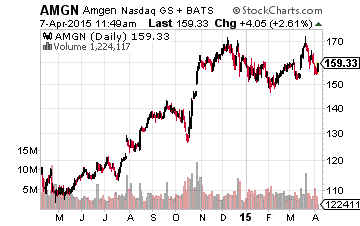

Amgen (NASDAQ: AMGN), one of the first large biotech companies; also merits consideration.

Amgen (NASDAQ: AMGN), one of the first large biotech companies; also merits consideration.

The company could continue to churn out 10% or better earnings growth on the back of four to six percent revenue growth for the foreseeable future.

The stock yields two percent and has more than doubled its dividend payouts over the past three years.

The shares go for under 15 times next year’s consensus earnings.

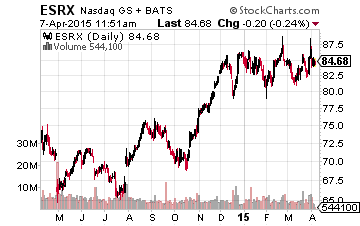

Outside the biotech and biopharma spaces, one has to like giant pharmacy benefit manager Express Scripts (NASDAQ: ESRX).

Outside the biotech and biopharma spaces, one has to like giant pharmacy benefit manager Express Scripts (NASDAQ: ESRX).

It is the only one of today’s selections that does not currently pay a dividend.

However, it dominates its space and constantly churns out earnings growth in the low teens.

The company is well-positioned to continue to benefit from the aging of the domestic population as well as the increasing amount of overall health care spending going to drugs as well as the increasing need to control healthcare costs. The shares go for a very reasonable 14 times next year’s earnings consensus.

None of these picks are going to provide the huge returns that other small biotechs and biopharmas like Eagle Pharmaceuticals (NASDAQ: EGRX) and ZIOPHARMA Oncology (NASDAQ: ZIOP), which were both profiled in previous articles on the Investors Alley website. However, in a market that seems increasingly vulnerable to a significant pullback they are good pickups in any decline in the overall market.

A new landscape is unfolding in the market while I write this very sentence. The dollar is at record levels, volatility is a weekly battle, earnings growth has come to a screeching halt, and the Fed cannot make up their mind. Change is coming, but is your portfolio ready?

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley

Positions: Long ABBV, AMGN, EGRX, ESRX, GILD