Any of my readers on SeekingAlpha, Real Money Pro or right here on Investors Alley that have followed any of my columns on speculative biotech plays for any length of time know my philosophy of taking a shotgun approach to this sector.

Stocks in this industry are highly volatile and can significantly move either way on any news such as results of test trials, buyout rumors or basically any news big or small.

[ad#Google Adsense 336×280-IA]As the result of this large amount of volatility in this space, I generally take positions one-third of the size I do in other sectors and I spread my bets over many more stocks within the sector.

I dubbed this strategy “Shotgun Investing”.

Any investor in this space is going to have some failures as drug development is a very complicated process.

However, by spreading one’s bets into myriad promising plays the occasional five or ten bagger should deliver significant returns to your portfolio over time.

Below are two selections within the small biotech sector that fit with this philosophy well. They both have promising drugs in the pipeline, strong analyst support and have plenty of upside potential should their compounds navigate the approval process successfully. Each sells for less than $10.00 a share.

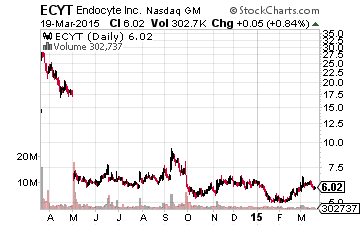

Let’s start with a recent purchase of mine, Endocyte (NASDAQ: ECYT), which I purchased this past week at $6.00 a share.

Let’s start with a recent purchase of mine, Endocyte (NASDAQ: ECYT), which I purchased this past week at $6.00 a share.

This small biotech concern is currently developing therapies that target both cancer and inflammatory diseases.

Endocyte’s technology uses small molecule drug conjugates (SMDCs) in combination with imaging diagnostics.

Endocyte currently has several SMDCs in clinical trials at various stages. SMDCs have three components. First there is a targeting ligand which is a small molecule that has a high affinity for binding to a receptor on the target, most often a cell. The linker is a system that is stable in the bloodstream which binds the targeting ligand to an additional agent. Finally, the drug payload is the biologically-active component of the combination.

As can be seen from the graphic below, the company has many compounds or “shots on goal” in the pipeline in various stages of trials.

There are several reasons to consider Endocyte for a speculative bet with plenty of upside if any of their drugs in the pipeline navigate the approval process successfully. For starters, at current levels you are basically buying the company for little more than the cash on its balance sheet.

There are several reasons to consider Endocyte for a speculative bet with plenty of upside if any of their drugs in the pipeline navigate the approval process successfully. For starters, at current levels you are basically buying the company for little more than the cash on its balance sheet.

Wedbush noted earlier this month that Endocyte ended its last quarter with $207 million in cash and cash equivalents on its balance sheet. The stock’s market capitalization currently is approximately $250 million. In addition, even with ongoing trials, company management provided guidance that it should end 2015 with still over $150 million in cash on its books.

Finally, even though the company is sparsely followed by analysts given its small market capitalization those analysts that do follow the company are very bullish on its prospects. Over the last month, Wedbush reiterated its “Buy” rating on ECYT and its $12.00 a share price target on this small biotech stock. Cantor Fitzgerald is even more bullish with a $21.00 a share price target it tagged Endocyte with when it reiterated its “Buy” rating on March 2nd.

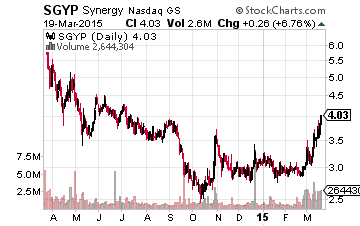

I last touched on Synergy Pharmaceuticals (NASDAQ: SGYP) late in 2014 here on Investors Alley.

I last touched on Synergy Pharmaceuticals (NASDAQ: SGYP) late in 2014 here on Investors Alley.

This small biotech firm with a market capitalization of less than $375 million is up some 25% since that article but the shares have been gaining strength recently and the company has some solid prospects.

The company has two key products in development. First is a compound called SP-33 which is currently targeted to treat opioid-induced constipation and possibly ulcerative colitis. SP-33 successfully completed a Phase II trial targeted at the first condition late in 2014 and started a small Phase I B trial for treatment of ulcerative colitis around the same time.

The product with more potential at this time is a compound called Plecantide. When we last discussed Synergy on these pages, this drug had just completed an over 400 patient Phase II trial assessing the safety and efficacy of the compound to treat irritable bowel syndrome with constipation.

The study successfully achieved its endpoint and showed statistically significant improvement in the overall responder rate. Since then the company has completed enrollment in two pivotal Phase III studies assessing two doses (3 mg and 6 mg) of Plecantide for patients with chronic idiopathic constipation.

Plecantide has solid potential in a growing market. Plecanatide is targeted to function like Linaclotide from Ironwood Pharmaceuticals (NASDAQ: IRWD) with less incidence of diarrhea. Revenues from Linaclotide, which is marketed as LINZESS©, reached almost $80 million on quarterly basis late in 2014 and sales are increasing at better than a 25% clip.

The company has a strong balance sheet after recently raising $200 million in a convertible debt issue that should fund operations well through 2017. Cantor Fitzgerald reiterated its “Buy” rating and $8.50 a share price target on Synergy on March 18th. Only five analysts cover the stock and they have price targets ranging from $5.75 a share all the way up to $10.00 a share. All price targets are significantly above the current prices of SGYP of approximately $3.75 a share.

Both stocks are speculative but I like the prospects for their emerging pipelines as do other analysts. Each equity makes a worthy addition within my Shotgun Investing portfolio.

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley