Part of the strength of this space is due to increasing merger and acquisition activity in the sector culminating in last week’s over $20 billion acquisition of Pharmacyclics (NASDAQ: PCYC) by AbbVie (NYSE: ABBV).

Less than two years ago, Pharmacyclics sported a market capitalization of less than $5 billion, thus highlighting the returns an investor can achieve with purchasing the right biotech stock at the right time.

[ad#Google Adsense 336×280-IA]You can also see the benefits of solid stock picking and good timing in some of the small biotech selections I have profiled here on Investors Alley in recent months.

ZIOPHARMA Oncology (NASDAQ: ZIOP) has moved from just over $4.00 a share to almost $14.00 a share since I profiled these speculative shares in December.

Curis Inc. (NASDAQ: CRIS) has been another big winner nearly tripling since being profiled in late December.

Probably the best piece of timing I have had in my own portfolio is with Cytori Therapeutics (NASDAQ: CYTX) which has doubled in just two weeks since being put in the Turnaround Stock Report.

Here are a couple of more attractive but speculative names I hold in my portfolio. All have been moving up nicely as of late but have further upside if things fall right for these companies.

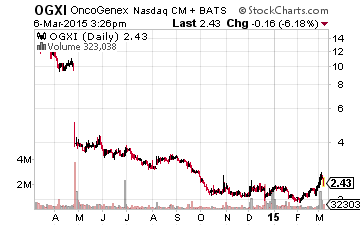

Let’s start with OncoGenex Pharmaceuticals (NASDAQ: OGXI) whose stock had an abysmal year in 2014 falling from $14.00 a share at its highs before bottoming around $2.00 a share towards the end of the year.

Let’s start with OncoGenex Pharmaceuticals (NASDAQ: OGXI) whose stock had an abysmal year in 2014 falling from $14.00 a share at its highs before bottoming around $2.00 a share towards the end of the year.

The catalyst for the huge sell-off was a failed Phase III trial to test whether its compound “custirsen” added to the standard treatment of docetaxel/prednisone for men with metastatic castrate-resistant prostate cancer would improve overall survival. The company then raised $24 million to fund other trials, which diluted current shareholders significantly.

The stock has been behaving better recently and has moved up to roughly $2.60 a share. OncoGenex has another Phase III trial late-stage trial evaluating custirsen combined with a different compound for use against prostate cancer as well as a trial going focused on treating non-small cell lung cancer.

The company is also running a half dozen phase II trials to investigate whether its other compound “apatorsen” can treat various forms of cancer combined with different compounds. Apatorsen targets a heat shock protein whose presence promotes aggressive tumor growth and treatment resistance. I like the fact the company has several “shots on goal” as well as the fact that cash on hand roughly equals its $55 million market capitalization.

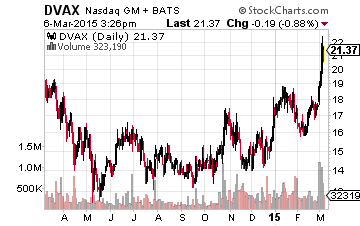

Let’s revisit another Turnaround Stock Report selection, a small vaccine player called DynaVax Technologies (NASDAQ: DVAX).

Let’s revisit another Turnaround Stock Report selection, a small vaccine player called DynaVax Technologies (NASDAQ: DVAX).

The shares are up more than 20% since I last highlighted this promising biotech company in late January. There are good reasons for its strong performance of late.

The company has an over 8,000 person Phase III trial currently going on to test the effectiveness of its hepatitis B vaccine. Hepatitis B is the most common liver disease in the world but much less lethal than hepatitis C.

The trial recently got a thumbs up from the independent Data and Safety Monitoring Board which just recommended that the study continue unchanged. This is the second of three evaluations that will take place in this trial and a routine but still important milestone.

The company has a couple of other compounds outside its hepatitis B efforts in pre-clinical development or Phase I trials. The most promising is a drug targeting asthma being developed with pharma giant AstraZeneca (NYSE:AZN) as a partner.

Dynavax can earn up to $100 million in milestone payments, as well as royalties should the drug be successfully developed. Finally, the company has over $120 million in cash on the balance sheet which represents some 25% of its market capitalization and will allow it to fund its developmental efforts. I believe the company’s hepatitis B vaccine will show good results later in the year, the company has a few “shots on goal” and a strong balance sheet; a very solid combination.

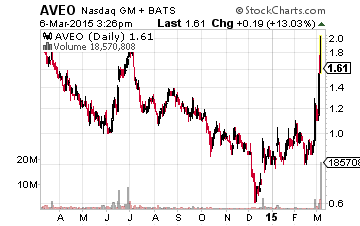

Finally, I want to do a quick update on AVEO Pharmaceuticals (NASDAQ: AVEO) which has almost doubled since I profiled it a few weeks ago.

Finally, I want to do a quick update on AVEO Pharmaceuticals (NASDAQ: AVEO) which has almost doubled since I profiled it a few weeks ago.

There is good reason for the rally. The company just reported very solid Phase II trial results for its compound targeting metastatic colorectal cancer combined with another drug.

I think the increased attractiveness of AVEO’s stock adds to its chances of becoming an acquisition target. That being said I want to add my two cents on culling positions when one is fortunate enough to purchase a stock that goes up so far so fast.

My rule of thumb when it comes to small biotech and biopharma stocks is to sell 10% of your original stake once it achieves a 50% gain, 20% of the original stake after the stock doubles and 20% more if one is fortunate to have your stock triple.

The other half of the original stake now rides on the “house’s” money unless something drastically changes on the company’s prospects. I have found this to be a good risk mitigation strategy and as Jim Cramer always says “No one ever goes broke booking a profit”. Happy Hunting.

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley