The small biotech and biopharma sectors has been very kind to my portfolio over the past six months. Avanir Phamaceuticals (NASDAQ: AVNR) which was one of the two inaugural picks for the July launch of the Small Cap Gems portfolio soared more than 200% before being bought out at a considerable premium by a larger Japanese pharma firm in early December.

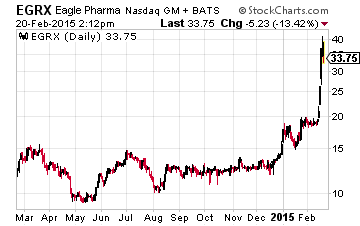

Eagle Pharmaceuticals (NASDAQ: EGRX), a December Small Cap Gems selection, is up more than 175% since inclusion into this portfolio and the company just signed a major licensing deal with generic drug giant Teva Pharmaceuticals (NASDAQ: TEVA).

Eagle Pharmaceuticals (NASDAQ: EGRX), a December Small Cap Gems selection, is up more than 175% since inclusion into this portfolio and the company just signed a major licensing deal with generic drug giant Teva Pharmaceuticals (NASDAQ: TEVA).

Eagle signed a deal with Teva for their compound for the treatment of chronic lymphocytic leukemia and indolent B-cell non-Hodgkin lymphoma. Teva will be responsible for all U.S. commercial activities while Eagle will manage all regulatory approvals, post-approval studies and, if necessary, initially supplying the product to Teva.

Eagle will receive a $30 million upfront payment along with up to $90 million in additional milestone payments as this drug goes through the approval process and then double digit royalty percentages on the sales of the drug once approved.

[ad#Google Adsense 336×280-IA]Obviously this was a game changer for a company with a $300 million market capitalization prior to trading on Tuesday.

The stock is up some 70% since this announcement.

My rule of thumb when it comes to small biotech stocks is to sell 10% of your original stake once one achieves a 50% gain, 20% of the original stake after the stock doubles and 20% more if one is fortunate to have your stock triple.

The other half of the original stake now rides on the “house’s” money unless something drastically changes on the company’s prospects.

That being said, I am still sitting on the majority of my original stake in Eagle as I think its technology and pipeline have great promise. In addition, I have found over two decades of investing in this space that sometimes a licensing agreement like this with a larger pharma player can be a precursor to a buyout offer at a nice premium from the same partner. After all, why potentially share technology with a competitor when you can lock it up for yourself?

Here are two other small cap plays in this arena that recently signed licensing deals with bigger concerns and that I think still have significant upside.

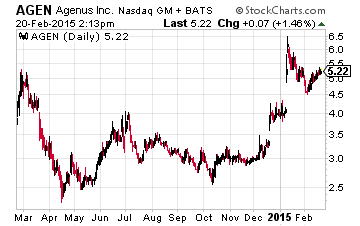

I continue to like Agenus (NASDAQ: AGEN) which signed a licensing agreement with much larger Incyte (NASDAQ: INCY) in mid-January.

I continue to like Agenus (NASDAQ: AGEN) which signed a licensing agreement with much larger Incyte (NASDAQ: INCY) in mid-January.

The partnership will give Incyte access to Agenus’ Retrocyte Display, a cell display platform to develop four potential checkpoint modulator antibodies.

The costs and profits derived from two of the therapies will be split equally between the two companies, while the other two therapies will have royalty-bearing programs for Agenus.

The stock of Agenus spiked to $6 a share on the news but the shares have fallen back to just over $5 a share, giving aggressive growth investors a good entry point. The shares are still up 60% since being put in the Small Cap Gems portfolio a few months ago.

Agenus also has vaccines for malaria and shingles it is developing in conjunction with GlaxoSmithKline (NYSE: GSK) that should be on the market by the end of the year. This will give the company its first recurring royalty income stream as well as some additional milestone payments.

I think either of these two larger partners could be logical acquirers of Agenus given its minuscule $320 million market capitalization, over $50 million in net cash, underlying technology and evolving pipeline of checkpoint inhibitors and vaccines. Maxim Group reiterated its “Buy” rating and $11 a share price target just over a month ago which would represent an additional 100% upside from the current share price.

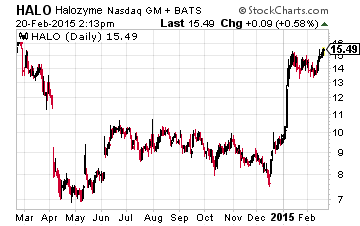

Halozyme (NASDAQ: HALO) continues to be a strong performer and is now changing hands at just over $15 a share, far above the under $9 a share price it was going for late in 2014 when it was put into the Turnaround Stock Report portfolio and is well on its way to getting back to the over $18 a share the stock was trading at early in 2014 before the company encountered some temporary setbacks.

Halozyme (NASDAQ: HALO) continues to be a strong performer and is now changing hands at just over $15 a share, far above the under $9 a share price it was going for late in 2014 when it was put into the Turnaround Stock Report portfolio and is well on its way to getting back to the over $18 a share the stock was trading at early in 2014 before the company encountered some temporary setbacks.

Halozyme’s pipeline includes several products in the clinical stage for dermatology, oncology, and diabetes. The company collaborates with Baxter (NYSE: BAX), Janssen Pharmaceuticals which is a unit of Johnson & Johnson (NYSE: JNJ), Pfizer (NYSE:PFE), and Roche. Halozyme features a diversified and broad portfolio of emerging products as well as a deep pipeline.

The main catalyst for the stock was a global license with Janssen in December to develop and commercialize products for up to five targets using Halozyme’s Enhanze technology combined with Janssen’s proprietary compounds. Halozyme will receive an upfront payment of $15 million and up to $566 million in development, regulatory and sales milestones plus royalties on commercial sales. Obviously this was big deal for a company that had a market capitalization of just over $1 billion at the time.

MLV & Company just reiterated its “Buy” rating and moved its price target to $20 a share this week from $15 a share previously. Halozyme’s partner list reads like a “who’s who” in the big pharma sector. Combined with an evolving pipeline, attractive technology platforms and an under $2 billion market capitalization it is easy to see this company being acquired in 2015 as well.

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley